Homestead Exemption Forney In Riverside

Description

Form popularity

FAQ

There are multiple ways to file a Homestead Exemption application Form 50-114, however the online option is the fastest, and details are provided in the transcript below.

As of January 1, 2024, the new minimum homestead exemption is $349,720 and the new maximum is $699,426. For Riverside County, the 2024 homestead exemption is $612,000. For San Bernardino County, the 2024 homestead exemption is $475,000.

Homestead exemption authorized. Pursuant to article VIII, section 1-b of the Texas Constitution, $15,000.00 of the assessed value of resident homesteads of persons 65 years of age or older or disabled persons shall be exempt from city ad valorem taxes.

WHERE TO FILE: This document, and all supporting documentation, must be filed with the appraisal district in the county in which your property is located. Location and address information for the appraisal district office in your county may be found at comptroller.texas/propertytax/references/directory/cad.

Generally, the filing deadline for a residence homestead exemption is no later than April 30. What if I miss the filing deadline? A late application for a residence homestead exemption, including for a person age 65 or older or disabled, may be filed up to two years after the filing deadline has passed.

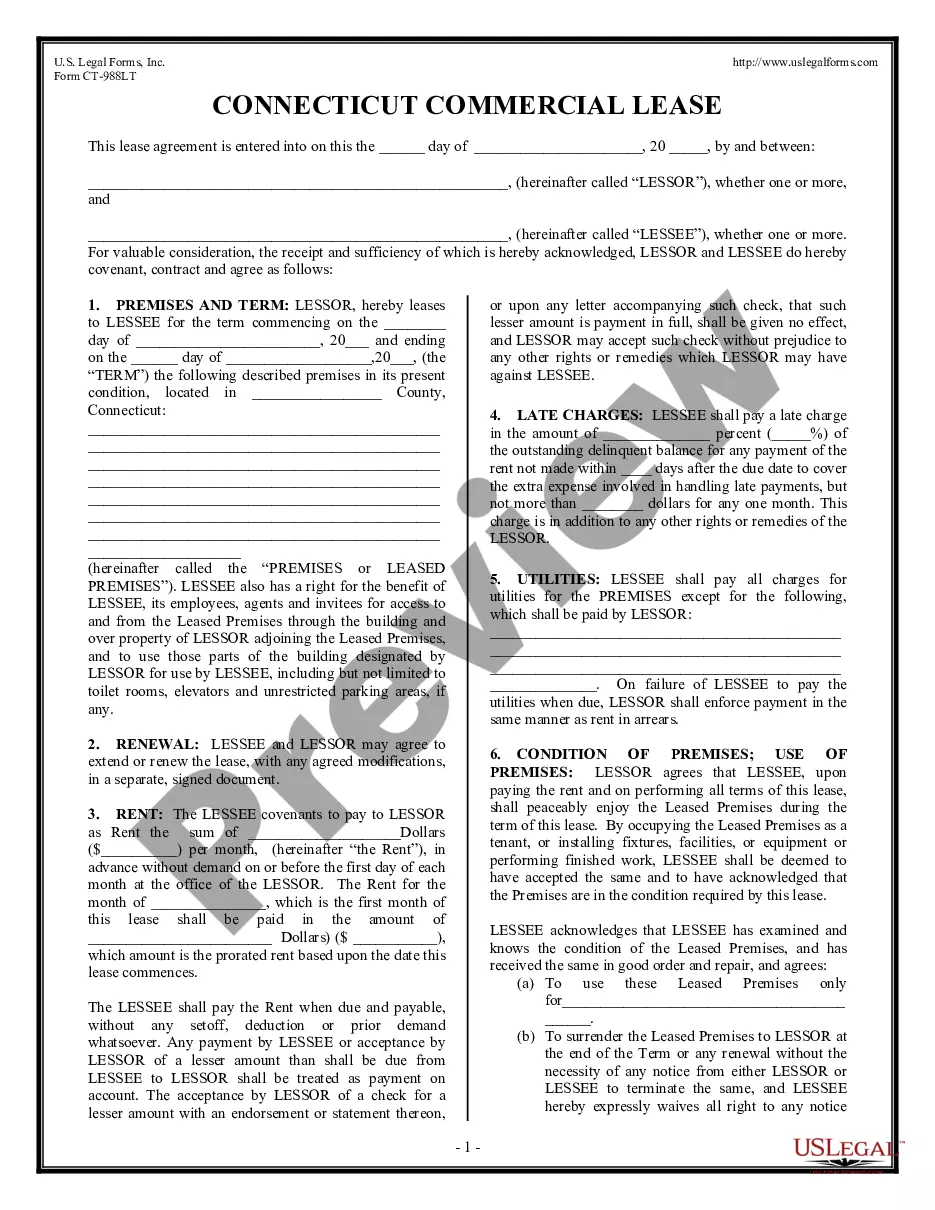

File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between Jan. 1 and April 30 of the year for which the exemption is requested. Do not file this document with the Texas Comptroller of Public Accounts.

To qualify for the general residence homestead exemption, a home must meet the definition of a residence homestead and an individual must have an ownership interest in the property and use the property as the individual's principal residence.

A homestead can protect the $50,000. There are two types of homesteads, automatic and declared.

Complete form BOE-266, Claim for Homeowners' Property Tax Exemption. Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office.

To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor.