Confirmation Letter Sample For Audit In Chicago

Description

Form popularity

FAQ

10 Best Practices for Writing a Digestible Audit Report Reference everything. Include a reference section. Use figures, visuals, and text stylization. Contextualize the audit. Include positive and negative findings. Ensure every issue incorporates the five C's of observations. Include detailed observations.

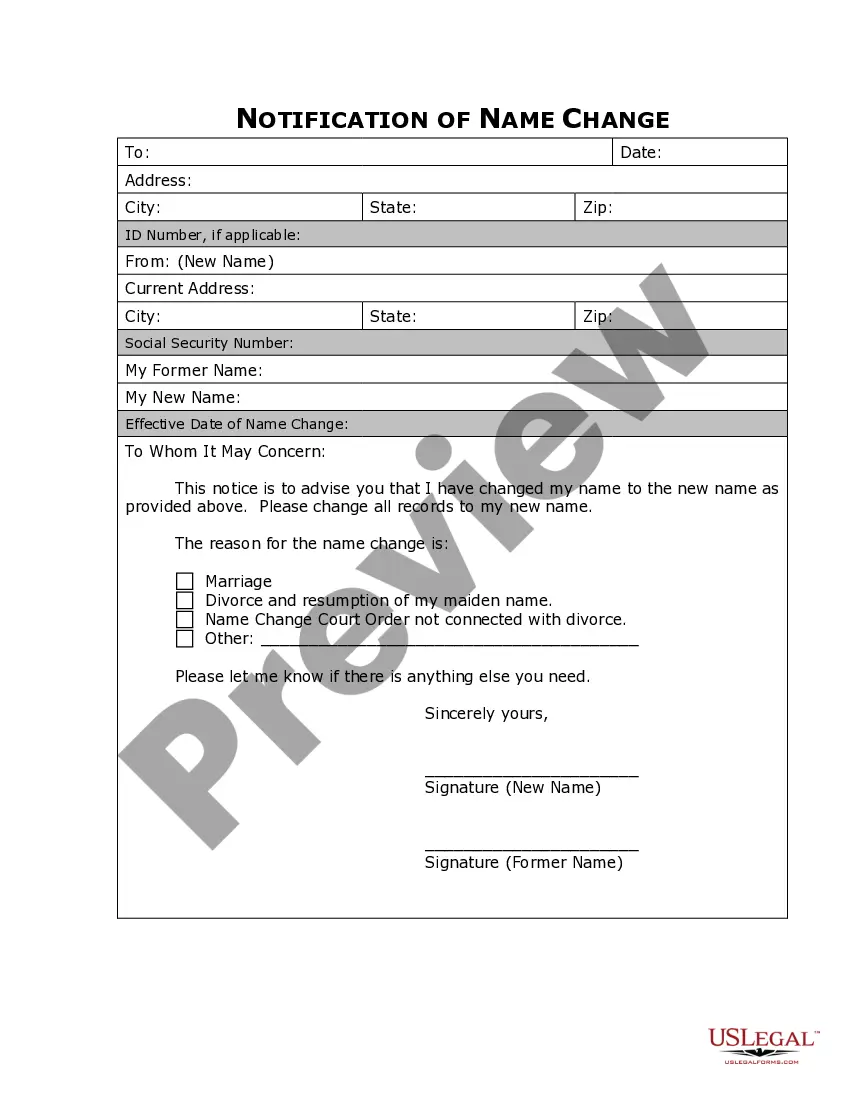

During the course of an audit, you may hear your auditors refer to something called a “confirmation letter.” This is a letter that your auditor will send out to third parties, such as banks or suppliers, asking them to confirm certain financial information.

Audit team reports frequently adhere to the rule of the “Five C's” of data sharing and communication, and a thorough summary in a report will include each of these elements. The “Five C's” are criteria, condition, cause, consequence, and corrective action.

An IRS audit letter typically includes the taxpayer's name, tax ID number or Social Security number, employee ID number, address, and contact information. It also specifies the tax year being audited and the documentation required.

Urgent or Fast Track requests must be sent to the bank via Confirmation. Any requests which are posted, faxed or emailed to the bank will be subject to a 25 business day SLA. Provide the full name (as per bank statement), main account number and sort code for every related legal entity required.

Examples of audit documentation include memoranda, confirmations, correspondence, schedules, audit programs, and letters of representation. Audit documentation may be in the form of paper, electronic files, or other media. 5.

Audit Confirmation: Company Name I have summarized your upcoming audit schedule and activities as follows: The audit will commence (Date and Time) at (Location) with a pre-audit meeting. The expected schedule of site visits, document reviews, interviews and observation tours is summarized below.

Professional Reply Acknowledge the Email. Start your reply by acknowledging the audit confirmation request. Provide the Requested Information. Clarify Any Discrepancies (If Applicable) ... Offer Further Assistance. End with a Professional Closing.

How should you respond to audit queries? The first rule is DO NOT LIE! Simply answer the question you have been asked. If the auditor needs more information, they can come back to you with follow up questions. There is nothing to be gained from lying to auditors of any kind and much to be lost.

| Tinh Huynh. Audit confirmations are information requests, typically distributed by email or through secure portals, in which accountants ask third parties to confirm information provided by the company being audited.