Form with which a corporation may alter the amount of outstanding shares issued by the corporation.

Change Ownership Of Shares In Houston

Description

Form popularity

FAQ

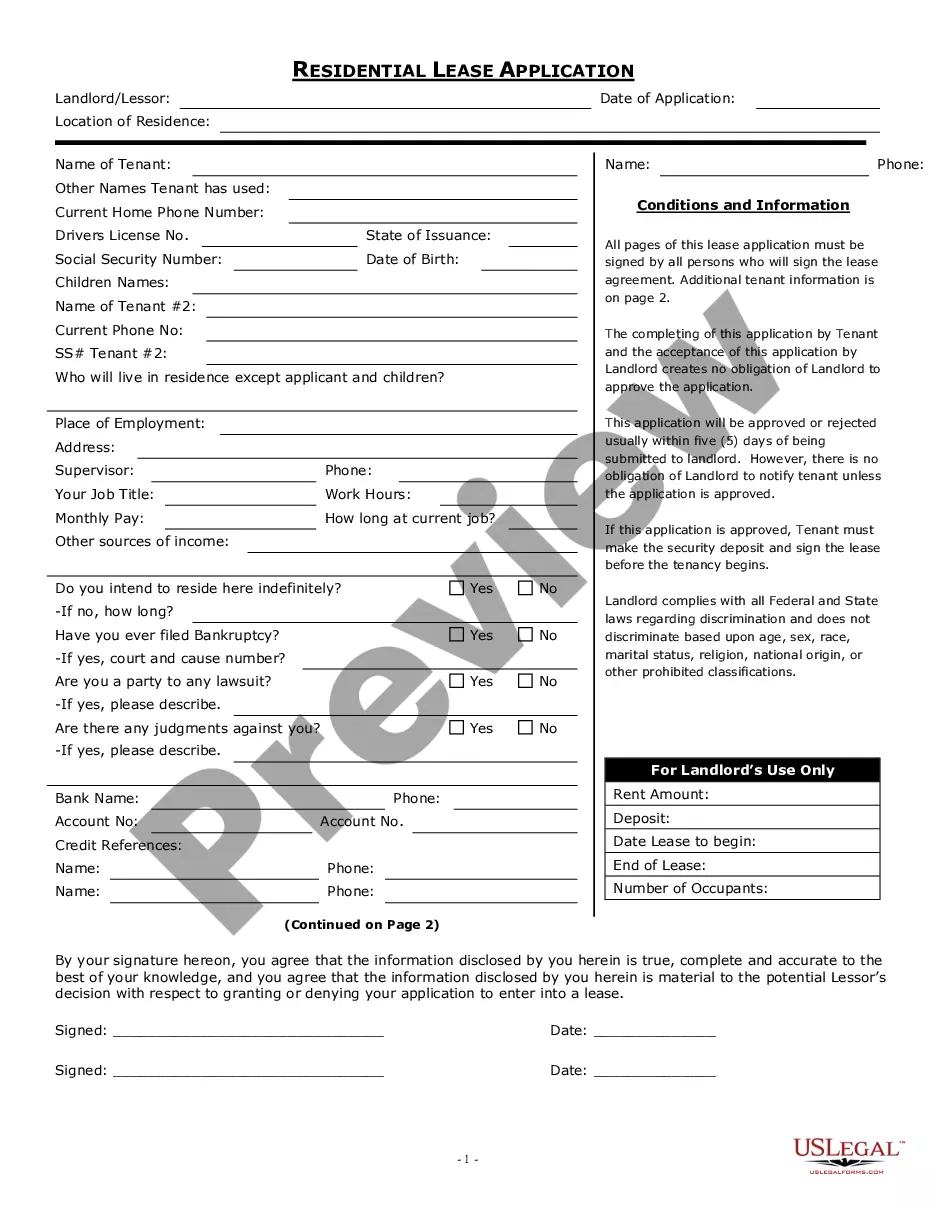

Once you have decided to transfer the shares, you will have to fill out a Stock Transfer Form in order to legally transfer the shares. At this point in time, there is no need to inform Companies House, this will be done during your next Confirmation Statement.

Follow these steps to enter a change of ownership for an S corporation. Enter the date of change and the resulting number of shares on this date for each shareholder. UltraTax CS will calculate up to 24 changes of ownership.

Share owners can transfer, that is sell their shares and the rights that go with them (also called "rights attached to the shares"). Transfers must conform to any conditions or restrictions that apply to the corporation's shares and their transfer. For example, directors could have to approve all transfers of shares.

Share owners can transfer, that is sell their shares and the rights that go with them (also called "rights attached to the shares"). Transfers must conform to any conditions or restrictions that apply to the corporation's shares and their transfer. For example, directors could have to approve all transfers of shares.

