Bond Demand And Supply In Minnesota

Instant download

Description

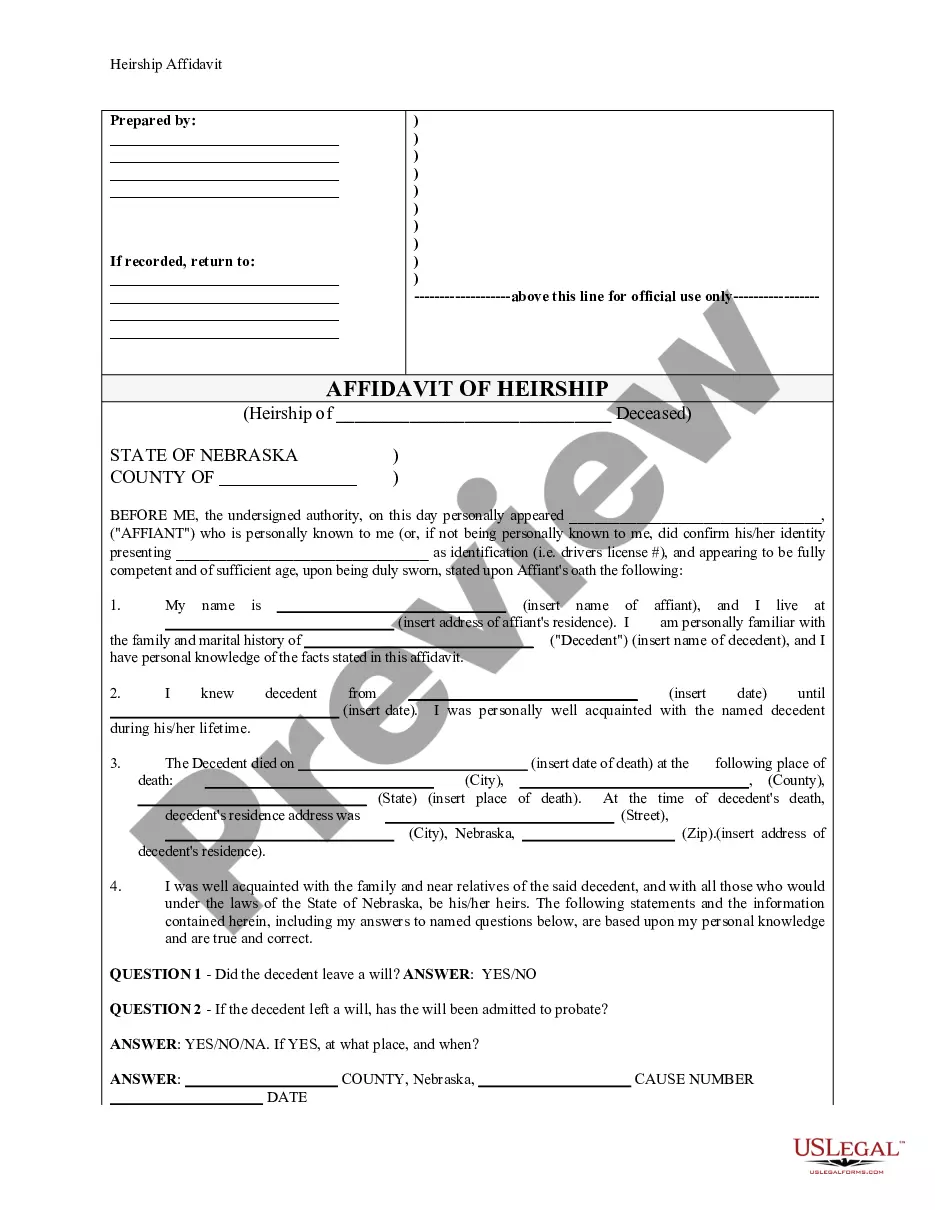

The Demand Bond form is an essential document used in Minnesota to formalize a borrower’s acknowledgment of their debt to a lender. This form specifies the total amount owed, interest rate, and payment terms, facilitating clear communication between parties involved in financial transactions. It requires the borrower to provide their personal information, including name and address, as well as the lender's details, thus ensuring both parties are identifiable. The form must be filled out accurately and signed, with a notary public acknowledgment for legal validity. The specific use cases for this form include situations where an individual needs to secure a loan or other forms of credit and wishes to create a legally binding agreement for repayment. Attorneys, paralegals, and legal assistants may find this form useful for client documentation in debt recovery cases or loan agreements. Partners and owners can utilize it to manage financial obligations in business transactions. Overall, the Demand Bond form serves as a critical tool in enhancing transparency and security in financial dealings in Minnesota.