Issue Stock For Cash Journal Entry In Middlesex

State:

Multi-State

County:

Middlesex

Control #:

US-0040-CR

Format:

Word;

Rich Text

Instant download

Description

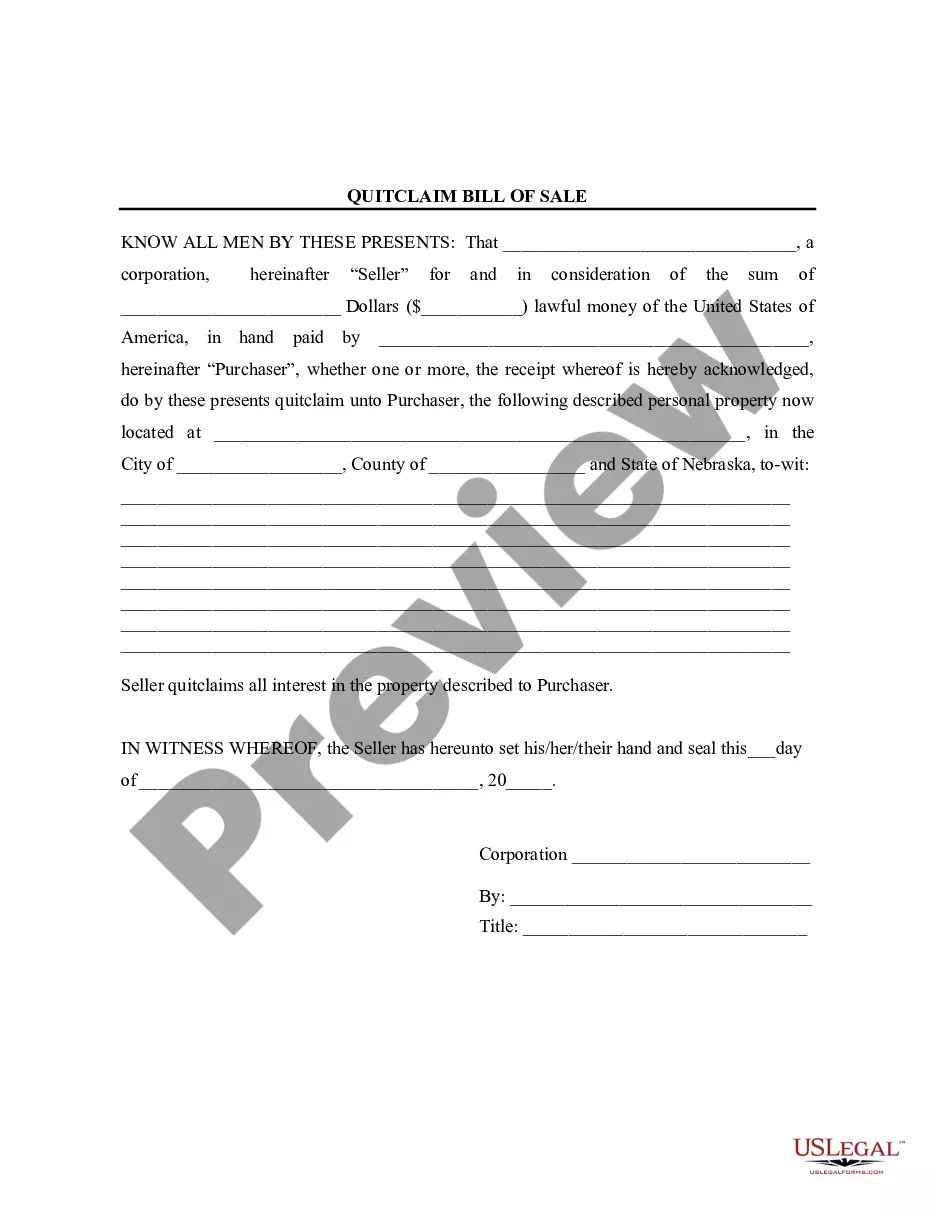

Form with which a corporation may resolve to issue additional Capital Stock in the corporation.

Free preview

Form popularity

FAQ

When the stock options are granted, the total stock option compensation expense is calculated as the fair market value of the stock options x the number of options granted. The company would debit stock option compensation expense and credit “equity APIC – stock option”.

Debit : Closing Stock a/c Assets are represented by real accounts. They carry a debit balance. By recording the journal entry for bringing the value of closing stock into books, we create the asset by name Closing Stock a/c. For this we have to debit the Closing Stock a/c.