Non Profit Resolution Template With Calculator In Suffolk

Description

Form popularity

FAQ

How to Start a Nonprofit in New York Name Your Organization. Choose a New York nonprofit corporation structure. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records.

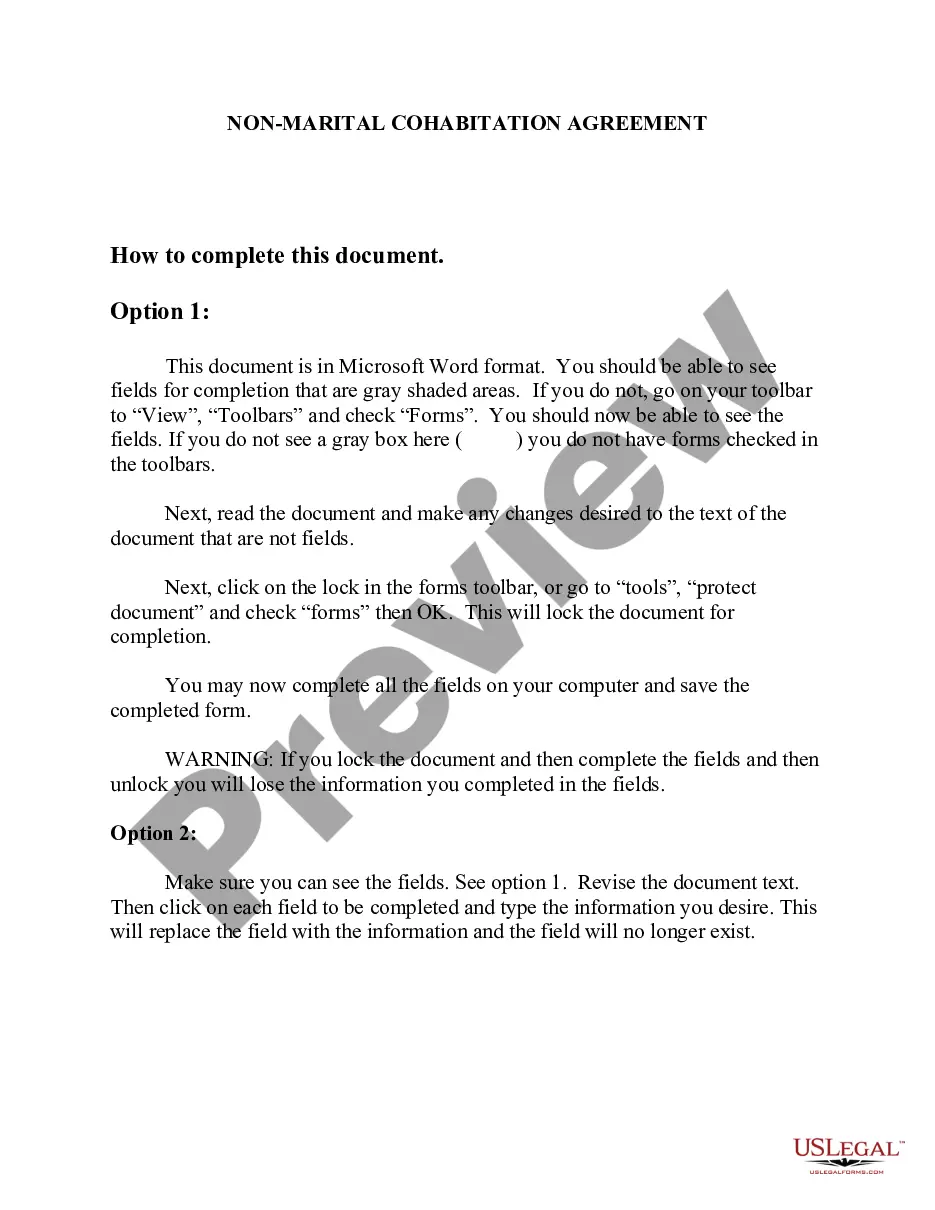

What Are the Components of a Nonprofit Board Resolution Template? The board meeting date. The number of the resolution. A title of the resolution. The resolution itself (what is being voted on) The name and vote of each voting member of the board. The Chairperson's name and signature.

