Form 8594 Requirements In Fulton

Category:

State:

Multi-State

County:

Fulton

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

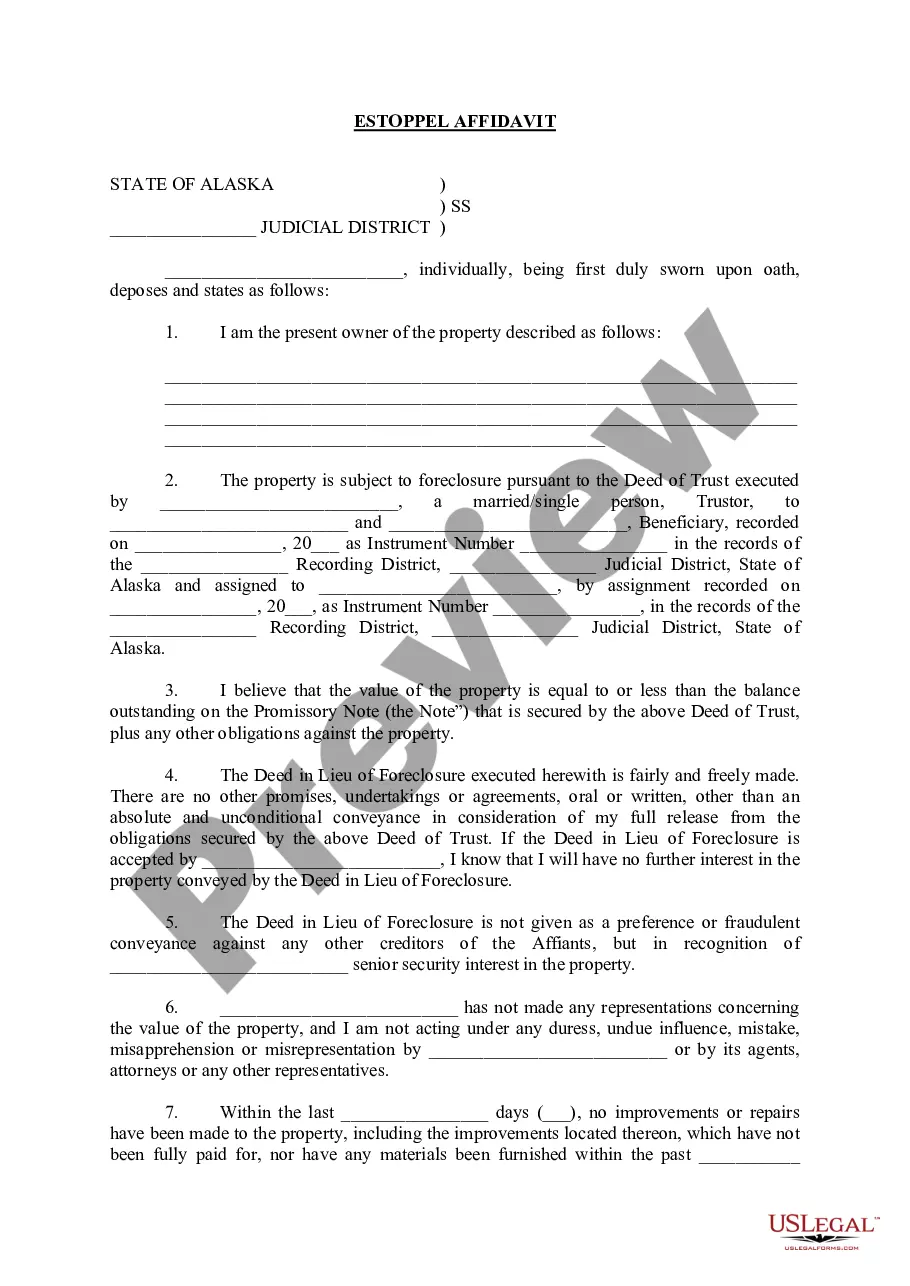

Form 8594 is a crucial document in Fulton for the allocation of purchase price concerning the sale of a business's assets, specifically under asset purchase agreements. This form facilitates compliance with federal tax regulations regarding asset transfers, ensuring both the buyer and seller correctly report asset allocations post-transaction. Key features of Form 8594 include sections to itemize the allocated amounts for tangible and intangible assets, such as inventory and goodwill, which are critical for establishing tax bases. Users are instructed to fill out the form accurately by referring to the asset purchase agreement, ensuring all assets and their values are represented. This form is primarily useful for attorneys, partners, owners, associates, paralegals, and legal assistants who are involved in business transactions, as it aids in preventing misunderstandings about asset valuations and their tax implications. Properly completing Form 8594 also mitigates potential disputes that could arise during audits related to business sales. Overall, it acts as a protective measure for all parties involved in the sale process.

Free preview