Public Records On Credit Report In California

Category:

State:

Multi-State

Control #:

US-004-PR

Format:

Word;

Rich Text

Instant download

Description

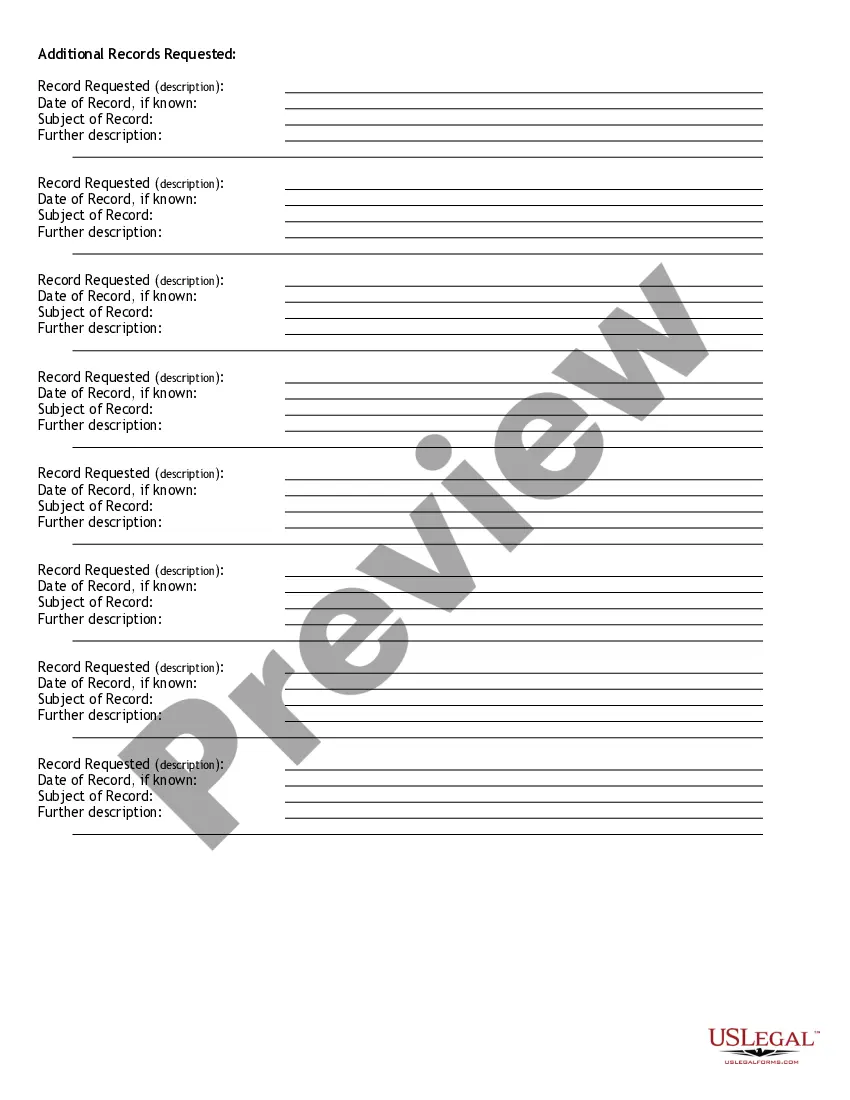

The Request for Public Records form is a vital tool in California for individuals seeking access to public records, particularly concerning public records on credit reports. This form provides a structured approach for users to request specific documentation from a designated public entity, ensuring compliance with open records laws. Key features include fields for the requester’s contact information, a detailed description of the records sought, and the option to specify multiple records if necessary. Users are informed about the conditions regarding copyright and are expected to agree to cover any associated costs, providing an overall sense of transparency. For attorneys, partners, owners, associates, paralegals, and legal assistants, this form streamlines the process of gathering pertinent information needed for cases, probative research, or general inquiries. It empowers legal professionals to effectively advocate for their clients by acquiring essential public documentation, including credit reports. Additionally, filling and editing instructions are clearly outlined, allowing users to complete the form accurately and efficiently, contributing to successful outcomes. In summary, this form is not only a request mechanism but also a critical resource for navigating public records within the broader legal framework.

Free preview