Formato Resolucion Corporativa In Michigan

Description

Form popularity

FAQ

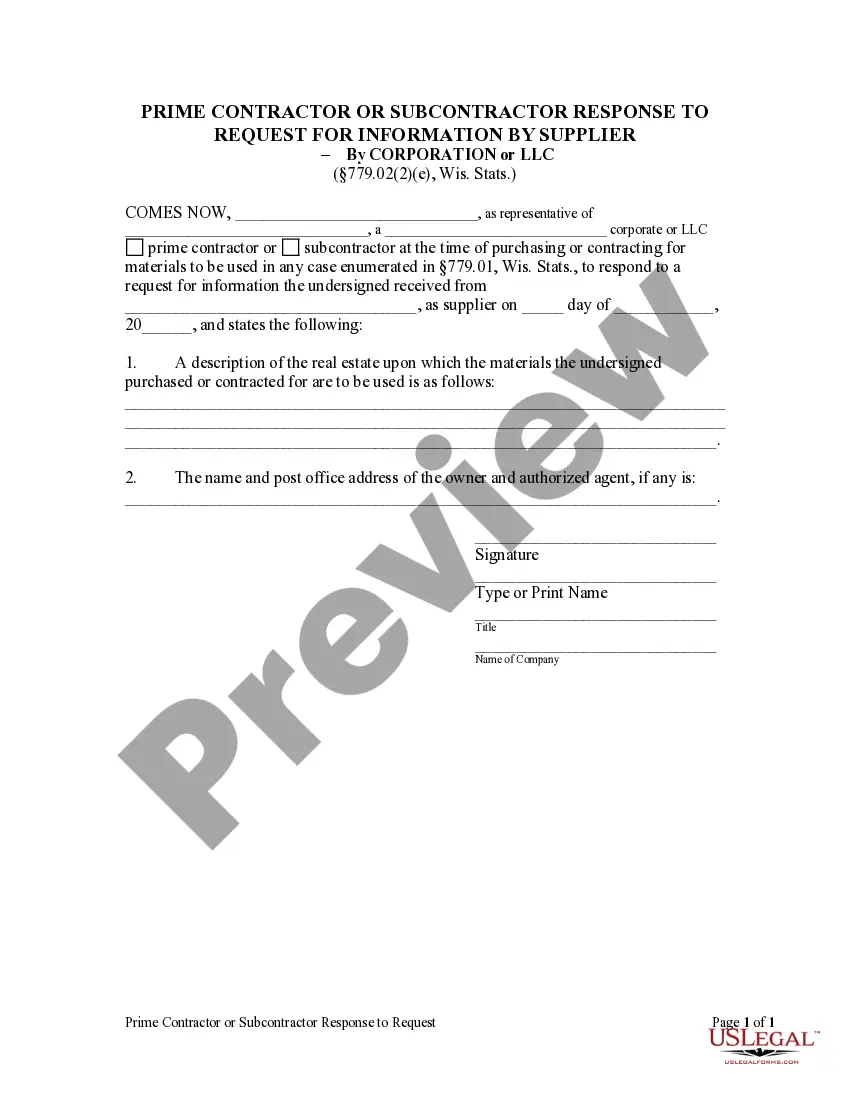

Although actual requirements can vary depending on the state, they typically involve the following: Select a state of incorporation. Choose a business name. File incorporation paperwork. Appoint a registered agent. Prepare corporate bylaws. Draft a shareholders' agreement. Hold the first board meeting. Get an EIN.

To start a corporation in Michigan, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Department of Licensing and Regulatory Affairs (LARA). You can file this document online, by mail or in person.

An LLC is a business structure where taxes are passed through to the owners. An S corporation is a business tax election in which an established corporation passes taxable income to shareholders.

Filing as an S Corp in Michigan Step 1: Choose a Business Name. Step 2: Appoint Directors and a Registered Agent. Step 3: File Articles of Incorporation. Step 4: Create S Corp Bylaws. Step 5: Apply for an Employer Identification Number. Step 6: File Form 2553 for S Corporation Election.

Line 6 – Enter the number of personal and dependent exemptions you are claiming. The total number of exemptions you claim on the MI-W4 may not exceed the number of exemptions you are entitled to claim when you file your Michigan individual income tax return.

