Lis Pendens Release Form With Lien In Maryland

Description

Form popularity

FAQ

How long does a judgment lien last in Maryland? A judgment lien in Maryland will remain attached to the debtor's property (even if the property changes hands) for 12 years.

To get a lien release in Maryland, a person must first locate the lienholder, contact them directly, and ask for a copy of the release. Send a written request, if necessary, with the required payment.

How do I find a lien? Liens against property can be recorded at the Department of Land Records alongside deeds. Search for liens online using Maryland Land Records (mdlandrec). Some liens come from court judgments. Unpaid taxes on the property may result in a lien.

In an action to which the doctrine of lis pendens applies, the filing in the land records of a county in which real property that is the subject of the action is located of either (1) a certified copy of the complaint giving rise to the lis pendens or (2) a Notice of Lis Pendens, substantially in the form approved by ...

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials.

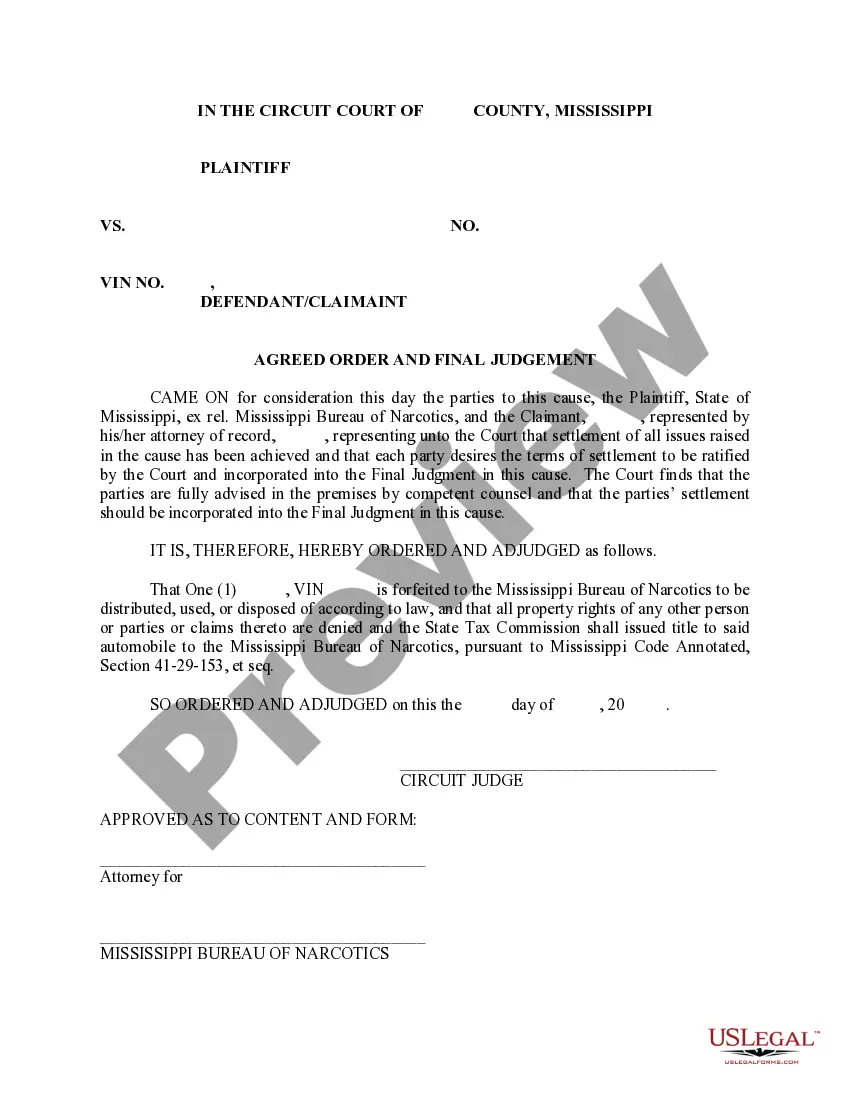

A Notice of Lien shall contain: (A) the names of the parties, designating each judgment creditor as a plaintiff and each judgment debtor as a defendant; (B) the name of the court and assigned docket reference; (C) the date of the judgment; and (D) the amount of the judgment.

How do I find a lien? Liens against property can be recorded at the Department of Land Records alongside deeds. Search for liens online using Maryland Land Records (mdlandrec). Some liens come from court judgments. Unpaid taxes on the property may result in a lien.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials.

In an action to which the doctrine of lis pendens applies, the filing in the land records of a county in which real property that is the subject of the action is located of either (1) a certified copy of the complaint giving rise to the lis pendens or (2) a Notice of Lis Pendens, substantially in the form approved by ...

ACTION FOR RELEASE OF LIEN INSTRUMENT. When a mortgage or deed of trust remains unreleased of record, the mortgagor, grantor, or a successor in interest entitled by law to a release may file a complaint for release of the lien instrument in any county where the lien instrument is recorded.