Agreement For Salary Deduction In Pima

Category:

State:

Multi-State

County:

Pima

Control #:

US-00417BG

Format:

Word;

Rich Text

Instant download

Description

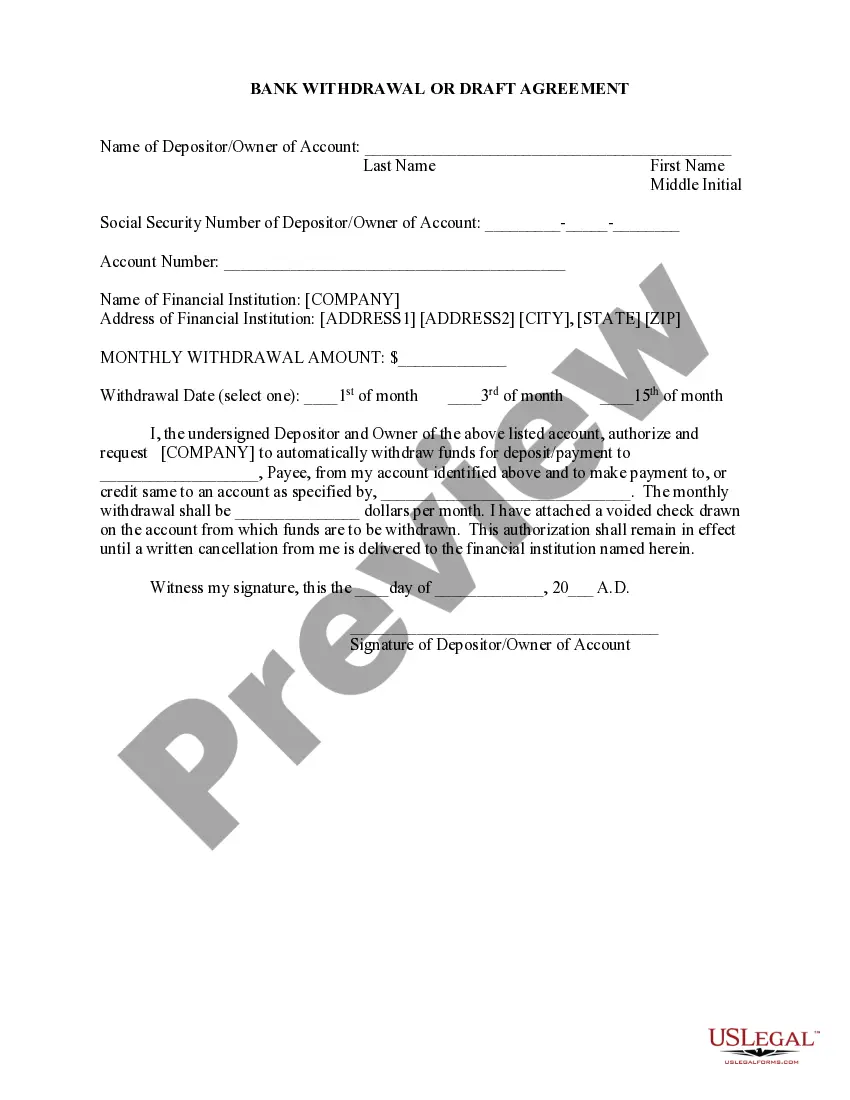

The Agreement for salary deduction in Pima is a legally binding document between an employer and an employee, outlining the terms for deferred compensation. This agreement is designed to encourage key employees to remain with the organization until retirement by providing additional post-retirement income. Key features include stipulations for payment amounts, a scheduled payment plan, and conditions under which the payment rights may be terminated. The form serves as an essential tool for employers looking to retain talent by formalizing financial commitments. Filling and editing instructions emphasize the need to complete accurate party information, including the employer and employee's details, payment figures, and significant dates. This agreement is particularly relevant for attorneys, partners, owners, associates, paralegals, and legal assistants, as it provides a clear framework for structuring employee compensation agreements while ensuring compliance with state laws. Users should pay careful attention to the conditions related to service to other entities and provisions regarding the employee's death to ensure proper handling of the agreement post-mortem.

Free preview