Purchase Business Sale Purchase With Tax In Bexar

Category:

State:

Multi-State

County:

Bexar

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

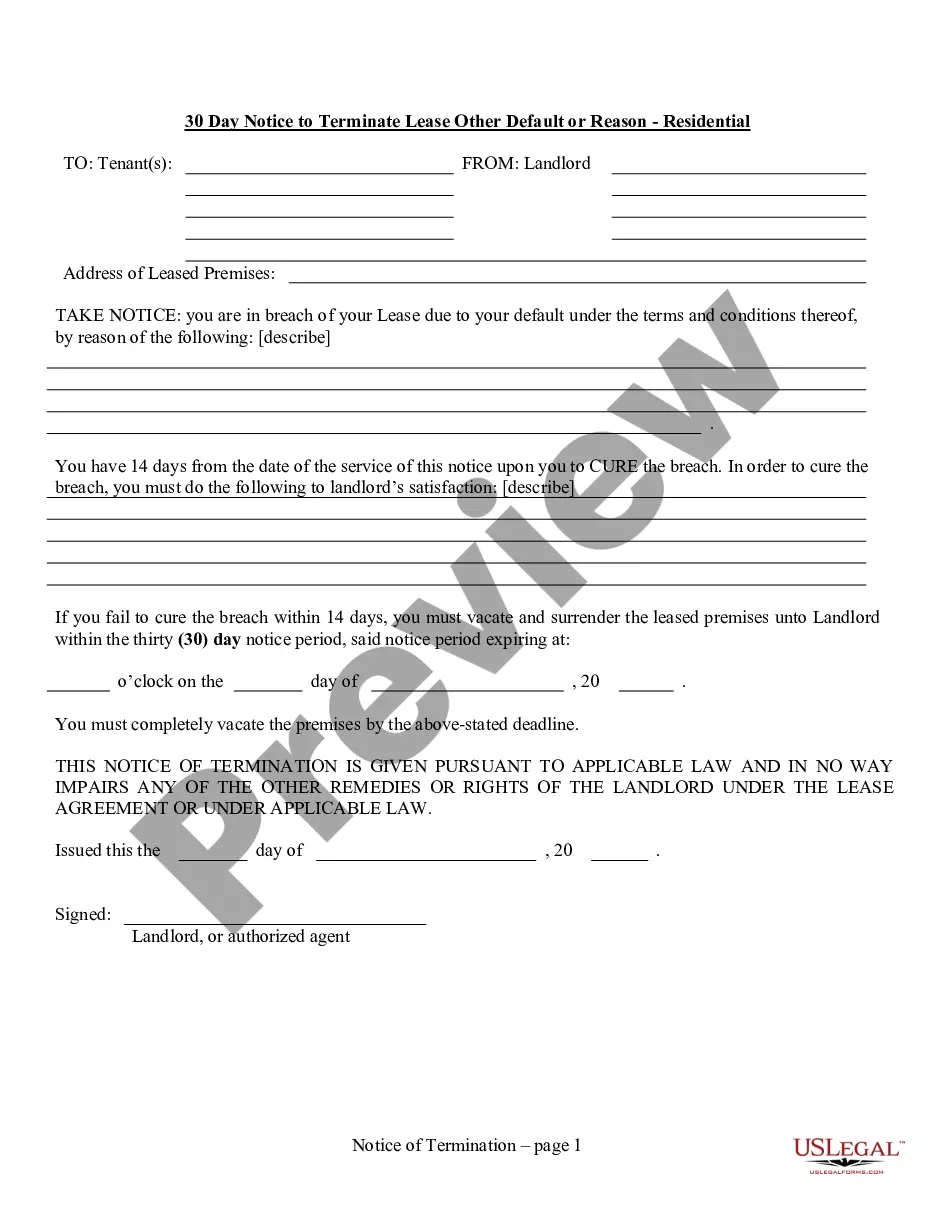

The Purchase Business Sale Purchase with Tax in Bexar is a formalized asset purchase agreement that outlines the terms for the sale of business assets, including equipment, inventory, and goodwill while addressing tax responsibilities. Key features include sections on the purchase price allocation, assumption of liabilities, and representations and warranties of both the seller and buyer. Filling and editing instructions suggest modifying sections to fit specific circumstances and deleting non-applicable provisions, ensuring clarity and relevance for users. Users should pay particular attention to tax-related clauses, as the buyer is responsible for sales and transfer taxes associated with the transaction. This form is especially useful for attorneys, partners, owners, associates, paralegals, and legal assistants involved in business transactions, as it provides a structured approach to documenting asset transfers. It can also serve as a reference for ensuring compliance with legal requirements and protecting parties' interests within the framework of Bexar County regulations.

Free preview