Homestead Exemption For Ohio In Wayne

Category:

State:

Multi-State

County:

Wayne

Control #:

US-0032LTR

Format:

Word;

Rich Text

Instant download

Description

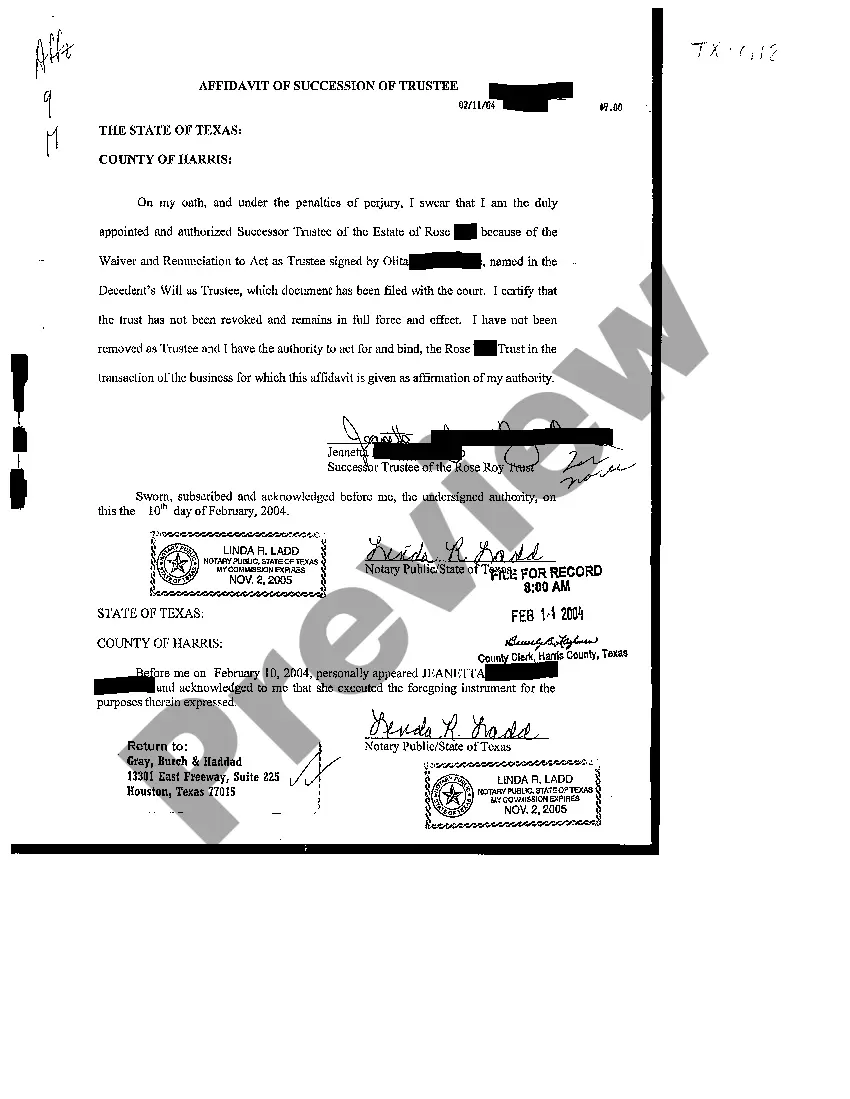

The Homestead Exemption for Ohio in Wayne provides property tax relief to eligible homeowners by allowing them to exempt a portion of their property's value from taxation. This exemption is intended to protect primary residences and offers significant savings for qualifying individuals. The form associated with this exemption is essential for homeowners and legal professionals who assist clients in claiming the benefit. Key features include the requirement to prove residency and provide documentation, such as an affidavit confirming the homeowner's occupancy. Filling out the form involves straightforward instructions, including providing necessary personal information, property details, and attesting to the accuracy of the claim. Legal professionals, including attorneys, paralegals, and legal assistants, will find this form useful when advising clients on property tax matters and ensuring they receive the full benefit of applicable exemptions. It simplifies the process of claiming the Homestead Exemption and ensures compliance with local regulations. A clear understanding of this form can facilitate discussions among partners and owners regarding potential tax savings and planning strategies.