Asset Purchase Agreement Form Irs In California

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

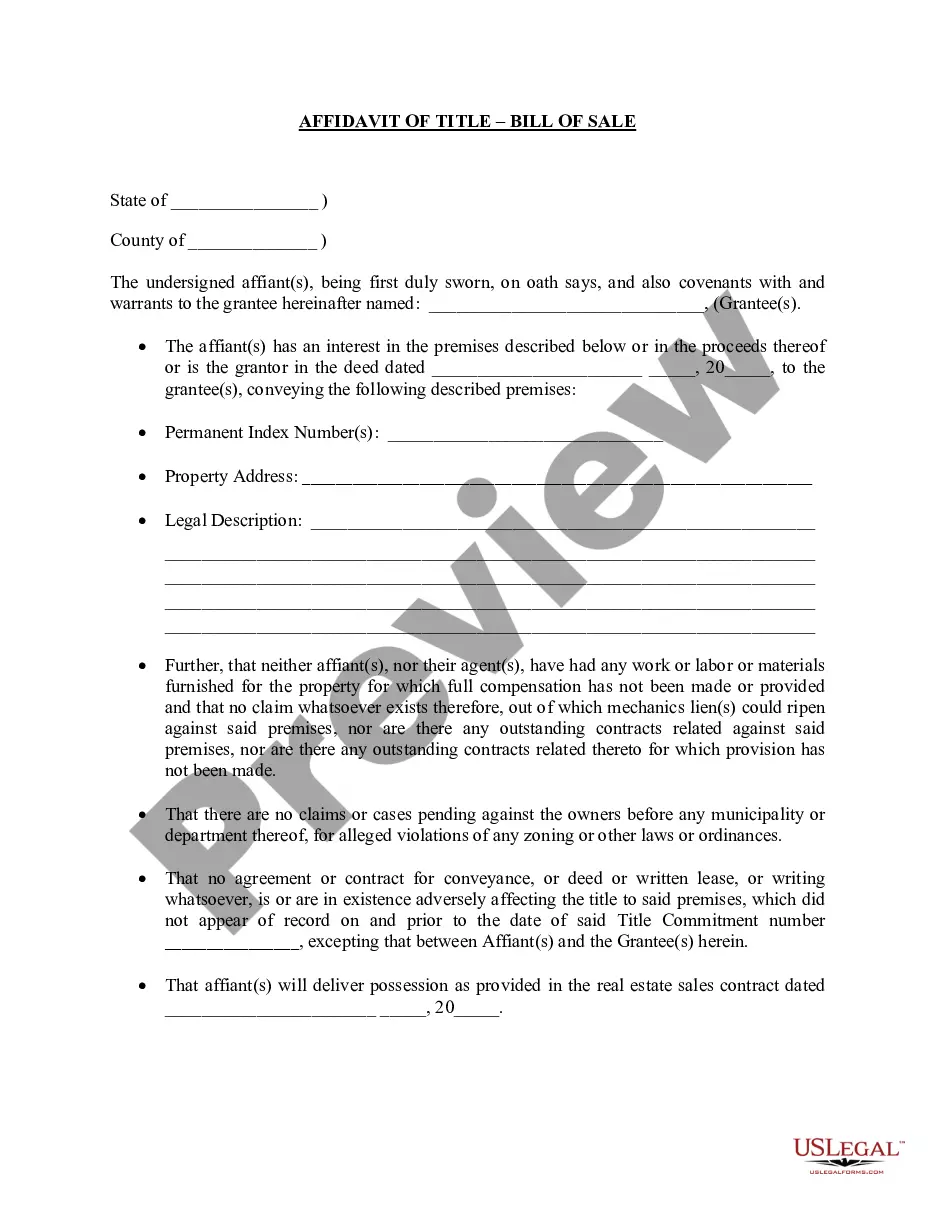

The Asset Purchase Agreement form IRS in California is a legally binding document facilitating the sale of a business's assets from a Seller to a Buyer. This agreement outlines critical details regarding the assets being purchased, any liabilities being assumed, and the overall purchase price allocated across specific categories such as equipment and goodwill. Key features include provisions for excluded assets, payment terms, representations and warranties from both parties, and conditions precedent to closing. Users can edit this template by customizing sections to fit their unique transaction specifics, including dates and financial figures. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants engaged in business transactions, as it ensures all legal bases are covered during asset transfers. The structure promotes clarity, helping users navigate the obligations and rights of each party involved in the agreement.

Free preview