Employment Work Form Withholding In New York

Instant download

Description

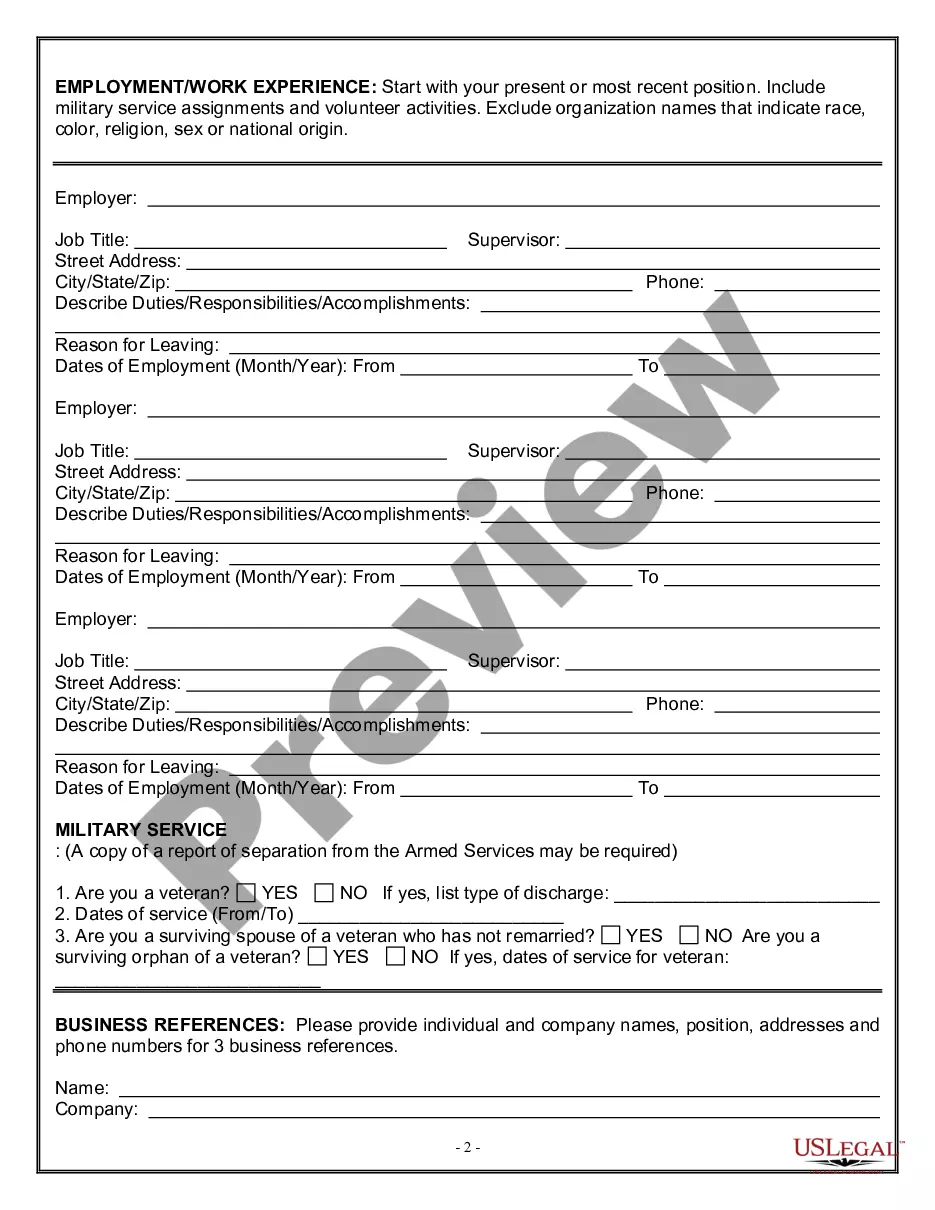

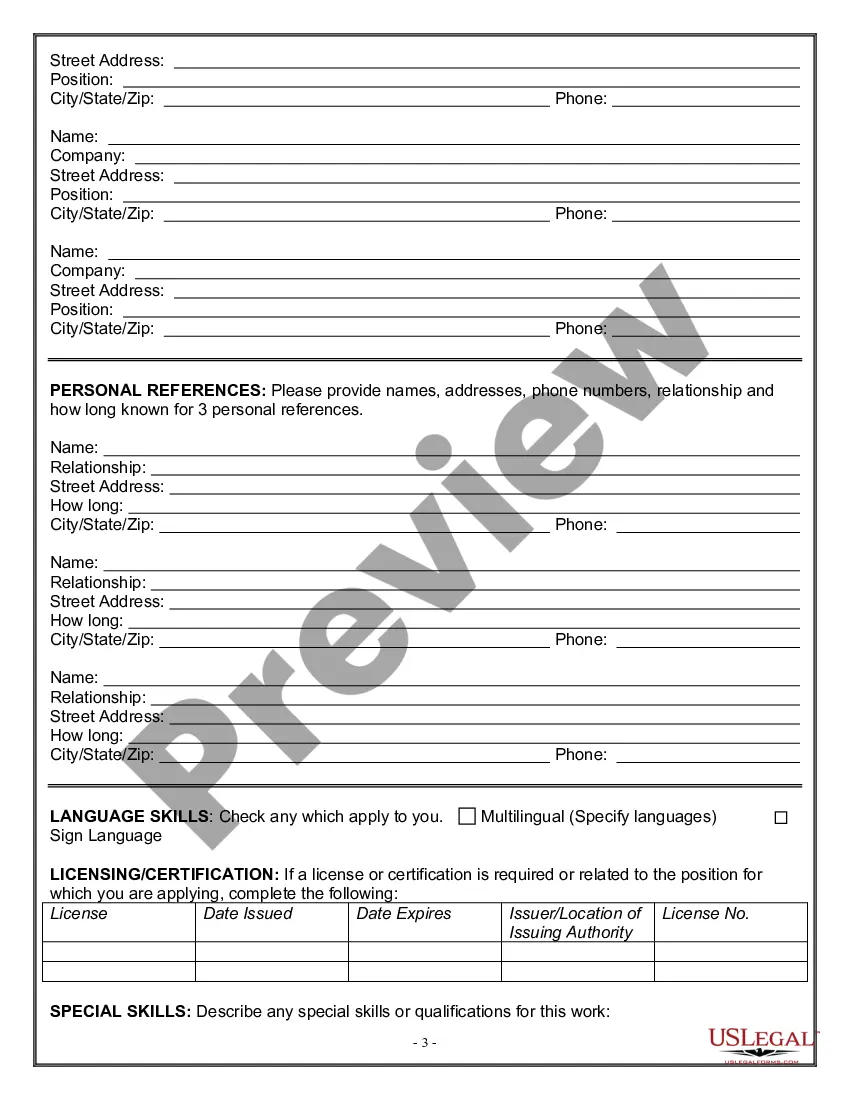

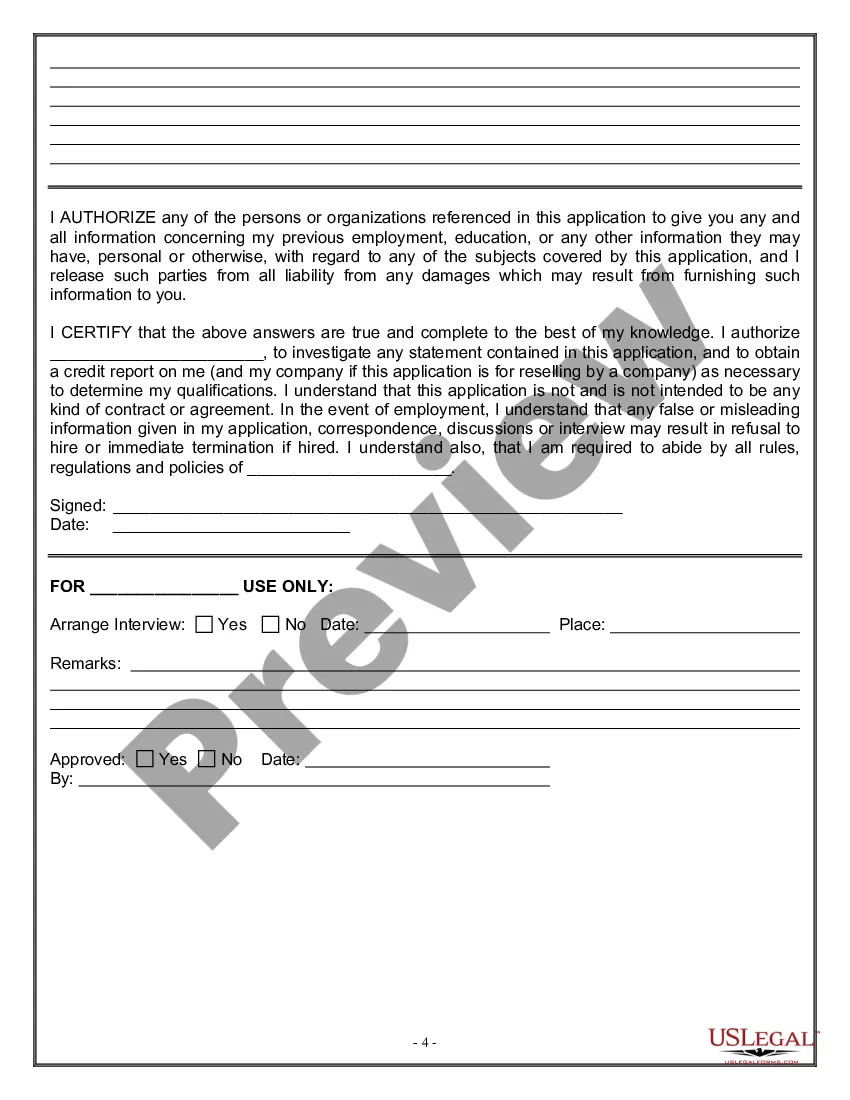

