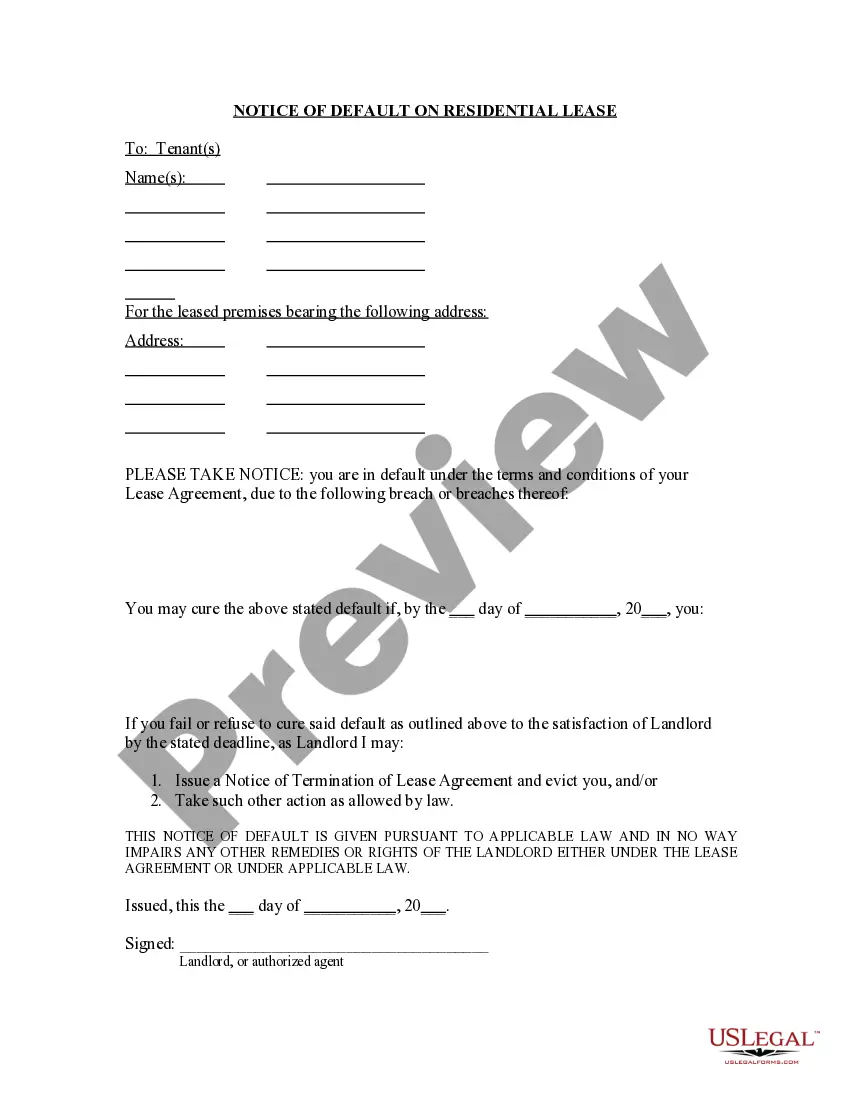

This form is a sample letter in Word format covering the subject matter of the title of the form.

Ejemplo Recibo De Pago In California

Description

Form popularity

FAQ

You can stop the wage assignment by filling out the enclosed Revocation Notice Form, or by writing a letter stating that you are revoking the wage assignment. Send the Revocation Notice Form or letter by registered or certified mail to the creditor, at the address listed above.

Wage assignments are governed by state law and do not involve a court order. Since they are voluntary and the employee specifies the amount to withhold, they do not fall under the requirements of the Federal Consumer Credit Protection Act.

As stated above, if an employer fails to comply with a garnishment write, that employer may become liable for the full amount of the employee's judgment debt. As reported by Workforce, small missteps along the way can expose the employer to potential liability.

No assignment of wages is valid in California unless certain conditions are met. In addition, only a certain percentage of an employee's disposable wages can be withheld from each paycheck. Unlike a garnishment order, which is required to be honored by law, an employer has no obligation to honor an assignment.

A wage assignment is a voluntary agreement between the employee and creditor where an amount is withheld from the employee's paycheck to satisfy a debt owed to a third-party recipient, whereas under a wage garnishment, the amount withheld from the employee's check is typically obtained through a court order initiated ...