Corporate Resolution Bank Account With Open

Description

How to fill out Corporate Resolution Bank Account With Open?

No matter if you regularly handle paperwork or if you occasionally need to submit a legal document, it is essential to have a resource where all the samples are related and current.

One action you must take with a Corporate Resolution Bank Account With Open is to verify that it is the most up-to-date version, as this determines its eligibility for submission.

If you wish to make your search for the most recent document samples easier, seek them on US Legal Forms.

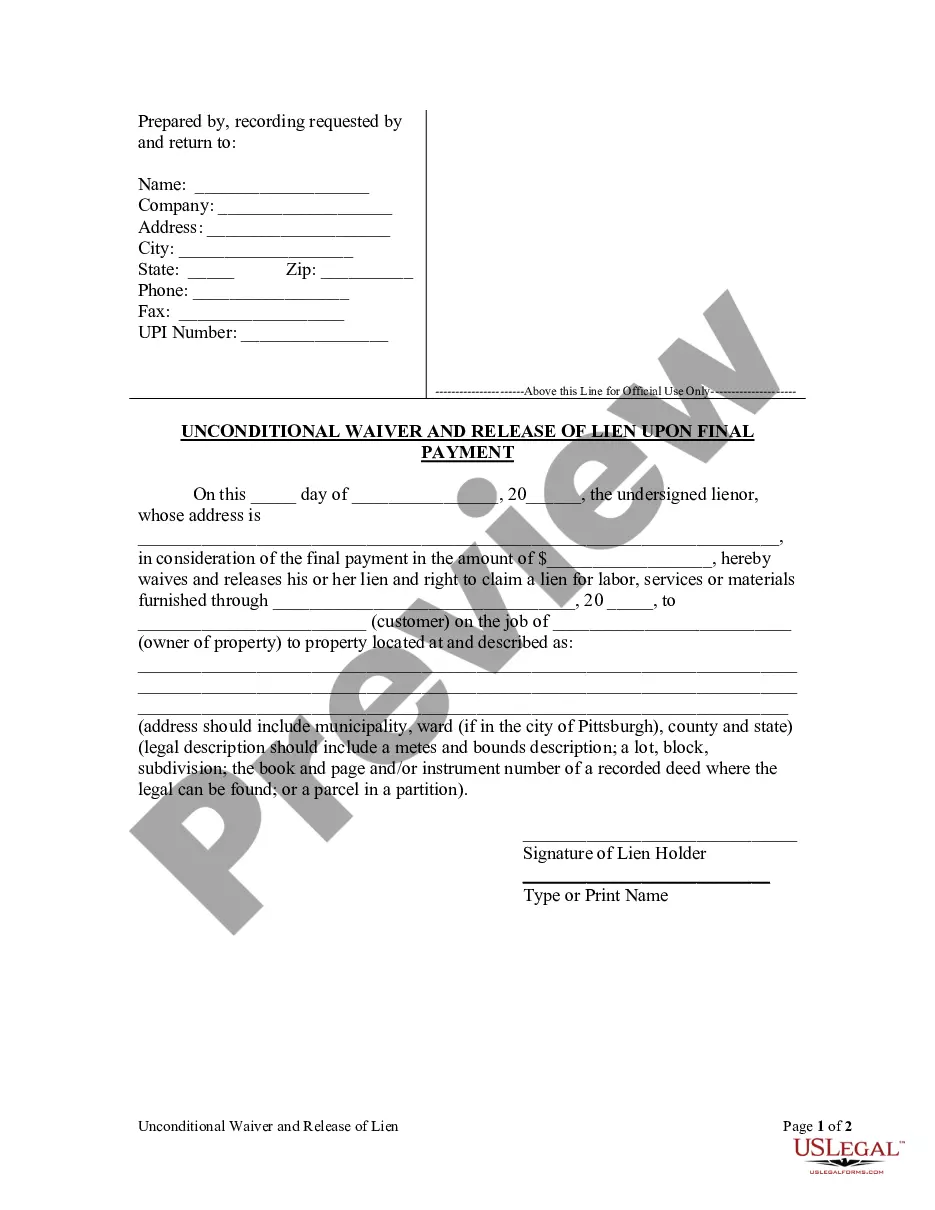

Utilize the search menu to locate the form you require. Review the preview and outline of the Corporate Resolution Bank Account With Open to confirm it is the exact one you need. After double-checking the form, click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Provide your credit card details or PayPal account to complete the purchase. Select the document format for download and confirm it. Eliminate confusion when dealing with legal documents; all your templates will be organized and verified with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that includes nearly every type of sample you might need.

- Search for the templates you require, instantly check their relevance, and learn more about their application.

- With US Legal Forms, you gain access to approximately 85,000 document templates across various fields.

- Retrieve the Corporate Resolution Bank Account With Open samples in just a few clicks and keep them at any moment in your account.

- A US Legal Forms account will facilitate access to all necessary samples with added convenience and fewer hassles.

- Simply click Log In in the site header and navigate to the My documents section where all the needed forms are readily available, eliminating the need for time-consuming searches for the right template or its suitability.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

Yes, a resolution is often necessary to open a bank account for your business. It serves as a formal record of who is authorized to handle the financial affairs of the company. If you're unsure how to create this document, the US Legal Forms platform offers solutions that can guide you through the process effectively.

To open a corporate account, you typically need several documents, including the corporate resolution, your business license, and tax identification number. Banks may also require personal identification from those authorized on the account. Preparing these documents ahead of time can make the process smoother and quicker.

The best bank to open a corporate account varies based on your business needs, but consider institutions known for their services tailored to businesses. Look for banks offering low fees, comprehensive online banking, and strong customer support. It's essential to compare different banks and choose one that aligns with your financial management goals.

A corporate resolution is often required by banks to specify the individuals who can manage a corporate account. This requirement helps banks to comply with regulations and protect against unauthorized transactions. If you plan to open a corporate bank account, having this document prepared can streamline the process.

Yes, you typically need a corporate resolution to open a bank account for a business. This document confirms who is authorized to act on behalf of the company during the account opening process. Without it, banks often require additional verification, which can delay the opening of your corporate account.

A corporate resolution for a bank account is a formal document that grants specific individuals the authority to manage the company's bank account. This document details who can open, close, or modify the bank account. Understanding this is crucial as it ensures only authorized persons conduct financial transactions on behalf of the company.

When writing a corporate resolution for an LLC, you'll want to follow a structured format. Start with the company name and state the resolution's purpose, such as the decision to open a bank account. Include a record of the meeting, the date, and the required signatures to demonstrate authority and compliance.

Filling out a corporate resolution form requires outlining the specifics of your resolution clearly. Start with your corporation's name and the purpose, such as opening a bank account. Make sure to include the date of the meeting and obtain signatures from the authorized officers to ensure the resolution is valid.

An example of a resolution to open an account could read as follows: 'Resolved that the corporation shall open a checking account at XYZ Bank.' It would detail the signatories who are authorized to manage the account and may include instructions regarding who can deposit or withdraw funds. This level of detail is essential for clarity.

An example of a company resolution might state that the board of directors approves the opening of a new bank account. The resolution would include specific details such as the name of the bank, the accounts to be opened, and the authorized signatories. This concrete example illustrates the intention to facilitate financial operations for the corporation.