Capital Contribution Resolution

Description

How to fill out Issue Capital Stock - Resolution Form - Corporate Resolutions?

Drafting legal paperwork from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re looking for a a simpler and more affordable way of creating Capital Contribution Resolution or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our online catalog of over 85,000 up-to-date legal documents addresses almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-compliant forms diligently prepared for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can easily find and download the Capital Contribution Resolution. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes minutes to set it up and navigate the catalog. But before jumping directly to downloading Capital Contribution Resolution, follow these recommendations:

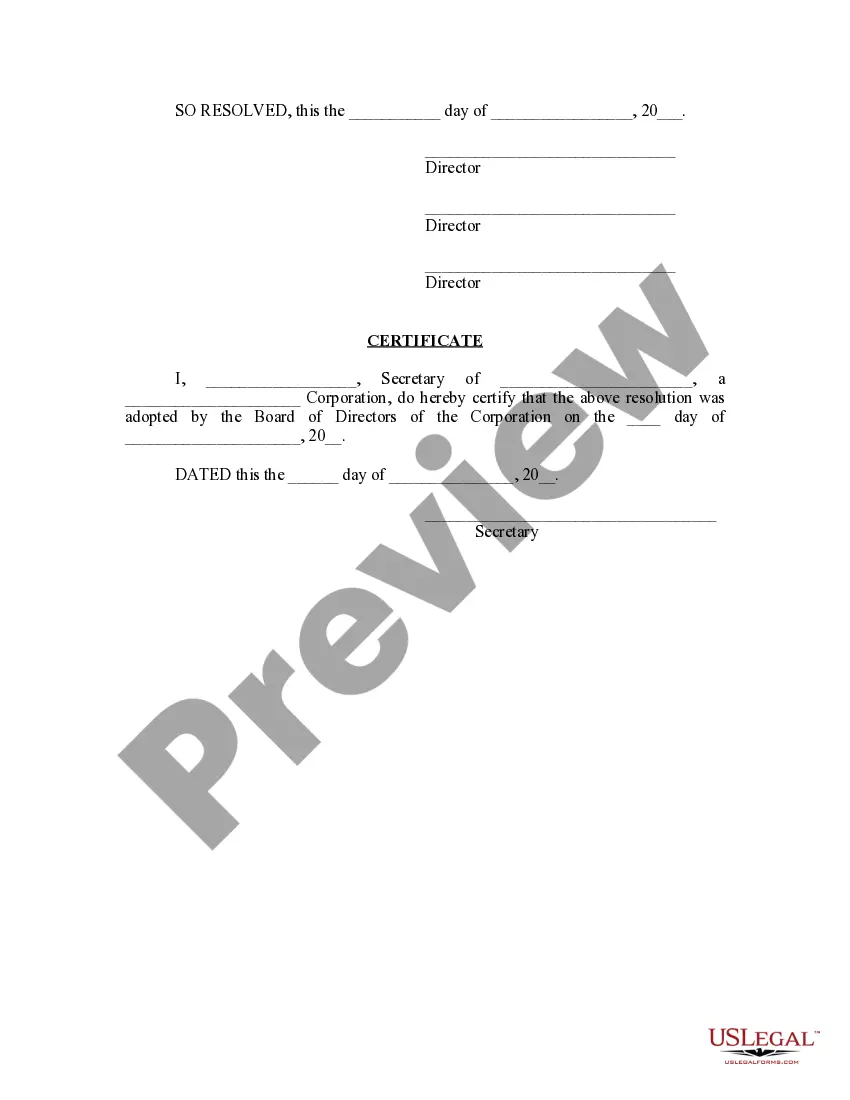

- Review the form preview and descriptions to ensure that you are on the the document you are searching for.

- Check if template you select complies with the requirements of your state and county.

- Pick the best-suited subscription option to purchase the Capital Contribution Resolution.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us today and turn form completion into something simple and streamlined!

Form popularity

FAQ

For example, an owner might take out a loan and use the proceeds to make a capital contribution to the company. Businesses can also receive capital contributions in the form of non-cash assets such as buildings and equipment. These scenarios are all types of capital contributions and increase owners' equity.

Contents Define the parties involved in the agreement and their respective roles. Identify the purpose of the agreement, including the capital contribution amount and any related terms and conditions. Detail any applicable taxes, fees, or charges related to the agreement.

Resolutions of the shareholders approving an increase in the authorized capital of the corporation. These resolutions are drafted as clauses to be inserted into minutes of a special meeting of shareholders or resolutions in writing of all the shareholders entitled to vote on the resolution.

Contributed Capital Formula It is calculated by subtracting retained earnings from total equity. read more is the par value of issued shares. The common stock of the company appears on its balance sheet below as common stock and preferred stock. Additional Paid-in Capital ? The additional paid-in capital.

Board Resolutions: Capital Contribution (Corporate Limited Partner) Resolutions of the board of directors of a corporate limited partner authorizing an additional contribution of capital to a limited partnership (LP). This Standard Clause has integrated Drafting Notes with important explanations and drafting tips.