Payment Plan Contract For Horse In Tarrant

Description

Form popularity

FAQ

One feature of many equine transactions is that the seller often conditions the sale of a horse on the buyer's promise to notify the seller when the buyer wishes to sell the horses and give the original seller a chance to repurchase the horse. This is known as the Right of First Refusal (“RFR”).

Equine-related contracts sometimes include a “right of first refusal” clause that restricts how a horse can be re-sold. Through these clauses, a horse buyer agrees to give the seller an opportunity to buy back the horse later under certain specified conditions.

A horse bill of sale may detail the horse's name, the size of the horse, its gender, its lineage, markings, colors, and other physical features. This type of bill of sale may also include information about breeding the horse or any warranties if the horse is expected to produce young.

Discuss terms of the agreement with your agent and get them on paper before you begin looking at horses. Standard commissions range between 10 percent and 15 percent and may apply to both the buyer's and seller's agents. Agree ahead of time what your budget will be and if the commission must be included in your budget.

A buyback agreement is a legal document in which a business owner transfers the ownership of shares back to the company instead of selling them directly to an investor. For example, a buyback agreement can be used when a company wants to repurchase its stock from current shareholders.

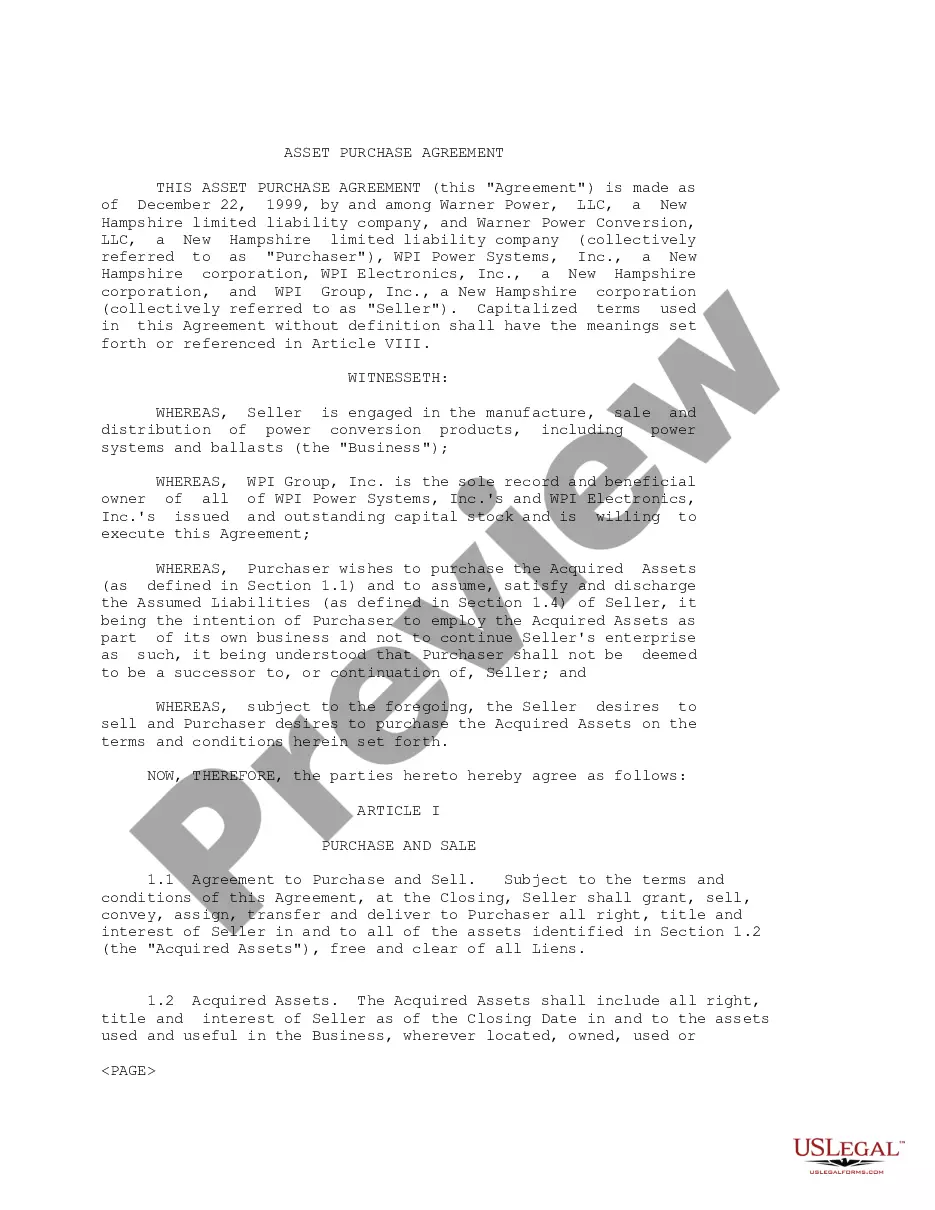

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.

Equine-related contracts sometimes include a “right of first refusal” clause that restricts how a horse can be re-sold. Through these clauses, a horse buyer agrees to give the seller an opportunity to buy back the horse later under certain specified conditions.