Installment Contract Agreement With Seller In Washington

Description

Form popularity

FAQ

An installment contract offers a buyer less protection than a traditional mortgage. This is true mainly because of forfeiture provisions, which give the buyer no right of redemption and allow a buyer to lose all interest in the property for even the slightest breach.

If a buyer defaults, the seller may have the right to reclaim the property or take legal action to collect unpaid amounts. The IRS has rules for handling defaulted installment sales, including potential recognition of remaining gains as income.

Unstated Interest - If an installment sale contract with some or all of the payments due more than one year after the date of sale does not provide for interest, part of each payment due more than 6 months after the date of the sale may be treated as interest. The amount treated as interest is called unstated interest.

However, the seller retains legal title to the property. This provides the seller security: if the buyer fails to make payments in ance with the terms of the installment agreement, the seller may be able to recover possession of the property quicker and at less expense than if foreclosing on a mortgage.

An instalment sale agreement between you and a credit provider allows you to buy a vehicle or asset using the principal debt, which you repay by means of regular instalments over an agreed period, with fees and interest.

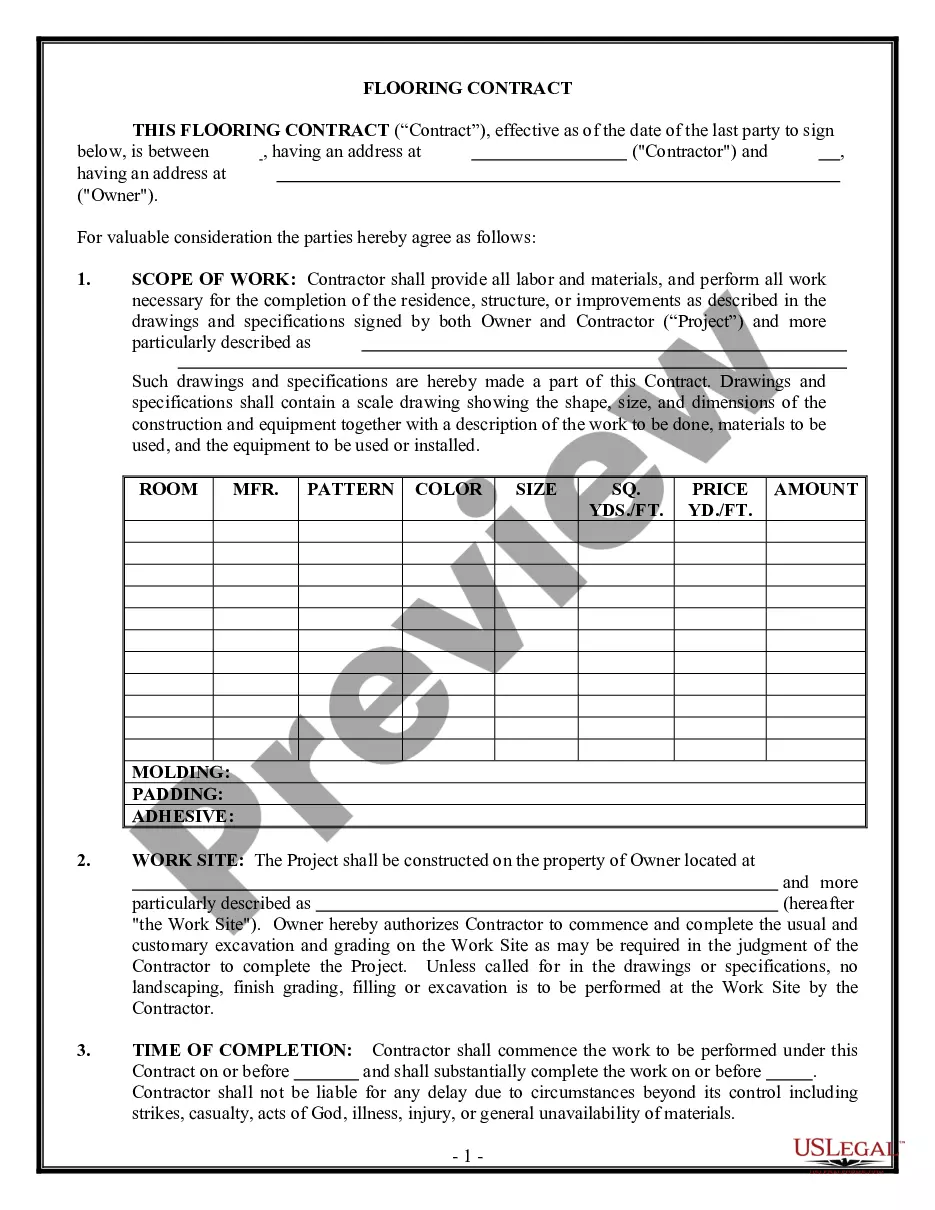

Real estate installment contracts are a financing option that allows for periodic payments instead of a lump sum payment. Also known as a land contract, contract for deed, or contract for sale in the real estate industry.

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time. Installment contracts can provide that installments are to be performed by either one or both parties .

An installment sales contract refers to any contract relating to periodic payments. However, in real estate, it is often called a contract for sale, land contract, or contract for deed.

Synonyms of 'instalment' • payment, repayment, part payment. • part, section, chapter, episode.