Nyc Deferred Comp Fees In Franklin

Category:

State:

Multi-State

County:

Franklin

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

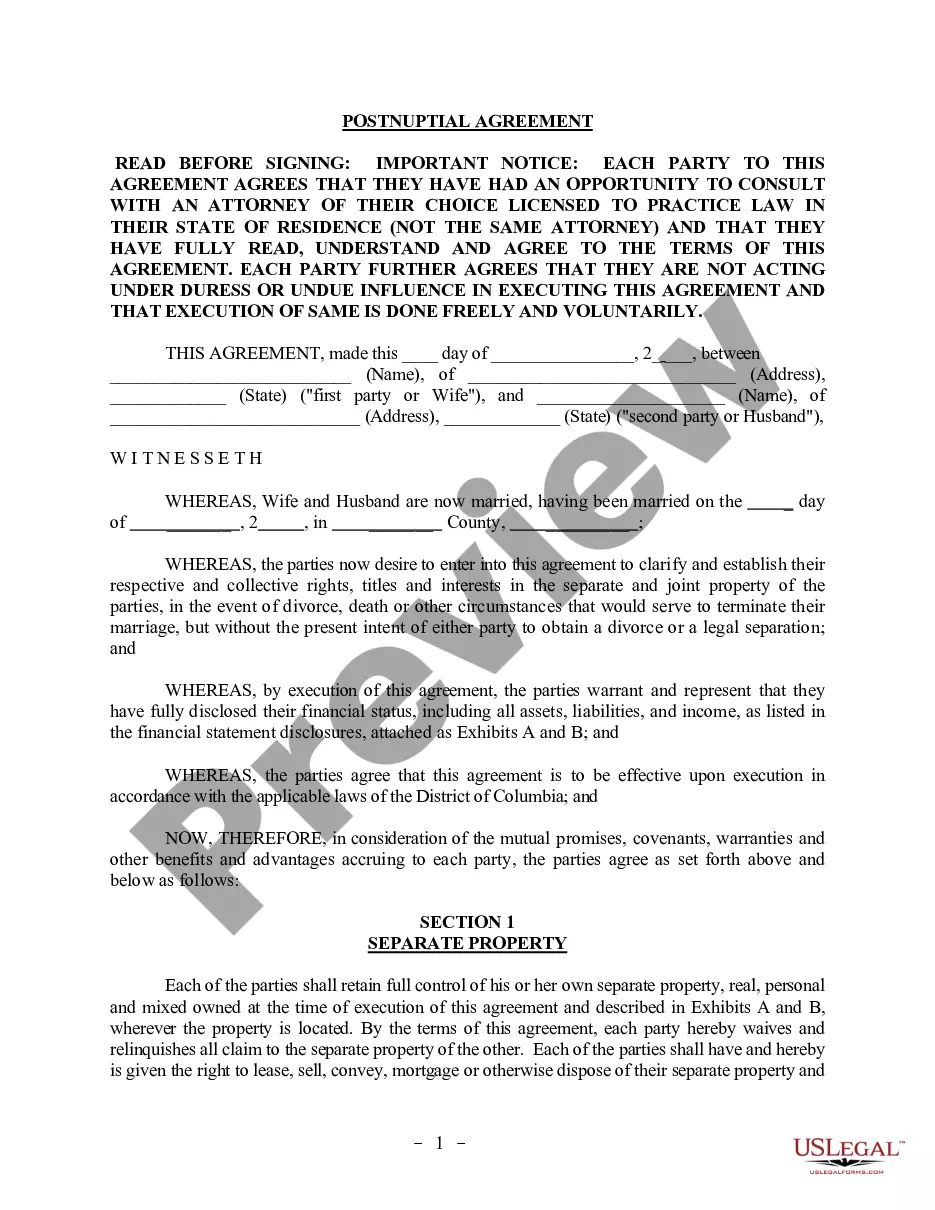

The document outlines a Deferred Compensation Agreement between an employer and an employee, specifically addressing the NYC deferred comp fees in Franklin. This agreement is designed to provide the employee with additional compensation upon retirement or in the event of death, ensuring a post-retirement income or pre-retirement death benefits. Key features include detailed payment structures, calculation of payments based on the National Consumer Price Index, and stipulations regarding noncompetition. The form also provides clear filling instructions and emphasizes the need for written modifications and formal notices. It is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who need a framework for managing deferred compensation arrangements. Users will benefit from understanding sections related to employment termination and implications for noncompliance. Clear guidance on execution and personal rights under this agreement facilitates effective administration for all parties involved.

Free preview