Deferred Compensation Plan Vs 401k In Franklin

Category:

State:

Multi-State

County:

Franklin

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

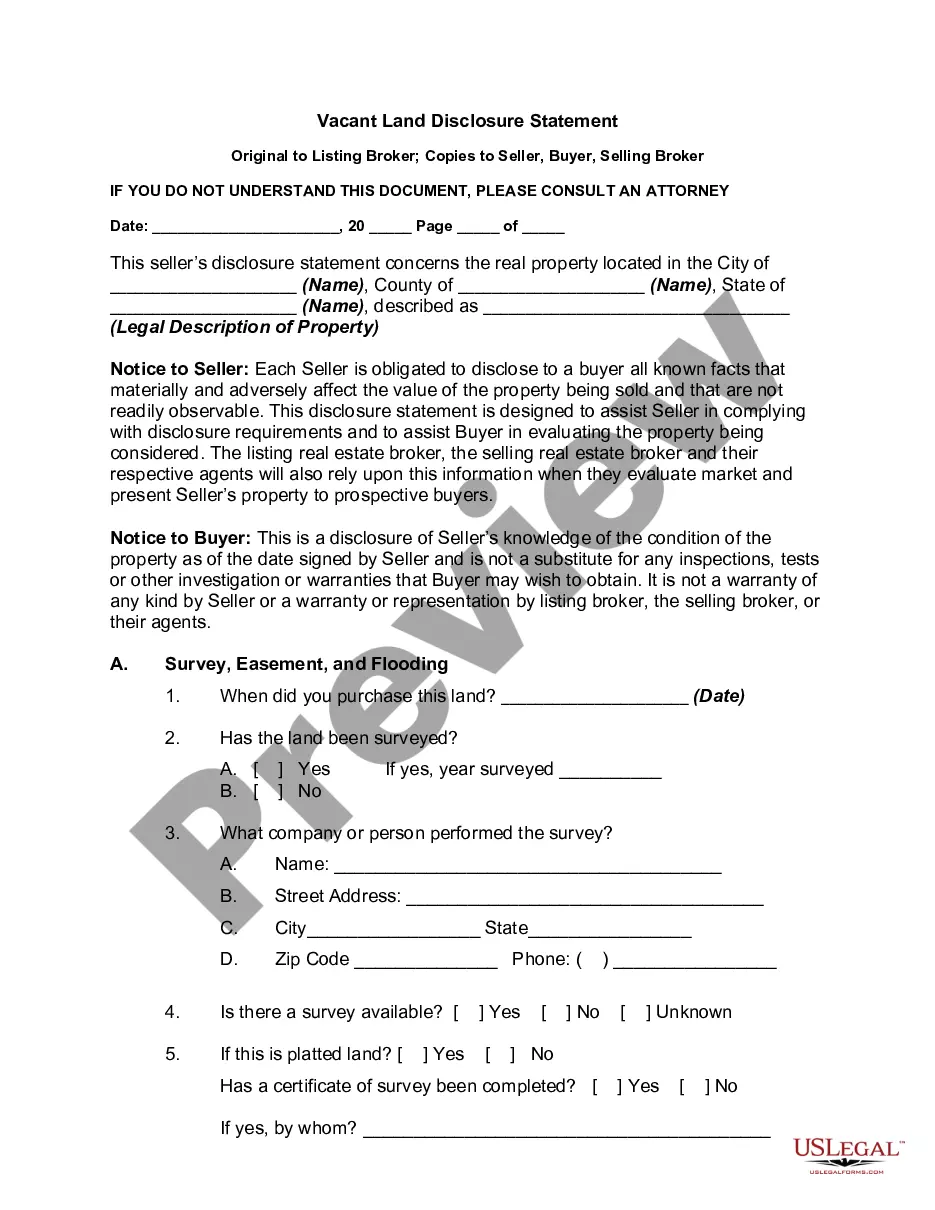

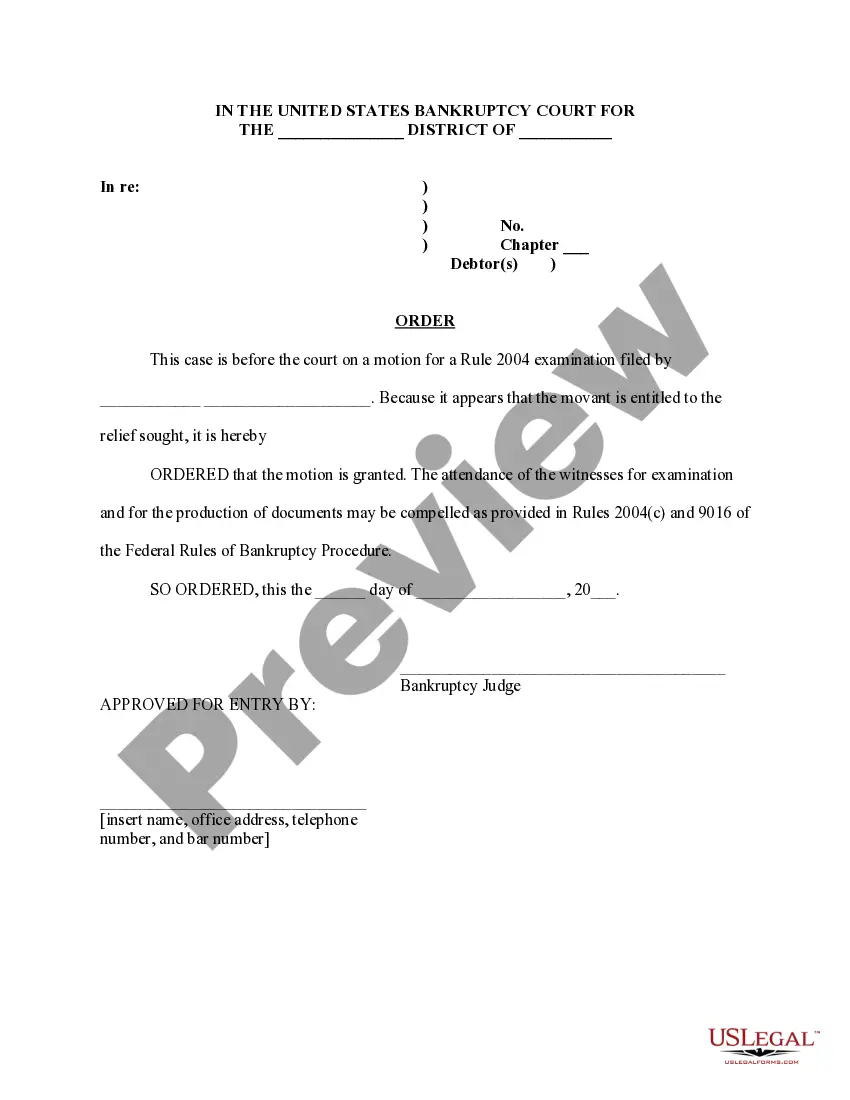

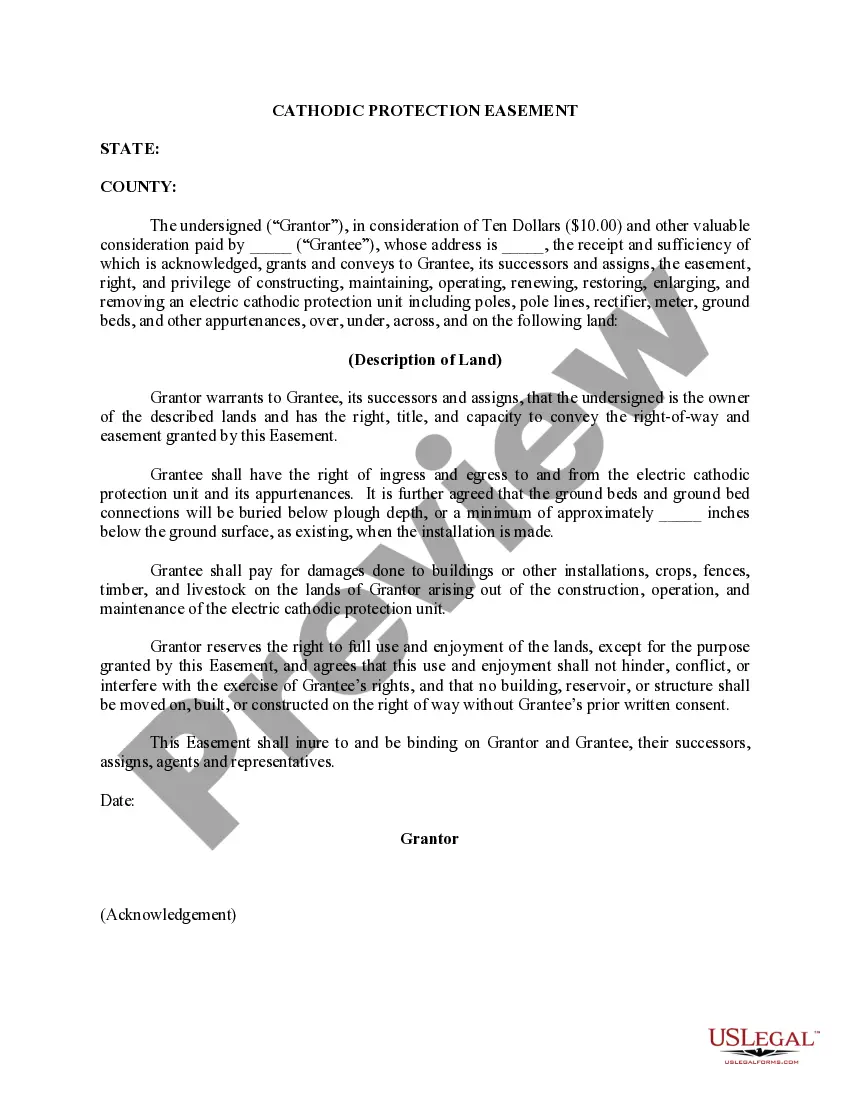

The Deferred Compensation Agreement serves as a legal framework for employers and employees to establish a supplemental pay structure that extends beyond a traditional 401k plan. Unlike a 401k, which is a retirement savings plan funded by employee contributions and employer matches, a deferred compensation plan allows for higher flexibility and potentially larger payouts directly from employers, particularly beneficial for key employees and executives. This agreement details the conditions for retirement payouts, death benefits, and provisions for non-competition restricting employees from taking similar roles at competitors. It also emphasizes the legalities governing the payments, including tax implications influenced by the National Consumer Price Index. For target audiences such as attorneys, partners, owners, associates, paralegals, and legal assistants, this form is crucial for ensuring compliance with relevant laws while negotiating compensation packages that align with both corporate objectives and employee retention strategies. It requires them to fill out details about the corporation and its employee, while provisions for modification ensure adaptability to changing circumstances. Understanding these intricacies is vital for legal professionals advising on compensation frameworks.

Free preview