Affidavit Form For Vehicle Transfer In Collin

Description

Form popularity

FAQ

Vehicle transfers are made by visiting the Texas Department of Motor Vehicles in person or online. In the case of property transfer, all necessary paperwork must be forwarded to the Collin County Clerk's Office with all the required documents, such as the original title and bill of sale, along with all forms.

Form 130-U The application includes a motor vehicle tax statement section to document the following: the motor vehicle sales tax due on a Texas sale of a motor vehicle. a gift from one eligible party to another eligible party. an even trade between two parties. a new resident tax.

Do Both Parties Have to be Present to Transfer a Car in Texas? If the seller or person gifting the car properly signed the title, they do not have to be present at the DMV to transfer the title. However, the person receiving the vehicle must present the Application for Texas Title in person at the DMV.

Obtain the TX 130-U form from the Texas Comptroller's website or a local office.

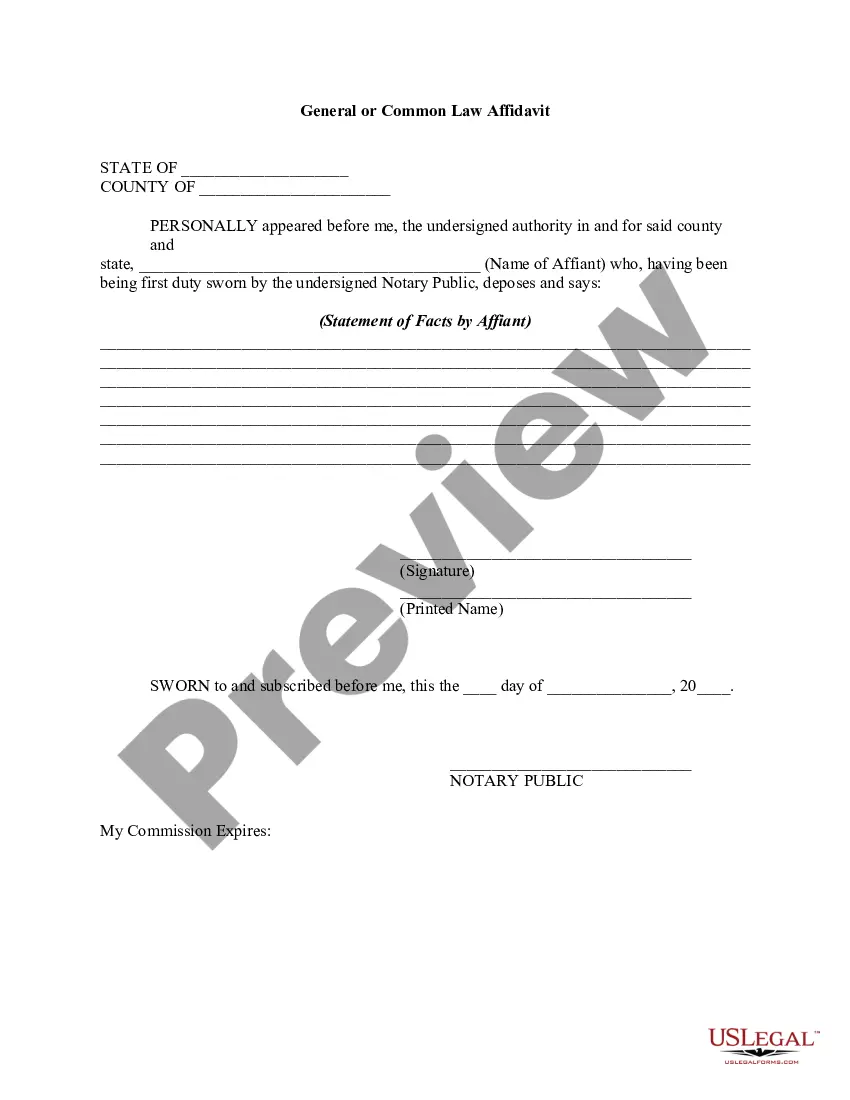

The signed negotiable title and completed Application for Texas Title and/or Registration (Form 130-U), must be provided to the county tax office to title the vehicle. The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317).

Documents Needed The original title assigned from the seller to the buyer. An Application for Texas Title (130-U) completed by buyer(s), buyer(s) signature must be original. Government issued photo ID for buyer. Proof of Texas liability insurance. Supporting documents for example:

You can submit a Vehicle Transfer Notification online through the DMV's website or at a local office. Remember not to procrastinate and be sure to transfer the title within 30 days of the sale to avoid racking up late fees.

Form VTR-346, Texas Motor Vehicle Transfer Notification, is a legal document you need to complete to inform the authorities you have sold or transferred ownership of a vehicle. Additionally, when you file this document, you relieve yourself from liability for civil or criminal acts that involve the vehicle.

The title “transfer” process can be solely performed by the buyer at the TX DMV if the vehicle title was properly signed over to them by the seller. The seller does not need to accompany the buyer to the TX DMV if it is.

Form 130-U The application is used by the County Tax Assessor-Collector (CTAC) and the Comptroller's office to calculate the amount of motor vehicle tax due. The application includes a motor vehicle tax statement section to document the following: the motor vehicle sales tax due on a Texas sale of a motor vehicle.