How to become a 501(c)(3) organization: The key to tax-exempt status for non-profits Step 1: Incorporate before applying for tax-exempt status. Step 2: Get an EIN. Step 3: File form 1023 with the IRS. Step 4: Ensure your 501(c)(3) also has tax-exempt status at the state and local level.

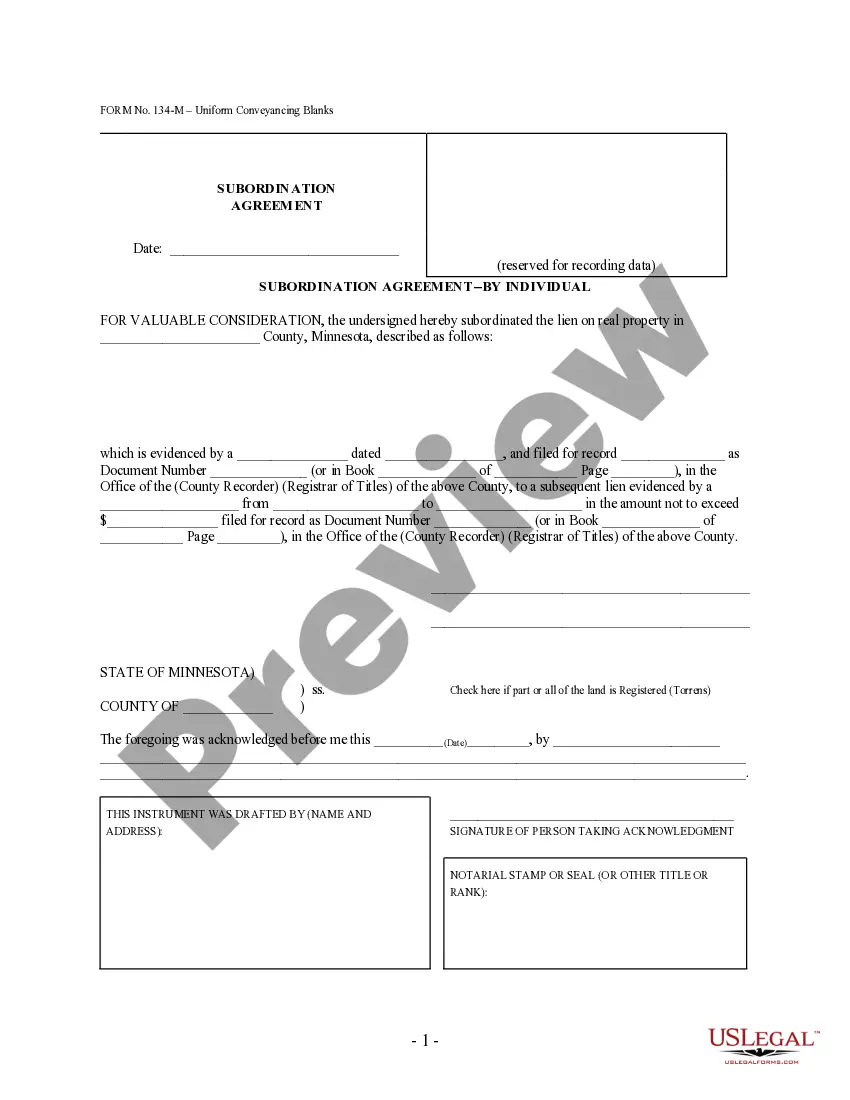

Corporate resolutions are necessary business documents for corporations, whether they be for-profit or nonprofit.

A Board Resolution template streamlines the process of documenting formal decisions made by a company's board of directors. It ensures consistency and compliance with legal and organizational requirements, reducing the risk of errors and omissions.