Business Sale Asset With Loss Journal Entry In Collin

Category:

State:

Multi-State

County:

Collin

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

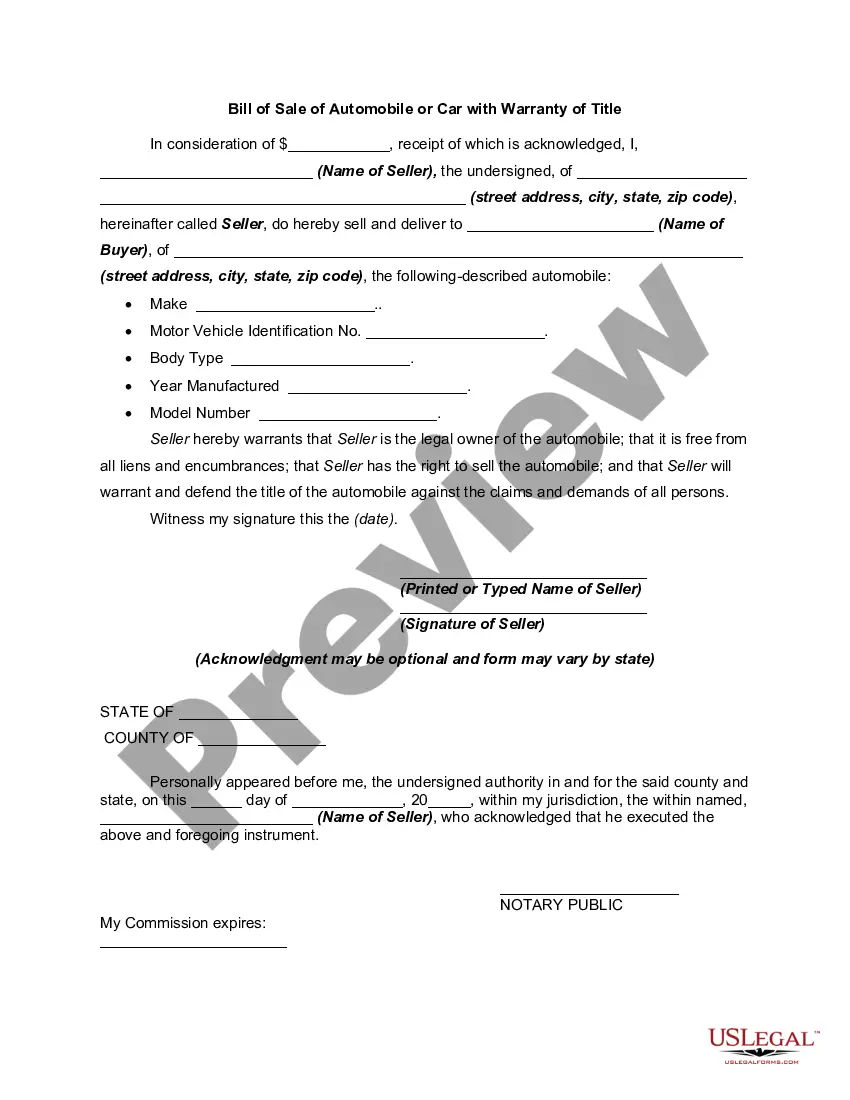

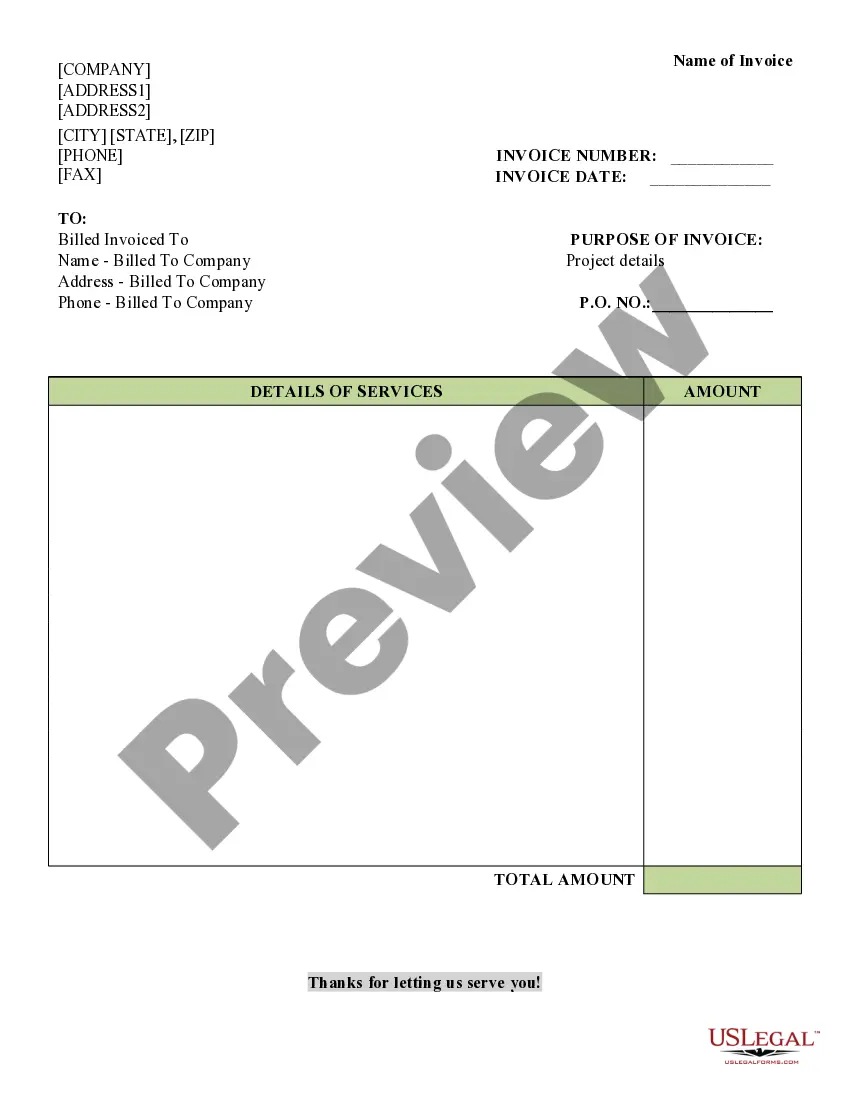

The Business Sale Asset with Loss Journal Entry in Collin is designed to facilitate the sale of business assets while acknowledging any losses incurred during the transaction. This form serves as a comprehensive asset purchase agreement outlining terms, conditions, and asset details, which are vital for both buyers and sellers. Key features of the form include sections defining the assets purchased, assumptions of liabilities, and stipulations regarding payment terms and warranties. It is critical to accurately modify the form to reflect specific business circumstances and delete any irrelevant provisions to ensure all details are pertinent. Important instructions for filling out include providing precise financial allocations, securing appropriate signatures from parties involved, and adhering to corporate governance related to authorization. This form is particularly beneficial for attorneys, partners, owners, associates, paralegals, and legal assistants by providing a structured framework for negotiations while safeguarding interests through legal warranties. Use cases also extend to scenarios involving the careful documentation of asset transfers when dealing with unfavorable financial outcomes.

Free preview