Homestead Exemption Forms With Miniatures In Oakland

Description

Form popularity

FAQ

California offers a senior income tax exemption in addition to its personal exemption. More specifically, seniors receive an extra benefit that allows them to double the standard exemption. For the 2024 tax year, California increased the personal exemptions for all filing statuses.

Senior Tax Exemptions in California The Senior Citizen Homeowners' Property Tax Exemption is available to homeowners who are at least 65 years old and meet certain income requirements.

This exemption is available to a single homeowner age 65 or older, or a couple filing a joint petition, if either or both are age 65 or over.

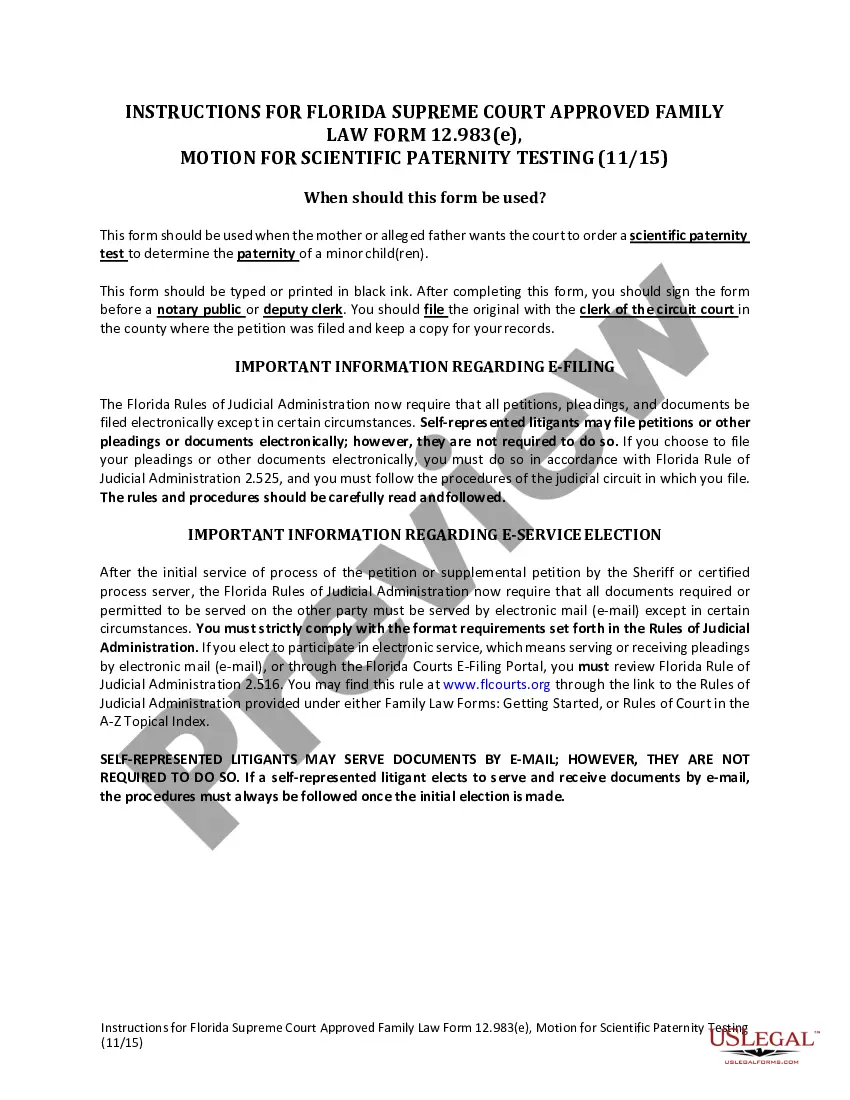

New applications for Homestead Exemptions may be filed online or in person, at the Property Appraiser's office between January 1 and March 1, with one exception. Florida law allows new Homestead applications only to be filed prior to January 1 of the year the exemption is to be effective.