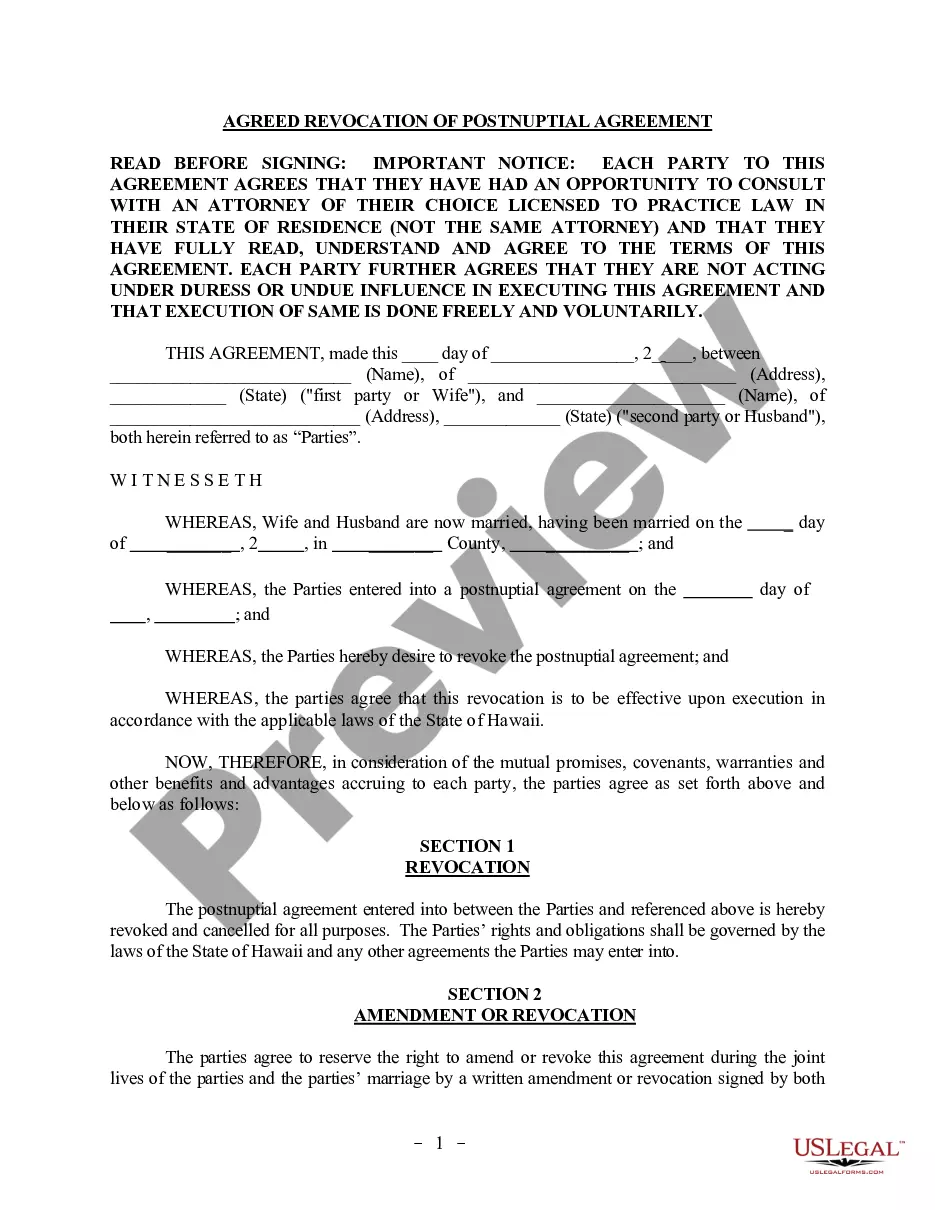

What should corporate resolutions include? Your corporation's name. Date, time and location of meeting. Statement of unanimous approval of resolution. Confirmation that the resolution was adopted at a regularly called meeting. Resolution. Statement authorizing officers to carry out the resolution.

To start a corporation in Michigan, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Department of Licensing and Regulatory Affairs (LARA). You can file this document online, by mail or in person.