Property Tax Exemption Application For Qualifying Disabled Veterans In Texas

Description

Form popularity

FAQ

The senior freeze tax is a valuable program for eligible seniors in Texas, providing much-needed relief from rising property taxes. If you're a senior homeowner in Texas, it's worth exploring the senior property tax freeze and submitting a senior freeze application to your county appraisal district.

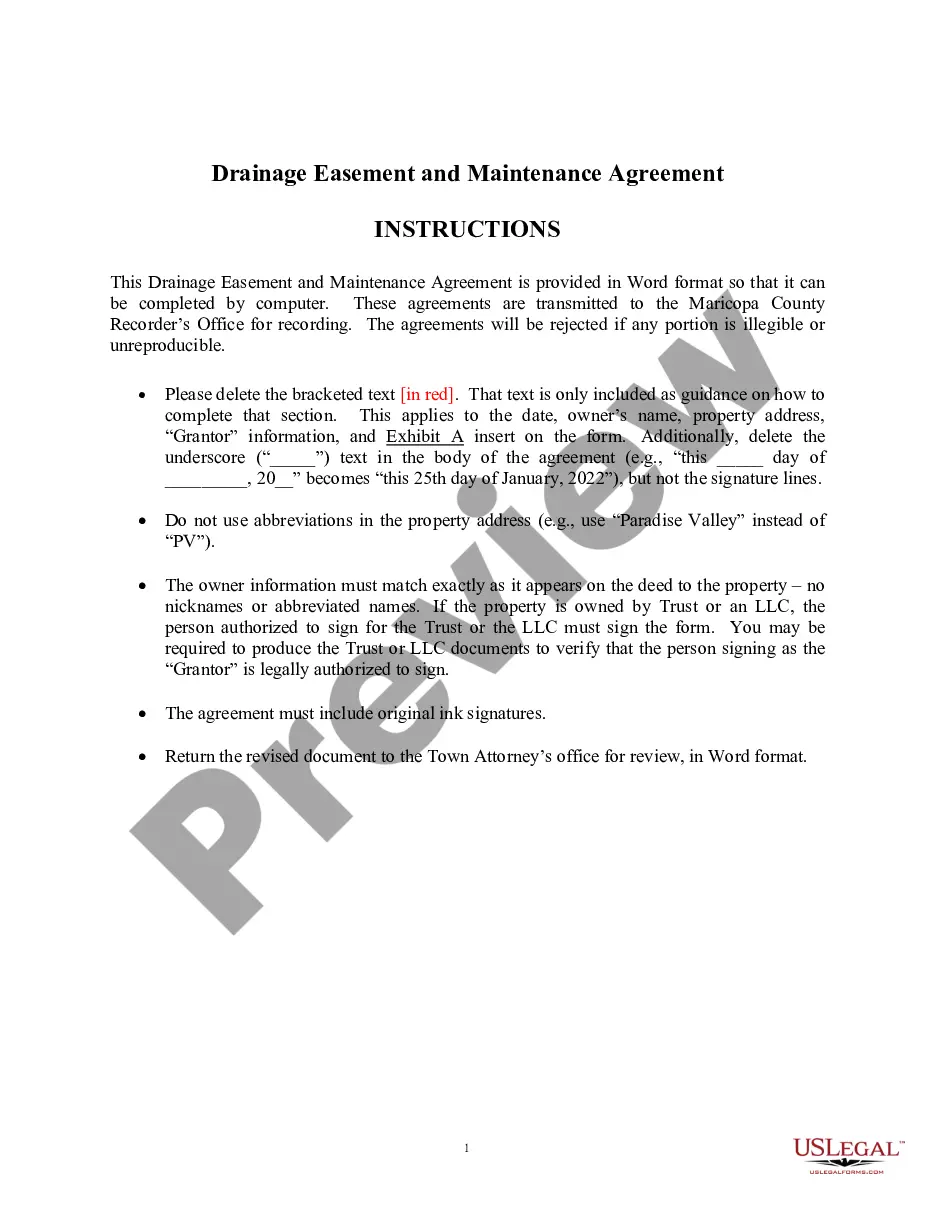

To get this exemption, you must fill out Form 11.13, checking the box for 100% Disabled Veterans Exemption, as well as all boxes that apply to you. You must attach documentation as well.

