Letter To Close Account After Death With Credit Card In Middlesex

Description

Form popularity

FAQ

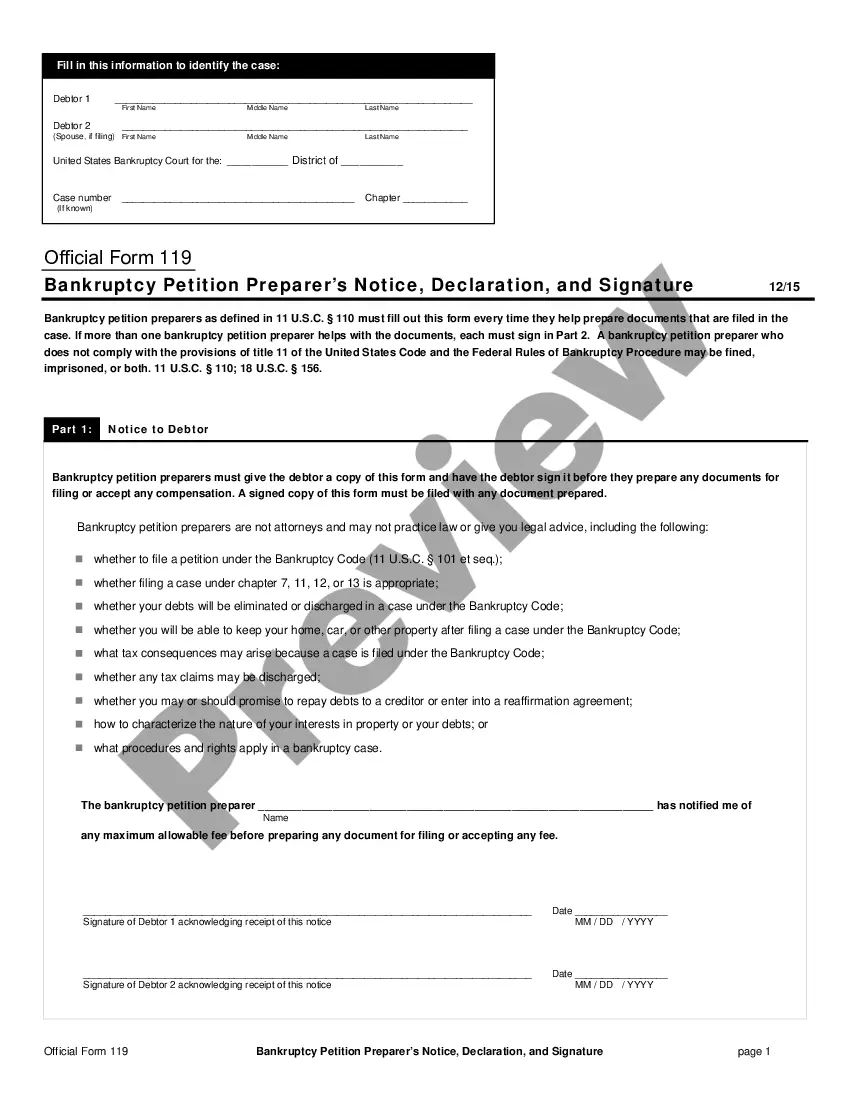

Your valid ID, such as a state-issued driver's license or ID card, U.S. passport, or military ID. Proof of death, such as certified copies of the death certificate. Documentation about the account and its owner, including the deceased's full legal name, Social Security number, and the bank account number.

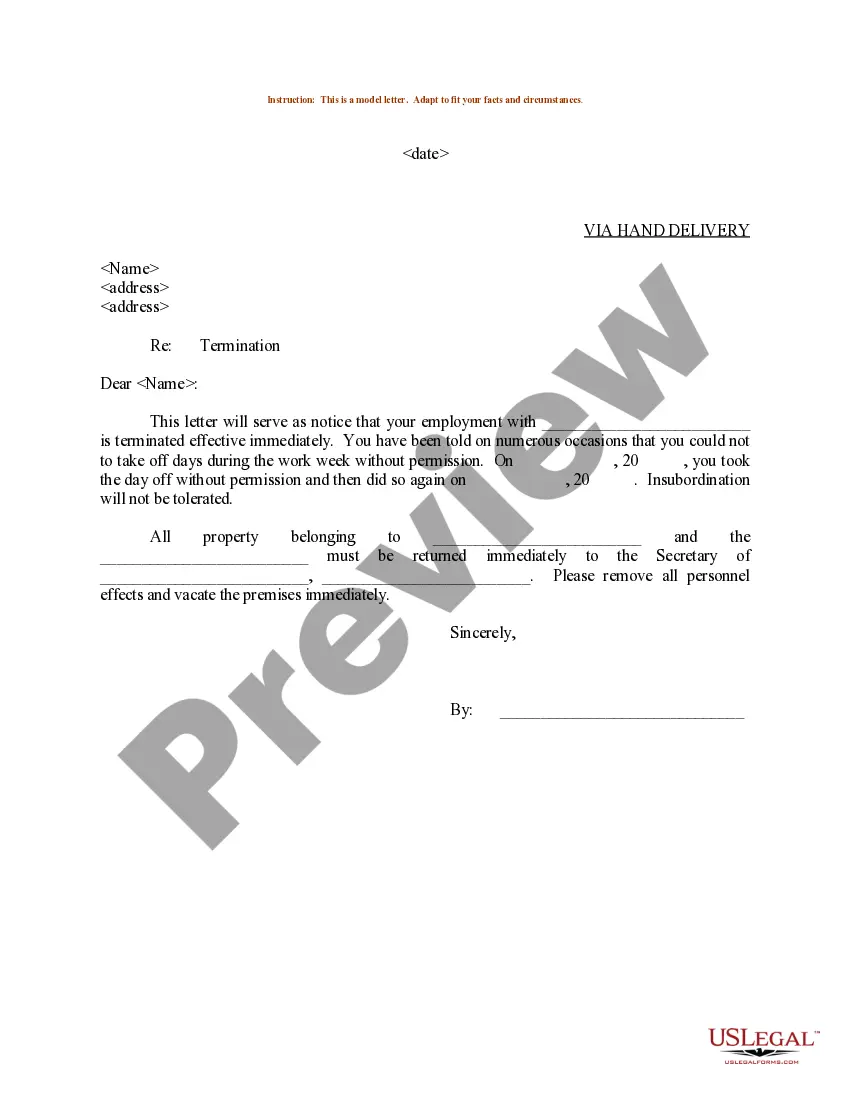

Using the credit report as your guide, contact all banks and credit card companies at which the deceased had an open account and close those accounts as quickly as possible. You will need to provide a certified copy of the death certificate to close the account.

Respected Sir/Madam, I am writing to you with a heavy heart to inform you of the demise of my husband, Mr. Rajeev Singh, who had a savings account in your esteemed bank. It is a difficult time for our family, and I need to settle his financial affairs.

The credit card company may request a copy of the death certificate or any paperwork relating to the estate. This is a great opportunity for you to reiterate your request to close the account in writing. If the account is a joint account, the issuer will simply remove your loved one's name from the account.

I am writing to inform you that my husband, (Name of deceased), recently passed away, and he had outstanding debts with your company. While I am not listed as a co-signer on any of these loans or credit cards, I am in the process of opening a small estate for my husband, and the court has accepted my filing.

Ing to California Probate Law, the first step in alerting creditors that someone has passed away is by completing a Notice of Administration to Creditors (form DE-157).