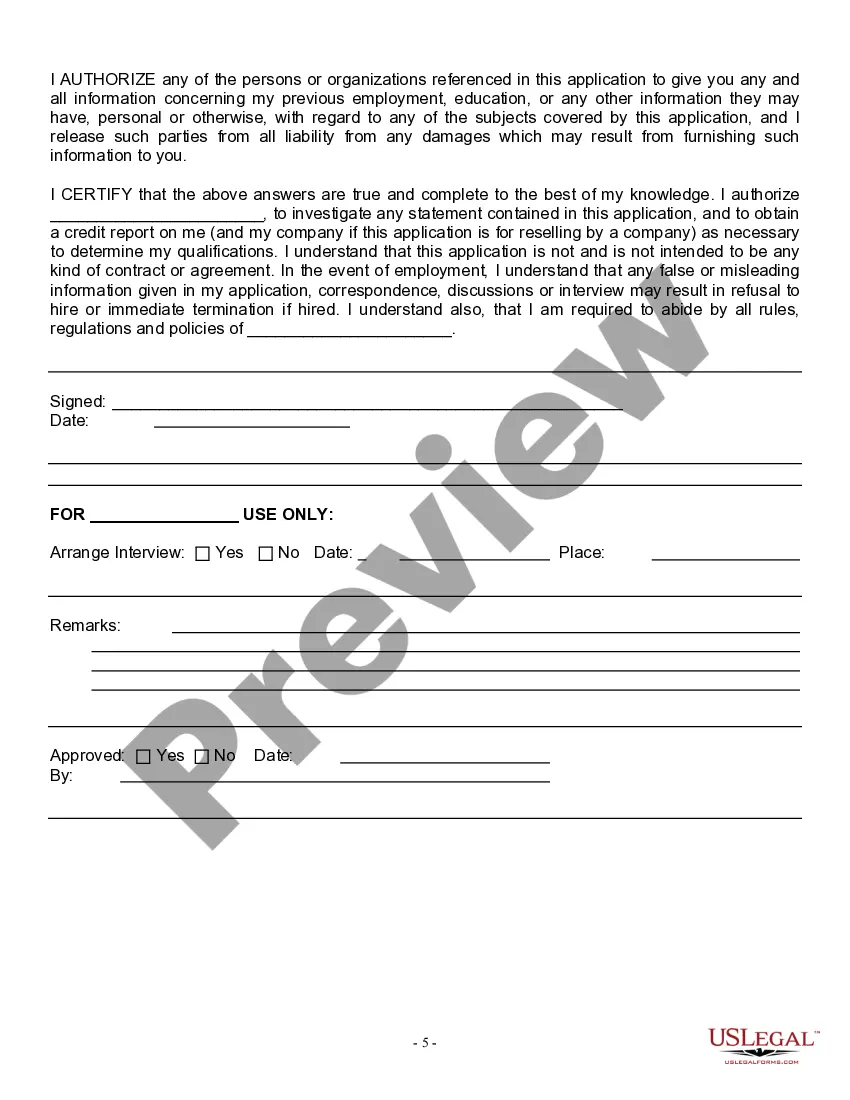

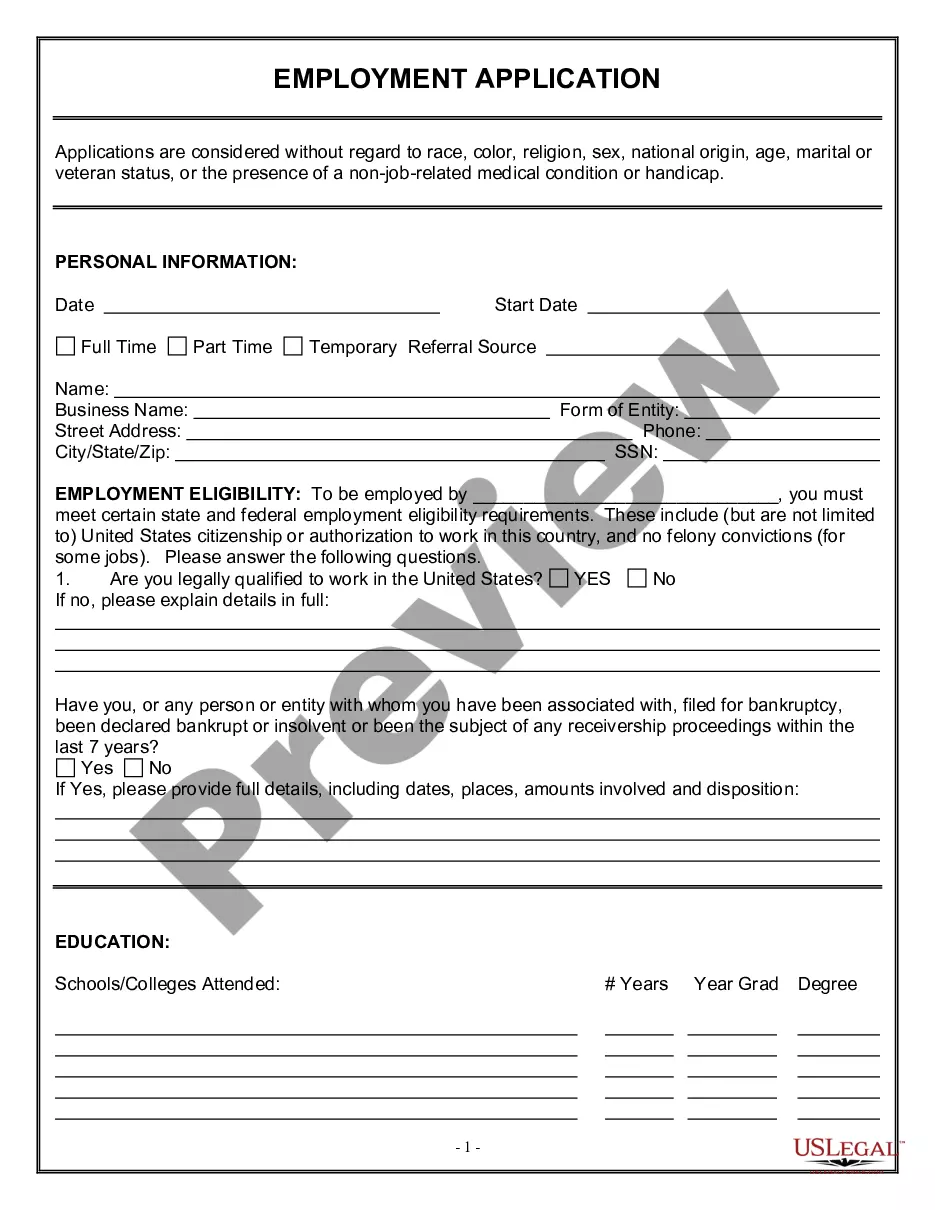

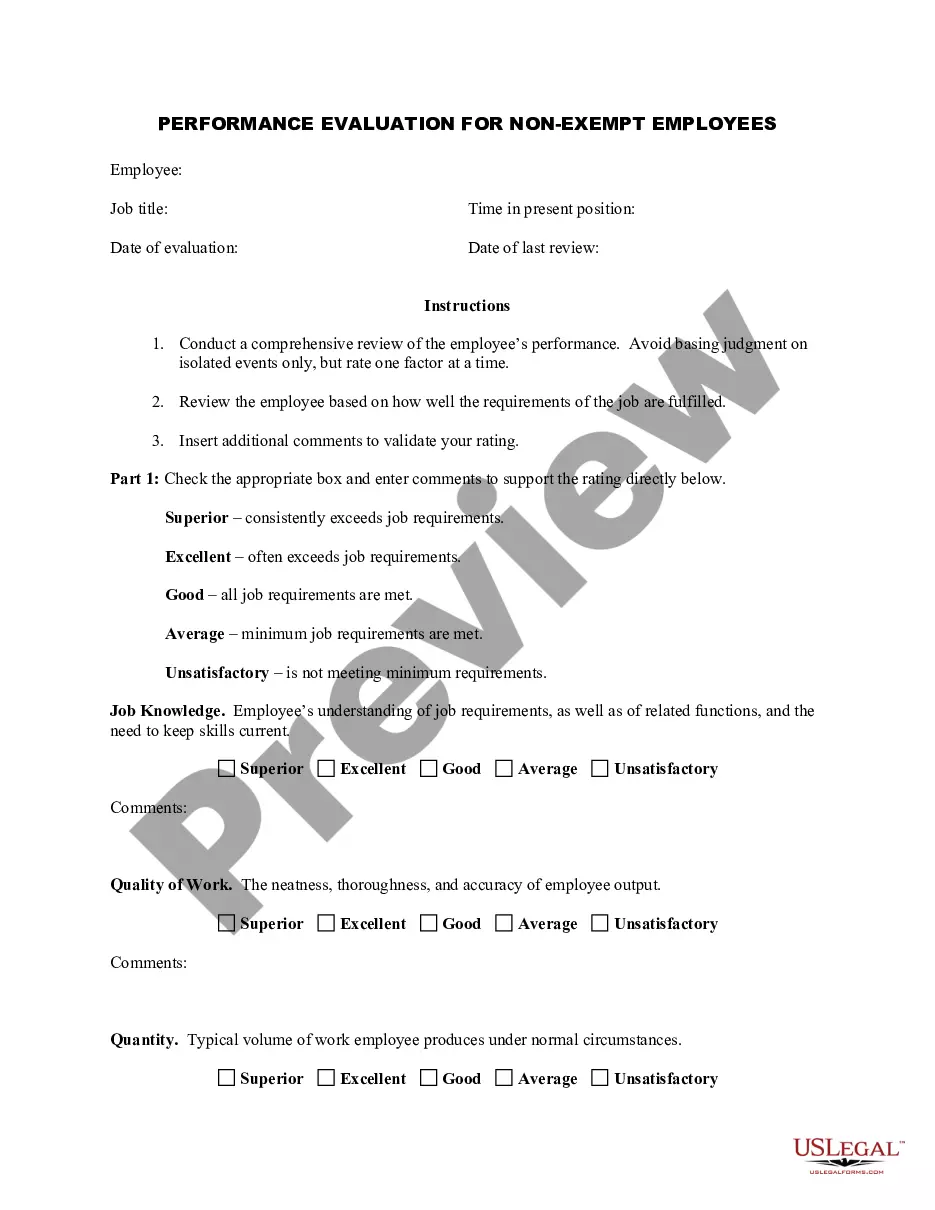

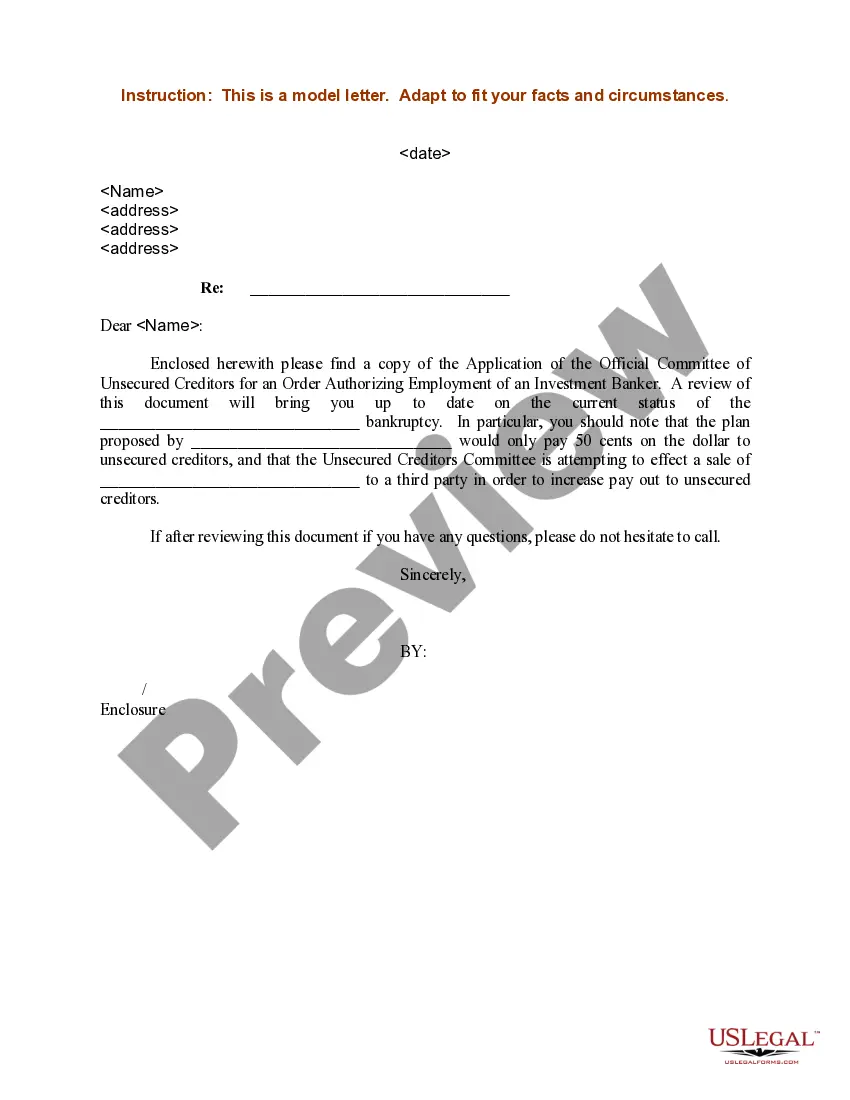

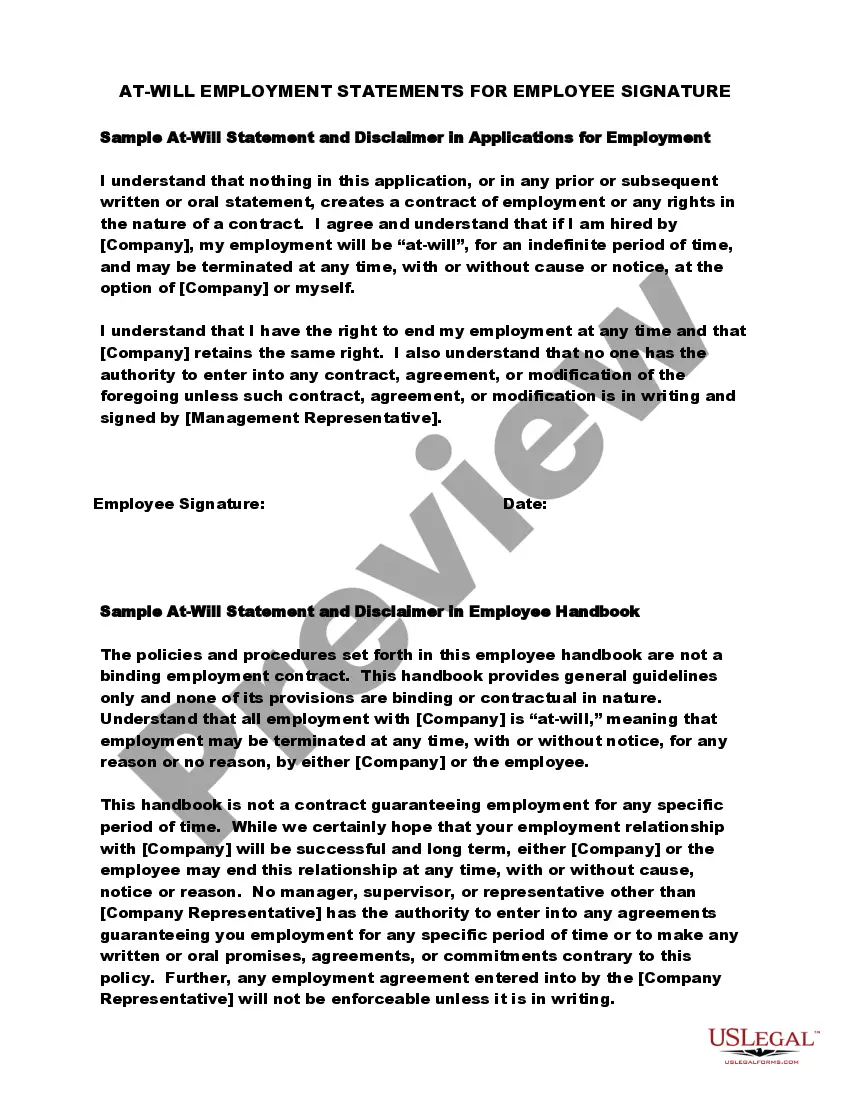

