Sample Letter To Close Trustee Accounting For Beneficiary In Oakland

Description

Form popularity

FAQ

California statutory law requires a trustee to account annually to current trust beneficiaries, i.e., those who are currently entitled to receive distributions of income and principal during the accounting period. Any trustee, other than the settlor(s) who established the trust, has a duty to account.

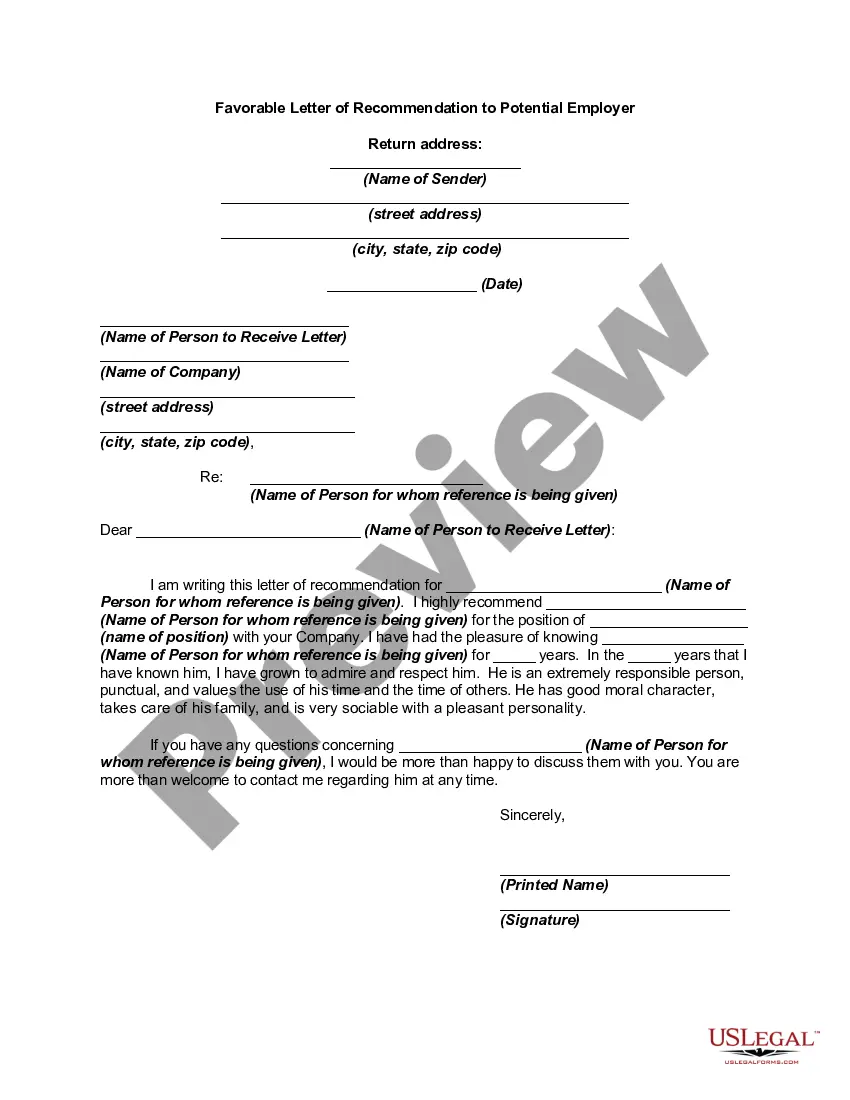

A letter, directly to the trustee, making a demand for an accounting is the first step. In some instances, in addition to making a demand for an accounting of the financial assets, a request for an inventory of the personal property of the decedent is also a good idea.

While a formal estate accounting must be provided to beneficiaries at least once a year, beneficiaries can request an informal accounting at any time.

Basic principles are important to understand when determining how to do trust accounting in California. Per California probate code sections 16060 and 16062, trustees must: Keep beneficiaries 'reasonably' informed about how they manage the trust. Provide an accounting at least once annually.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

The first step is determining your specific reasons for seeking a trust accounting. Determine Your Reasons for Requesting Information. Make a Request for a Trust Accounting in Writing. File a Formal Petition with the Court to Compel the Trustee to Account.

Below, we have broken the process down into manageable steps. Step 1: Start with a Proper Salutation. Step 2: Introduce Yourself and Your Relationship to the Deceased. Step 3: Clearly State the Purpose of the Letter. Step 4: Provide Detailed Information about the Inheritance.

Upon court motion: Beneficiaries can petition the court for a formal accounting; if the court grants the petition, the executor must provide one.

How to Get an Accounting. The California Probate Code gives beneficiaries the right to demand a full and complete accounting of the trust's assets, starting from the date of death of the decedent to the date of demand. A letter, directly to the trustee, making a demand for an accounting is the first step.