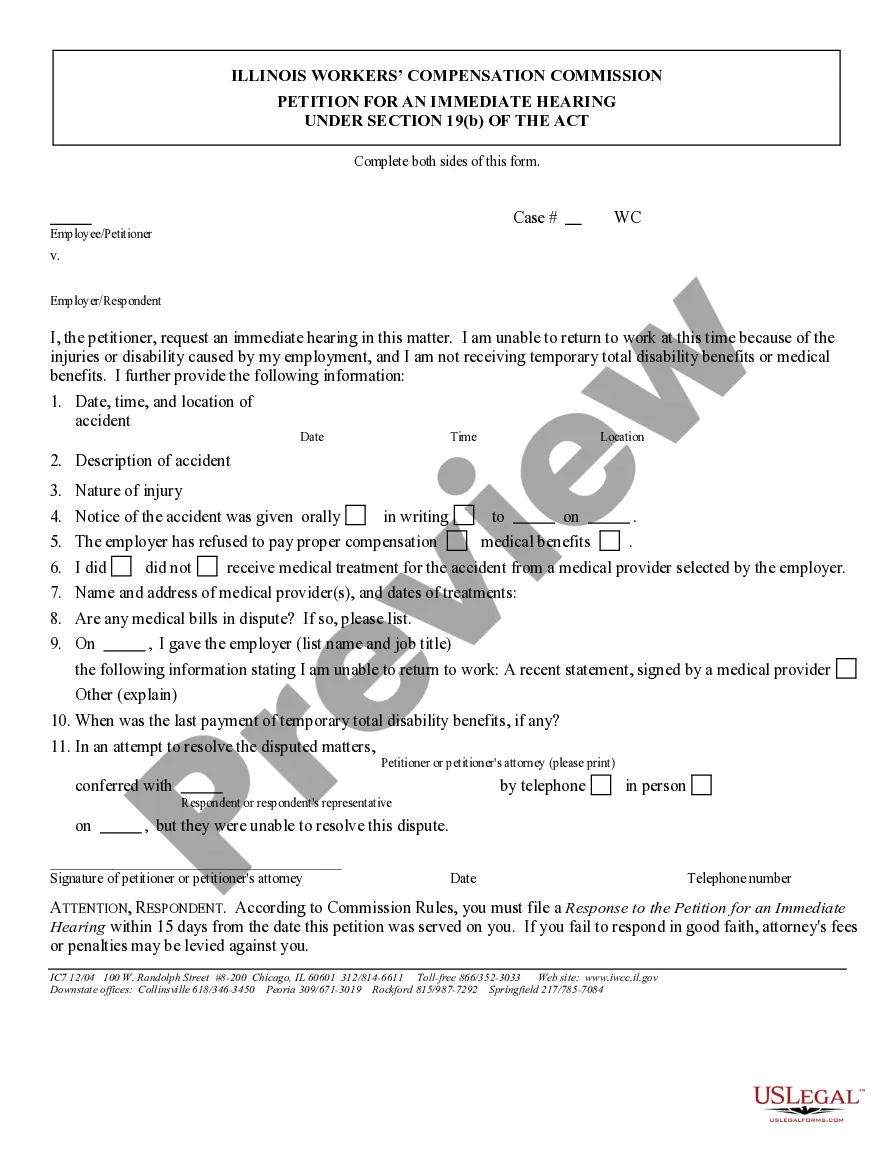

Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office. Once the exemption has been granted, it remains effective until a change in eligibility occurs, such as selling or moving out of the home. Annual filing is not required.

You must occupy the dwelling as your principal residence as of January 1 of each year to qualify for the Homeowners' Exemption for that year.

In some instances, Qualified School District Special Taxes may qualify for one of the following exemptions: Persons who are 65 years of age or older. Persons receiving Supplemental Security Income for a disability, regardless of age.

The California Revenue and Taxation Code provides homeowners with a $7,000 reduction in the taxable value of a qualifying owner-occupied residence for purposes of computing the annual property tax assessment. With an approximate 1% property tax rate, the exemption provides roughly $70 in annual property tax savings.