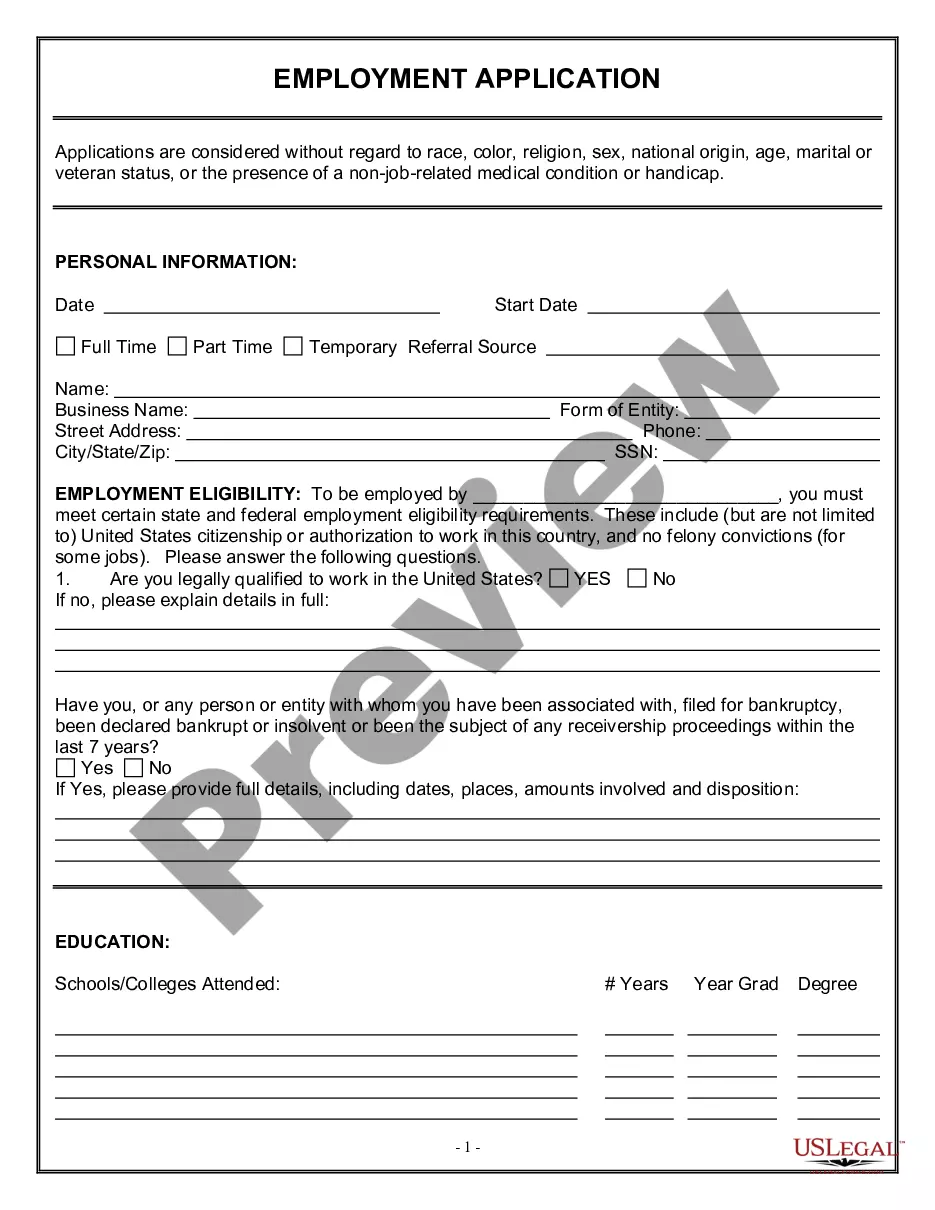

The Employment Work Form Withholding in New York serves as a crucial tool for employers to gather essential information from potential employees. This form collects personal details, employment eligibility, educational background, and work experience, ensuring compliance with state and federal regulations. Key features include sections for military service, references, language skills, and licensing or certification, which can be tailored to specific job requirements. Filling out the form correctly is paramount; users should ensure all sections are complete and accurate to avoid issues with employment eligibility. Editing can be done directly on the digital form, allowing for easy updates as necessary. Attorneys, partners, owners, associates, paralegals, and legal assistants will find this form beneficial for managing hiring processes, ensuring legal compliance, and maintaining accurate personnel records. This form can also highlight potential candidates’ qualifications and background checks, streamlining the hiring process for businesses while adhering to nondiscrimination policies.

Free preview