Nonprofit Resolution Template With Calculator In Massachusetts

Description

Form popularity

FAQ

This form should be used by corporations operating in Massachusetts to report their excise tax obligations. It is applicable for both C corporations and S corporations at the end of their tax year.

Who must file a form PC? Every public charity organized or operating in Massachusetts or soliciting funds in Massachusetts must file a Form PC, except organizations which hold property for religious purposes or certain federally chartered organizations.

Every executor, administrator, trustee, guardian, conservator, trustee in a noncorporate bankruptcy or receiver of a trust or estate that received in- come in excess of $100 that is taxable under MGL ch 62 at the entity level or to a beneficiary(ies) and that is subject to Massachusetts jurisdiction must file a Form 2.

The personal representative of the estate must file the estate tax return. If there is no personal representative, the person who has the decedent's property must file the return. The term personal representative includes: Executor.

The Massachusetts Corporation Excise Return Form 355 is designed for corporations operating within the state to report their income and comply with tax laws. This form serves not only to fulfill legal requirements but also allows corporations to account for deductions, credits, and other tax liabilities.

One crucial step in how to start a nonprofit in Massachusetts is forming a board of directors. The state requires every nonprofit to have at least three board members, the majority of whom should not be related by blood or marriage.

A partnership must annually file a Form 3, Partnership Return, to report the partnership's income to the MA DOR if: It has a usual place of business in Massachusetts, or. Receives federal gross income of more than $100 during the taxable year.

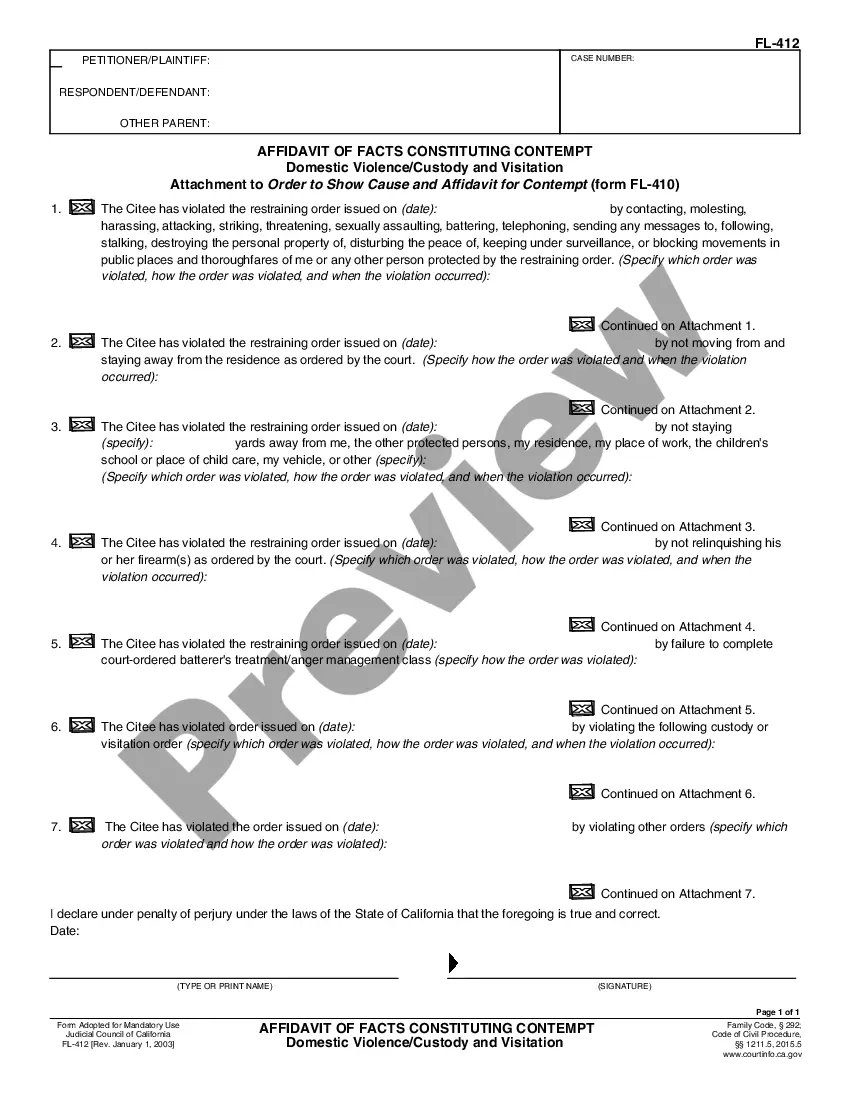

The resolution should state the name of the person authorized to sign the contract. If the resolution only states the title of the officer so authorized, a certification by a corporate officer must be provided certifying that the individual signing the contract held that office at the time the contract was signed.

There are two ways to get board resolution: The first way is by submitting documents that show that your company has been functioning for at least 2 years and that it has been continuously registered with the Dubai Chamber of Commerce & Industry (DCCI) during this period of time.

Certified True Copy (CTC) of a Board resolution is a physical document, which has to be printed on the letter head of the Company, affirming the outcome of a particular resolution that has been passed by the Board of Directors who have consented and approved in their duly convened meeting.