Exemption Form Homestead With Multiple Owners In Harris

Description

Form popularity

FAQ

The U.S. tax code provides tax advantages for married couples who file jointly and own a home. While duplicating these tax benefits with another residence would help your bottom line when you file taxes, it's not possible to claim two primary residences because of tax regulations from the IRS.

There can only be one homestead per family. But in the event of divorce, each spouse may claim a separate homestead. If one spouse passes away, the surviving spouse may retain the family status.

Both owners must sign the application form and, if both owners otherwise qualify, the homestead exemption will be granted for the entire home. This process is as simple as any other married couple or single individual applying for the exemption.

Here's how a homestead exemption can translate to savings. A homestead valued at $400,000, taxed at 1%, is eligible for an exemption of $50,000. The property's taxable value will be $350,000, and the tax bill $3,500. Without the exemption, the property tax bill would be $4,000.

A 20% optional homestead exemption is given to all homeowners in Harris County. If the value of your home is $100,000, applying the exemption will decrease its taxable value for Harris County taxes from $100,000 to $80,000.

No. A married couple can claim only one homestead.

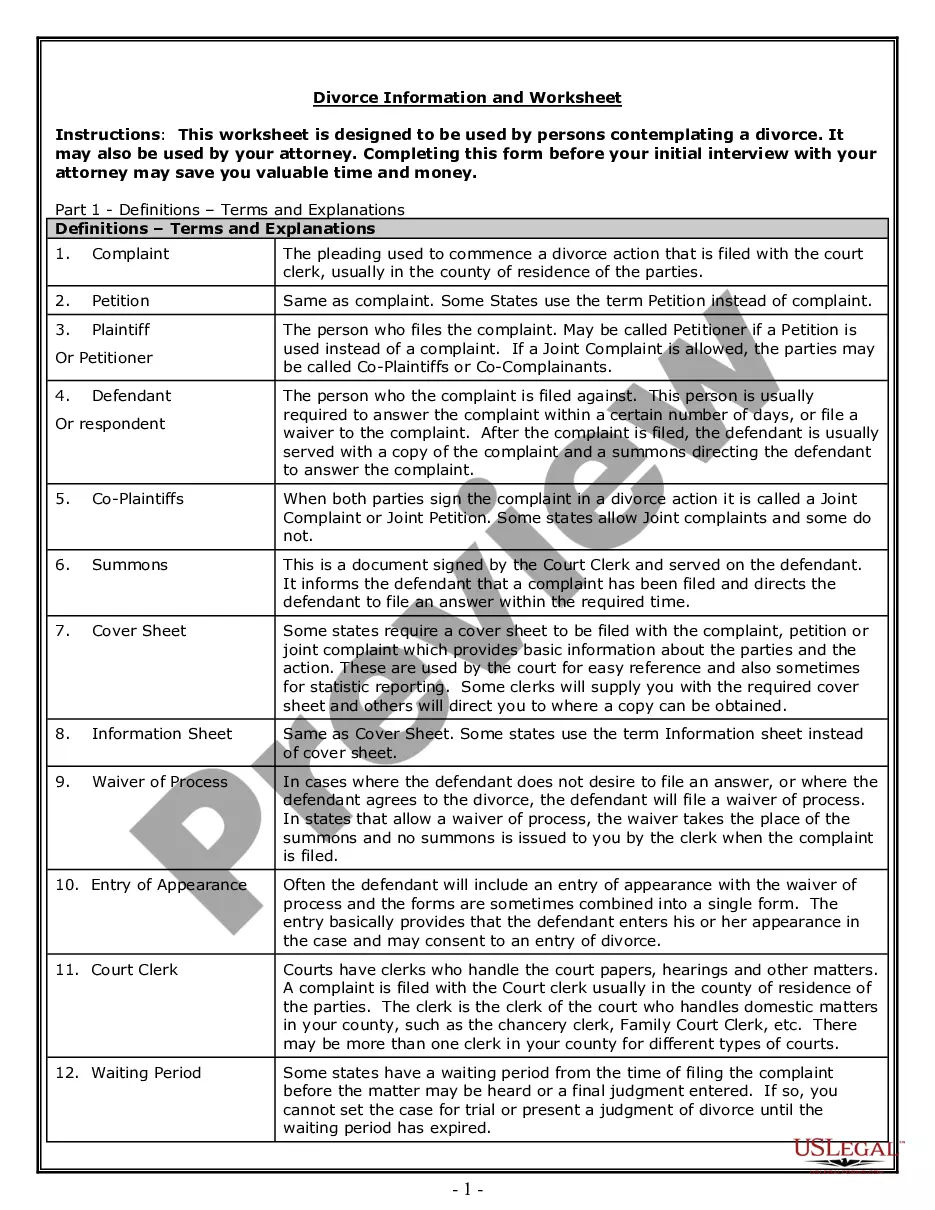

First, apply to HCAD for the exemption. We will send an application for the homestead exemption, or you may obtain the form directly from HCAD online at .hcad/ or by calling 713-957-7800. Once the exemption is approved by HCAD, the refund will be processed directly to the name and address on the tax roll.

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

At the Harris County Appraisal District website of .hcad you can look up your account and see which if any exemptions have been applied to your account.