Credit Letter Example With Address In Tarrant

Description

Form popularity

FAQ

The mailing address for Equifax is P.O. Box 740241, Atlanta, GA 30374-0241. The address for Experian is P.O. Box 2104, Allen, TX 75013-0949. The address for TransUnion is P.O. Box 1000, Chester, PA 19022.

To update your address on your credit report, you can contact each of the three major credit bureaus (Experian, Equifax, and TransUnion) individually and request that they update your information.

You don't need to contact the credit bureaus to update the personal information on your credit reports. Instead, get in touch with your creditors and ask them to update your records with your new address, name or employer.

Select the address of the bureau you need to contact: Equifax: Equifax Information Services LLC, P.O. Box 740256, Atlanta, GA 30348. Experian: Experian, P.O. Box 4500, Allen, TX 75013. TransUnion: TransUnion LLC Consumer Dispute Center, P.O. Box 2000, PA 19016.

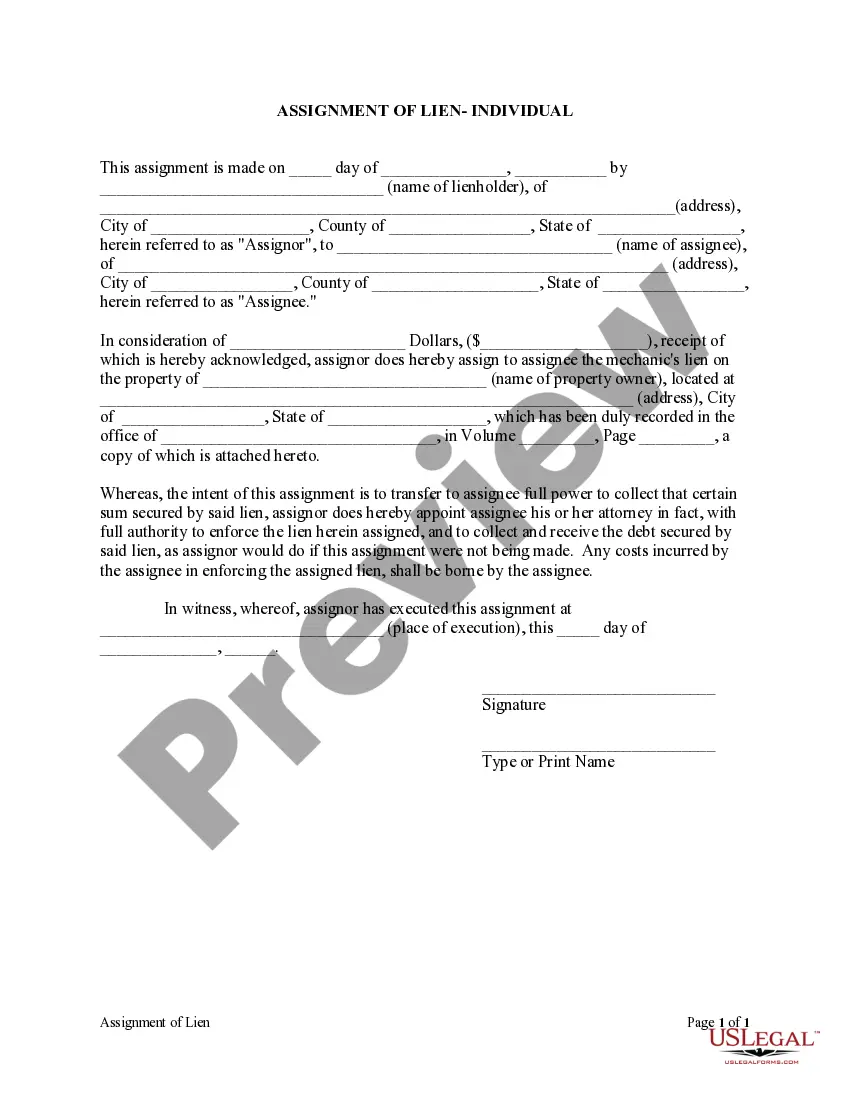

How to Write a Letter of Credit Prepare the letter of credit documents, including the credit application, bank instructions, and the credit agreement. Make sure all documents are signed, dated, and include all necessary information. Submit documents to the issuing bank. Confirm that the bank has accepted the documents.

The fastest way to report an incorrect address on your credit report is to open a dispute online. Experian will investigate the origin of the address. As long as it isn't associated with any of your accounts, Experian can remove it.

To update your address on your credit report, you can contact each of the three major credit bureaus (Experian, Equifax, and TransUnion) individually and request that they update your information.

While a letter of credit can offer a level of security in international trade, it is important to consider the potential drawbacks. There are fees associated with the issuing bank, and the seller's access to funds may be restricted due to the L/C.

How to Apply for a Letter of Credit. The exporter and their bank must be satisfied with the creditworthiness of the importer's bank. Once the Sales Agreement is completed, the importer applies to their bank to open a Letter of Credit in favor of the exporter.