Seniors age 65 or older can qualify for an additional exemption of $10,000 in addition to the $100,000 homestead exemption that all homeowners in Texas can receive. You qualify for this exemption in the year you turn 65.

Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether property qualifies for an exemption.

Ing to the Comptroller, there is no provision for the cessation of property taxes at any stage. However, there is a Texas property tax exemption for people over the age of 65, which offers temporary tax relief for seniors. At the age of 65, seniors can apply for an exemption from Texas property taxes.

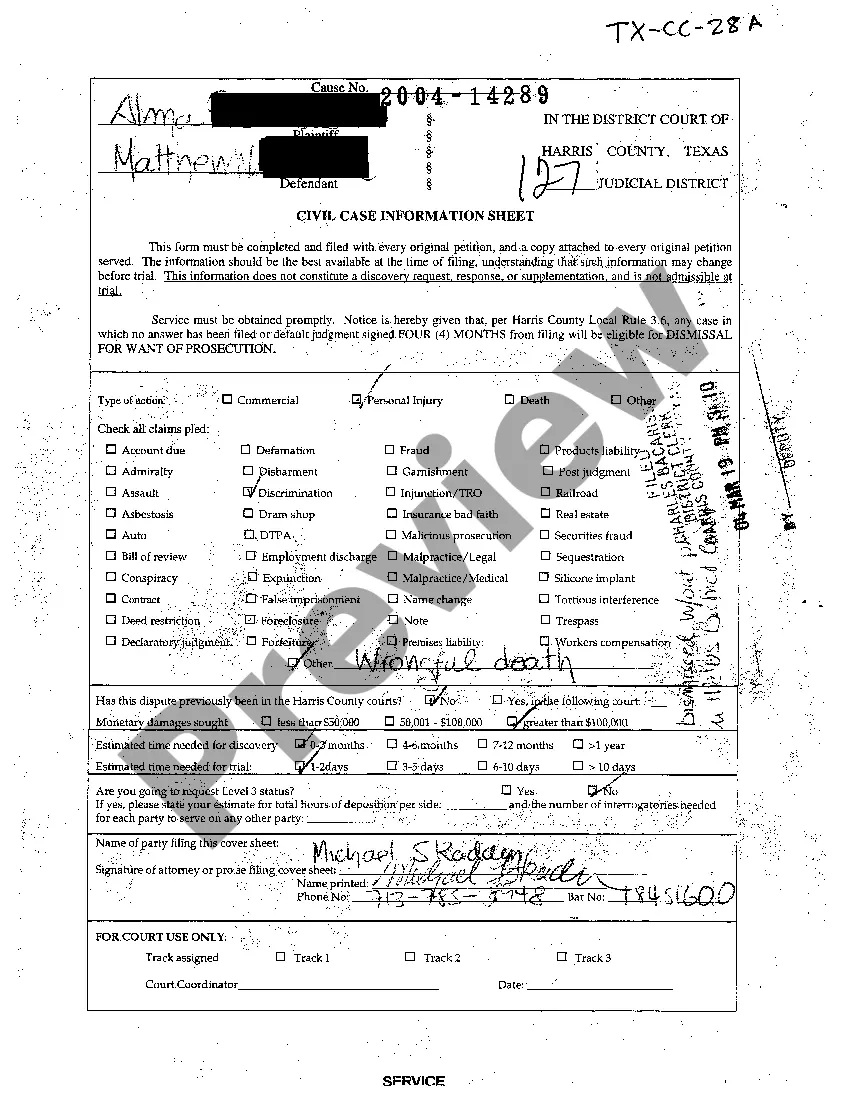

Yes. A disabled veteran with a service-connected disability awarded 100 percent disability compensation and a disability rating of 100 percent (or determination of individual unemployability) is eligible for this exemption.