Contact your broker to get the appropriate forms to complete. The process will be simpler if the new owner also has or will have an account with the same broker, because no change in the actual registration of the shares will be necessary. The broker will simply make the transfer on its own internal books.

For being about to transfer shares, the shareholder would require the board members' approval and the approval of all the other shareholders in the company. Once this is done, the share transfer form is filled in, and the new share certificate is issued ingly to the person getting the shares.

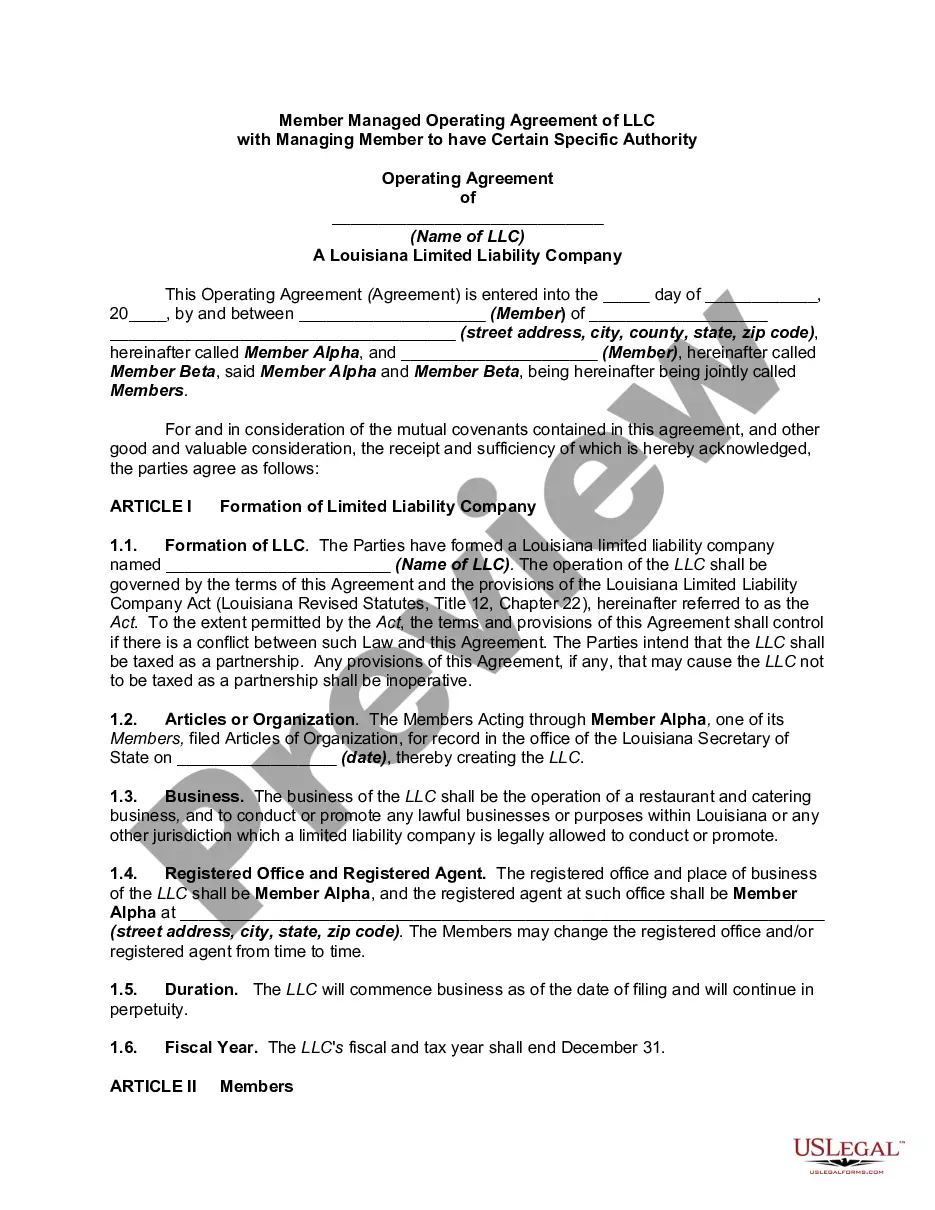

If your entity made an error on its PIR or has a critical need for an update, you may file an amended PIR with a cover letter to explain the error or critical need. Mail the form to P.O. Box 149348, Austin TX 78714-9348 with “Amended” at the top along with a statement explaining the need to amend the PIR.

File proper change of ownership paperwork in Texas First, the LLC members can file an amendment to the Certificate of Organization reflecting the updated management information. Alternatively, Texas requires LLCs to submit a Public Information Report annually to the Texas Comptroller of Public Accounts.