Nys Deferred Comp Withdrawal In Fairfax

Category:

State:

Multi-State

County:

Fairfax

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

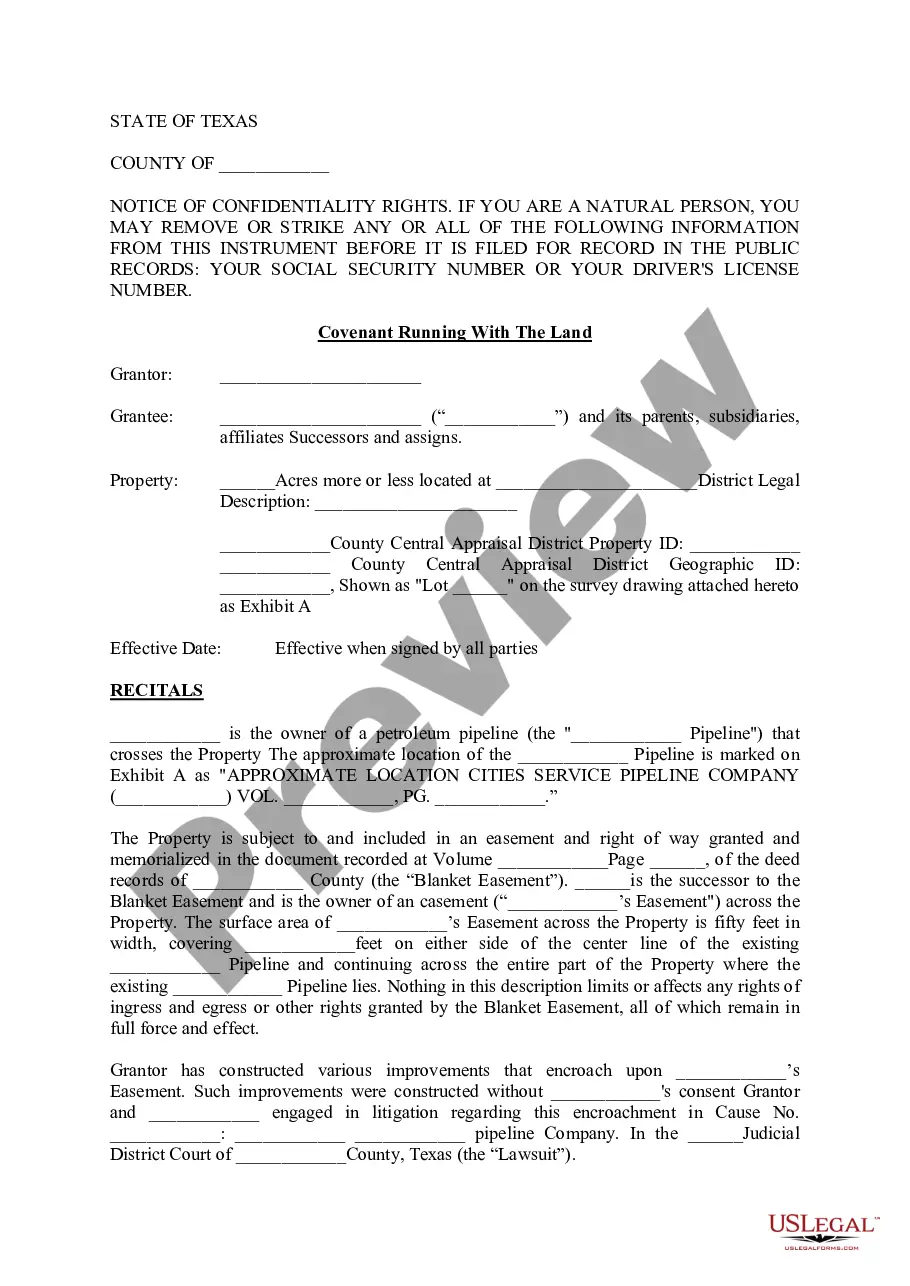

The NYS deferred comp withdrawal in Fairfax relates to a Deferred Compensation Agreement between an employer and employee, outlining post-retirement income benefits for the employee. This agreement ensures that the employee receives a specific monthly payment upon retirement, which can also extend to their beneficiaries in case of death before or after retirement. Key features include the adjustment of payments based on the National Consumer Price Index, stipulations regarding non-competition, and rules surrounding the termination of payments if employment conditions change. Attorneys, partners, and legal professionals should utilize this form to secure the financial interests of employees while ensuring compliance with corporate bylaws and employment laws. The form requires careful customization, including filling in details such as the corporation's name, employee's age, and payment amounts. Editing should focus on clarity and accuracy to properly execute the agreement, making it a vital tool for maintaining employee retention and satisfaction.

Free preview