Formulario Seguro Withholding Tax In Minnesota

State:

Multi-State

Control #:

US-00416BG-9

Format:

Word;

Rich Text

Instant download

Description

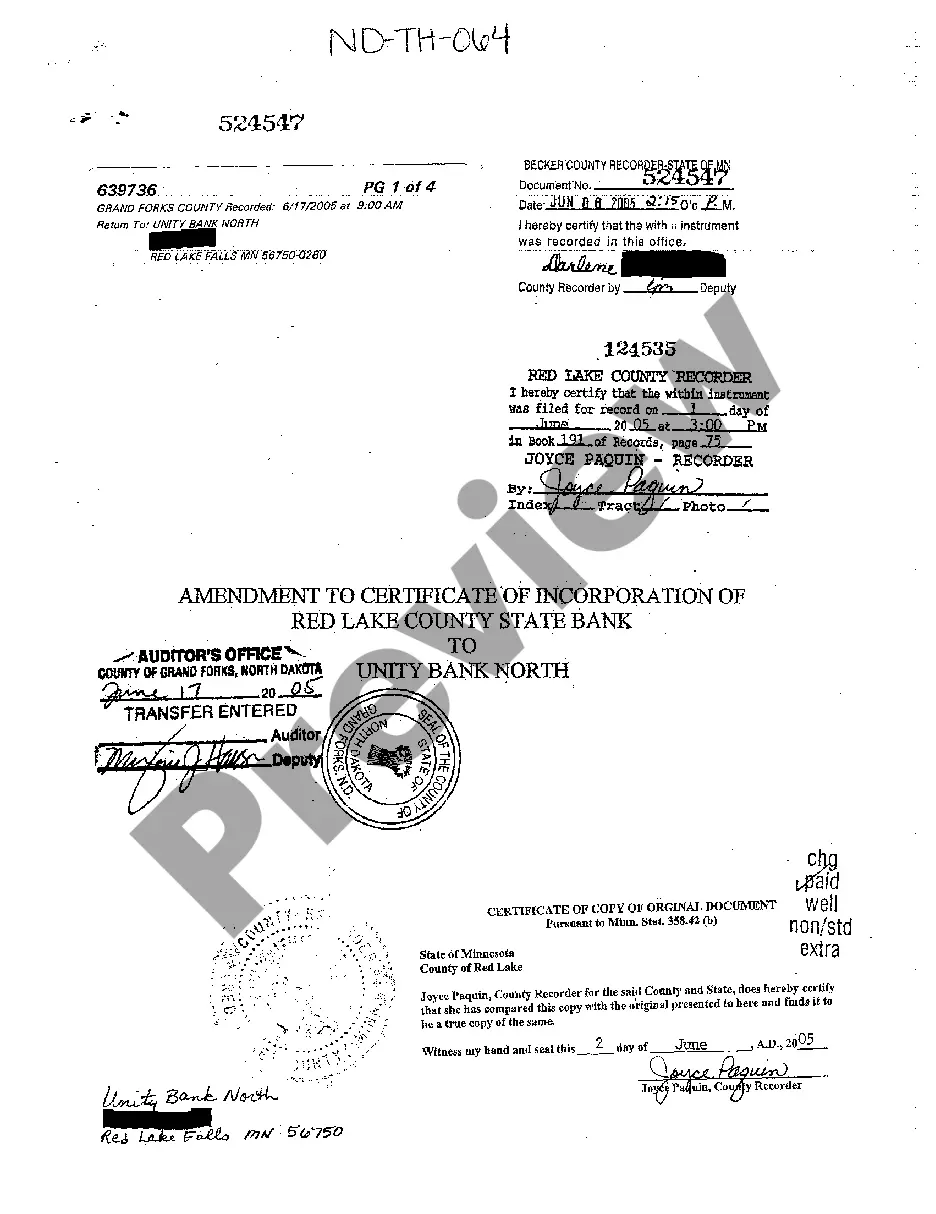

The Formulario seguro withholding tax in Minnesota serves as a critical document for managing withholding tax obligations for employees and employers in the state. This form enables employers to accurately deduct the appropriate taxes from employee wages, ensuring compliance with Minnesota tax regulations. Key features include clear sections for employee information, tax withholding amounts, and employer identification. Users are guided through filling out the form with straightforward instructions, emphasizing the importance of complete and accurate entries. Specific use cases include supporting attorneys in compliance matters, assisting partners and owners in wage management, and helping paralegals and legal assistants in documentation processes. The form's design allows for easy editing and updating, accommodating changes in employee status or tax regulations. Overall, this form is vital for ensuring fiscal responsibility and regulatory adherence, reflecting best practices in payroll management.