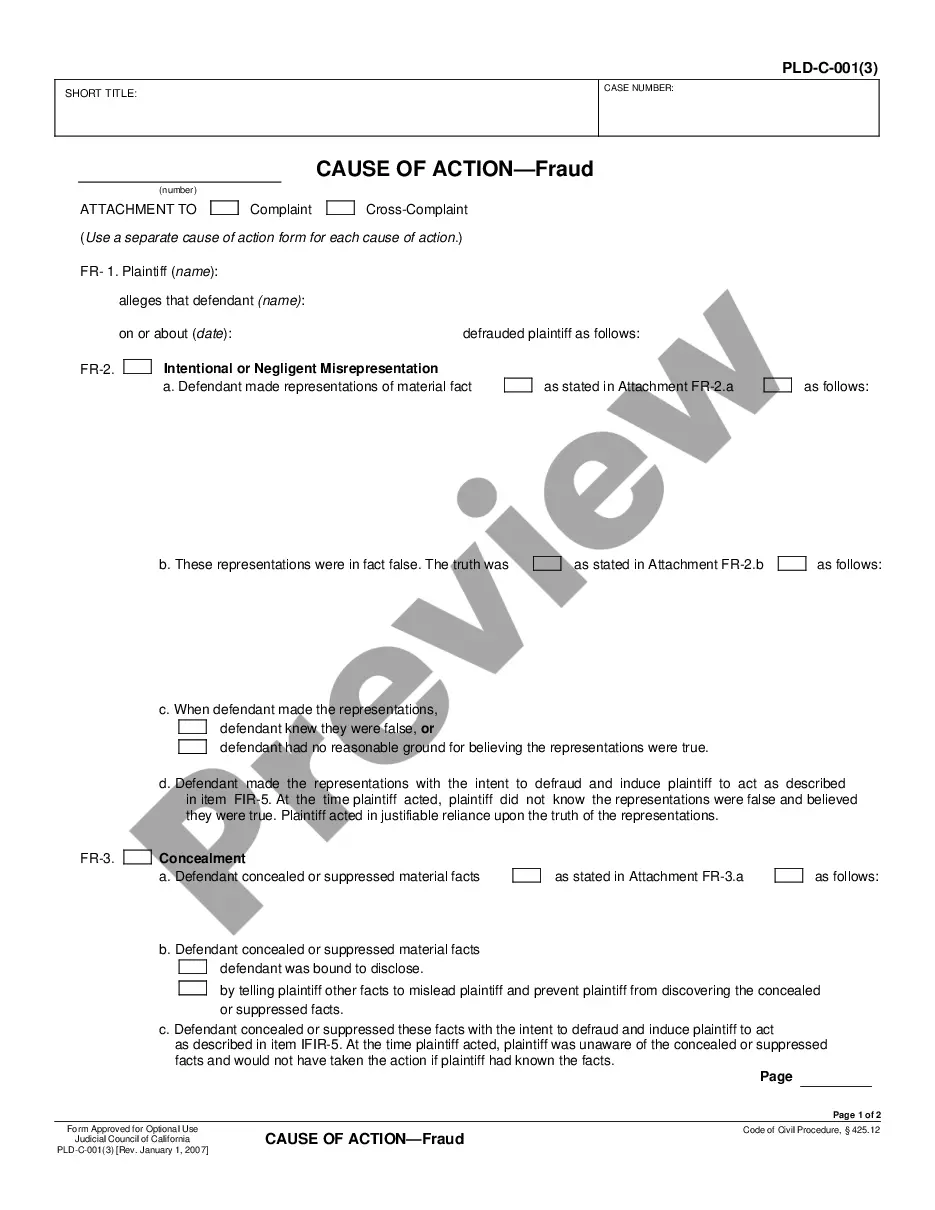

Form with which a corporation may alter the amount of outstanding shares issued by the corporation.

Buyback Of Shares Resolution Format In Illinois

Description

Form popularity

FAQ

Domestic BCA: Any company that files Articles of Incorporation in the State of Illinois under the Business Corporation Act of 1983, as amended is considered a domestic corporation in the State of Illinois.

Resolutions of the board of directors authorizing and approving a reporting company's stock repurchase program. These resolutions are drafted as standard clauses and should be inserted into board minutes or a form of unanimous written consent.

What should shareholder resolutions include? Your corporation's name. Date, time and location of meeting. Statement that all shareholders agree to the resolution. Confirmation of the necessary quorum for business to be conducted. Names of shareholders present or voting by proxy. Number of shares for each voting shareholder.

For corporations, the state imposes a corporate income tax, a corporate franchise tax, and a personal property replacement tax. For LLCs, the profits are only taxed on the owner's or member's personal taxes (plus the personal property replacement tax).

Any corporation whose issued and outstanding shares are subject, or upon election shall be subject, to one or more of the restrictions on transfer set forth in Section 6.55 may become a close corporation by executing and filing, in ance with Sections 1.10 and 10.20 of this Act, articles of amendment of its ...

The Business Corporation Act of 1983 permits Illinois cor- porations to be formed for any lawful purpose permitted by this act except bank- ing or insurance.

What does the Corporations Act 2001 do? The Corporations Act 2001 sets out the way a company must run in order to be compliant with the law. It deals with regulatory compliance, the behaviour of corporates, directors' duties and reporting.

Buyback Yield → Divide the total value of the share buybacks by the market capitalization at the beginning of the period. Conversion to Percentage → Multiply the resulting figure by 100 to convert the buyback yield into a percentage.

The Business Corporation Act of 1983 permits Illinois cor- porations to be formed for any lawful purpose permitted by this act except bank- ing or insurance.