Installment Contract For Payment In Philadelphia

Description

Form popularity

FAQ

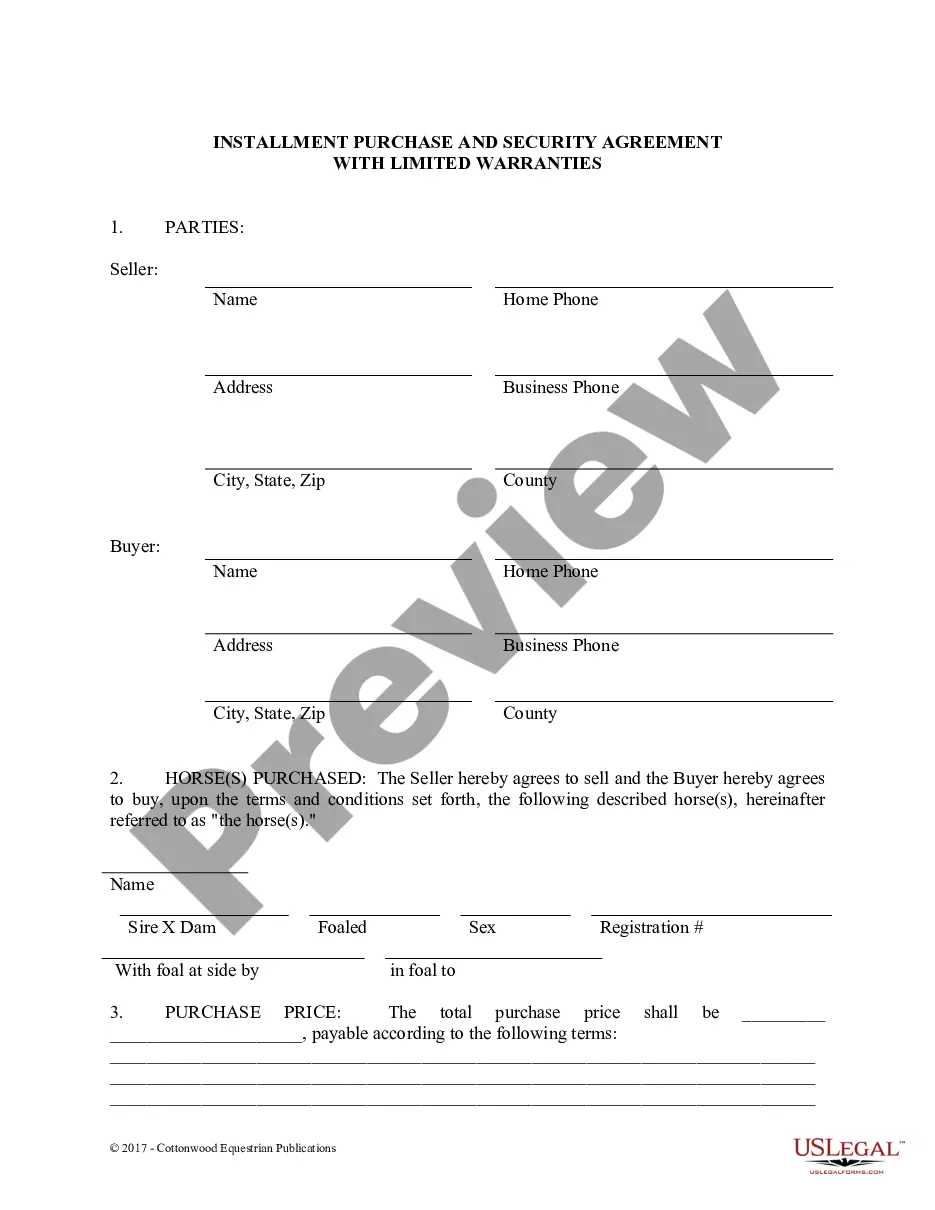

Setting up the payment plan Calculate the total amount due and the payment schedule. Determine the payment amounts, due dates and payment method. Write the agreement, detailing the payment plan. Include the date of the agreement and the parties involved. Get both parties to sign the agreement.

The OOPA program allows people who own and live in their home to make affordable monthly payments on property taxes that are past due. There is no down payment required and your monthly payments will be based on a percentage of your monthly income. or call (215) 686-6442.

Payment plan set up Example: 20% of the invoice is due after the first work deliverable is done. After that, the remaining balance is split up equally into two installments.

Setting up the payment plan Calculate the total amount due and the payment schedule. Determine the payment amounts, due dates and payment method. Write the agreement, detailing the payment plan. Include the date of the agreement and the parties involved. Get both parties to sign the agreement.

The minimum wage in Pennsylvania is $7.25 per hour.

The creditor should sign the Letter in the space provided before sending it to the debtor. If the debtor agrees to the repayment plan set out in the Letter Accepting Payments in Instalments, they should countersign the Letter in the space provided. This makes the Letter a binding agreement between the parties.

Step 1: Have your checking account number and bank routing number available. Step 2: Call 717-425-2495, Ext: PAYPA (72972). Step 3: The customer service representative will explain your options and next steps.