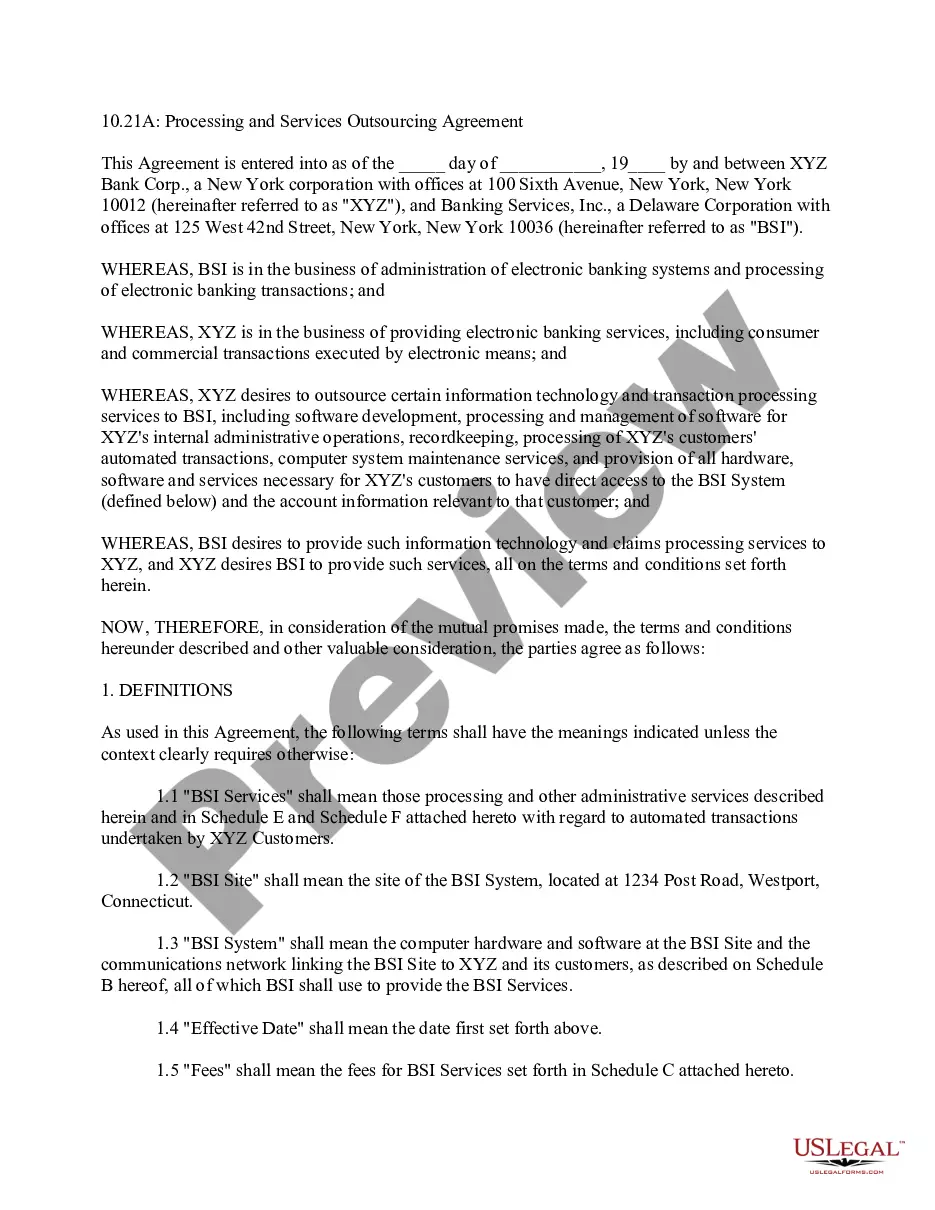

Property tax exemptions are one of the most meaningful and simple ways to reduce property taxes. The Texas legislature has provided numerous property tax exemptions for Texas taxpayers. Exemptions for homestead, over 65 homestead, disabled homestead and disabled veteran are just the start.

Veterans who are rated 100% due to service connected disability or in receipt of 100% compensation due to a grant of individual unemployability are entitled to an exemption from taxation of the total appraised value of the Veteran's residence homestead.

Check the Status of Your Application We strive to process exemptions as quickly as possible, but at times processing could take up to 90 days to process, per Texas Property Tax Code Section 11.45. Please allow at least 90 days to lapse before contacting our office to check when your application will be processed.