Lost Note Affidavit Form Foreclosure In Massachusetts

Description

Form popularity

FAQ

Short Sale or Deed-in-Lieu Short sales and deeds-in-lieu of foreclosure are "liquidation options." This means that through these options you avoid foreclosure but do not keep the property. In a short sale, the lender lets you sell the property to a third party for less than what you owe.

Mortgage Default Pre-foreclosure can only begin when the borrower breaches their repayment obligations under the mortgage agreement. The terms of the contract determine the repayment structure, but in most cases, the borrower defaults when they miss at least three months' payments.

No, after a foreclosure is complete the buyer has no right of redemption. However, it is important to note that in Massachusetts a lender can foreclose upon a property by getting a court order and taking possession of the property.

All mortgage loans in default are subject to receiving the SCRA notice when in default. Massachusetts General Laws Chapter 244 §14 requires a foreclosing party to mail a Notice of Sale to the homeowner at least 14 days before the sale date.

The foreclosure sale will be conducted by a licensed auctioneer. The auctioneer will read various legal notices, descriptions, and documents pertaining to the property. The auctioneer will take bids on the property, take deposit checks, and accept the highest bid to close the foreclosure property sale.

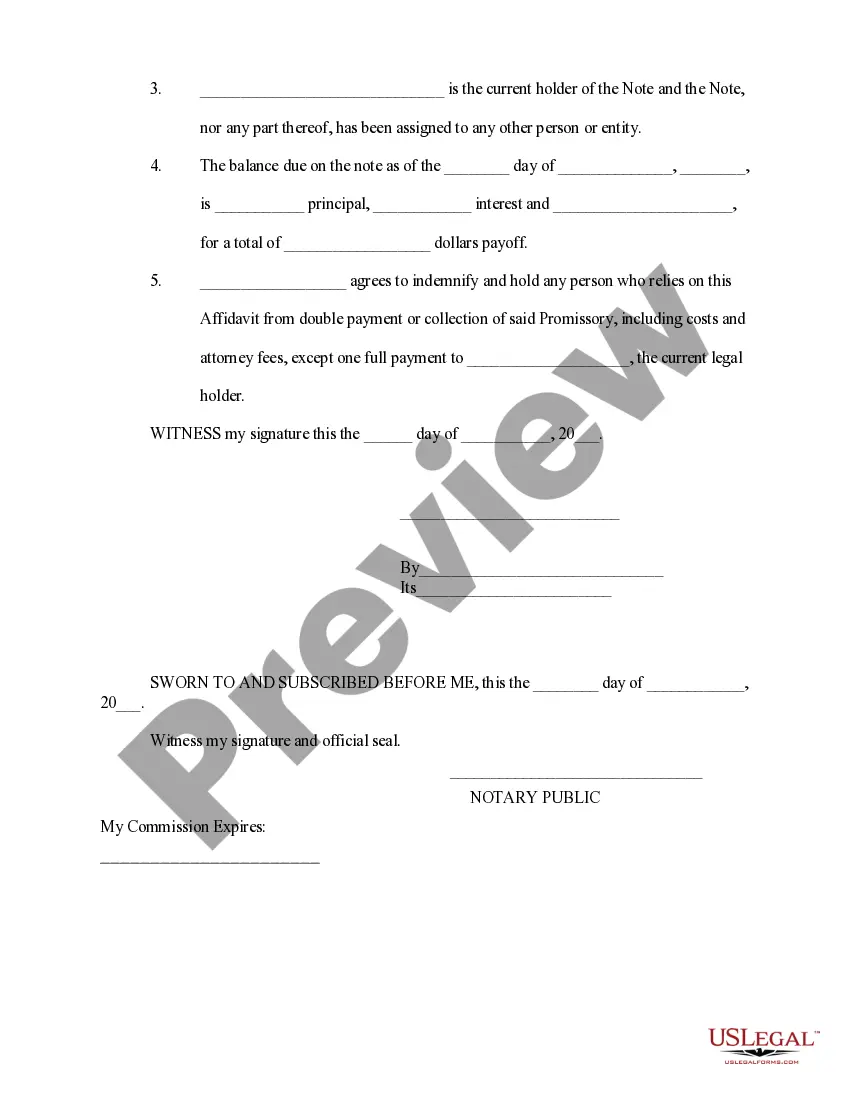

A standard form of affidavit used when a promissory note has been delivered to a lender in a financing transaction and subsequently lost by that lender. This Standard Document has integrated notes with important explanations and drafting tips.

The Notice of Intent to Foreclose document serves as a sort of “warning shot” – the claimant is showing that, if payment is not made, they won't hesitate to foreclose/enforce their mechanics lien. Often, a property owner or contractor will be persuaded to make payment after receiving a Notice of Intent to Foreclose.

Lenders must first send a notice of a foreclosure to the homeowner. The notice must be sent at least 14 days prior to the foreclosure sale date. A foreclosure sale will take place at the date, time, and place specified in the foreclosure notice. The foreclosure sale will be conducted by a licensed auctioneer.