Retail Installment Contract Vs Bill Of Sale With Notary In King

Description

Form popularity

FAQ

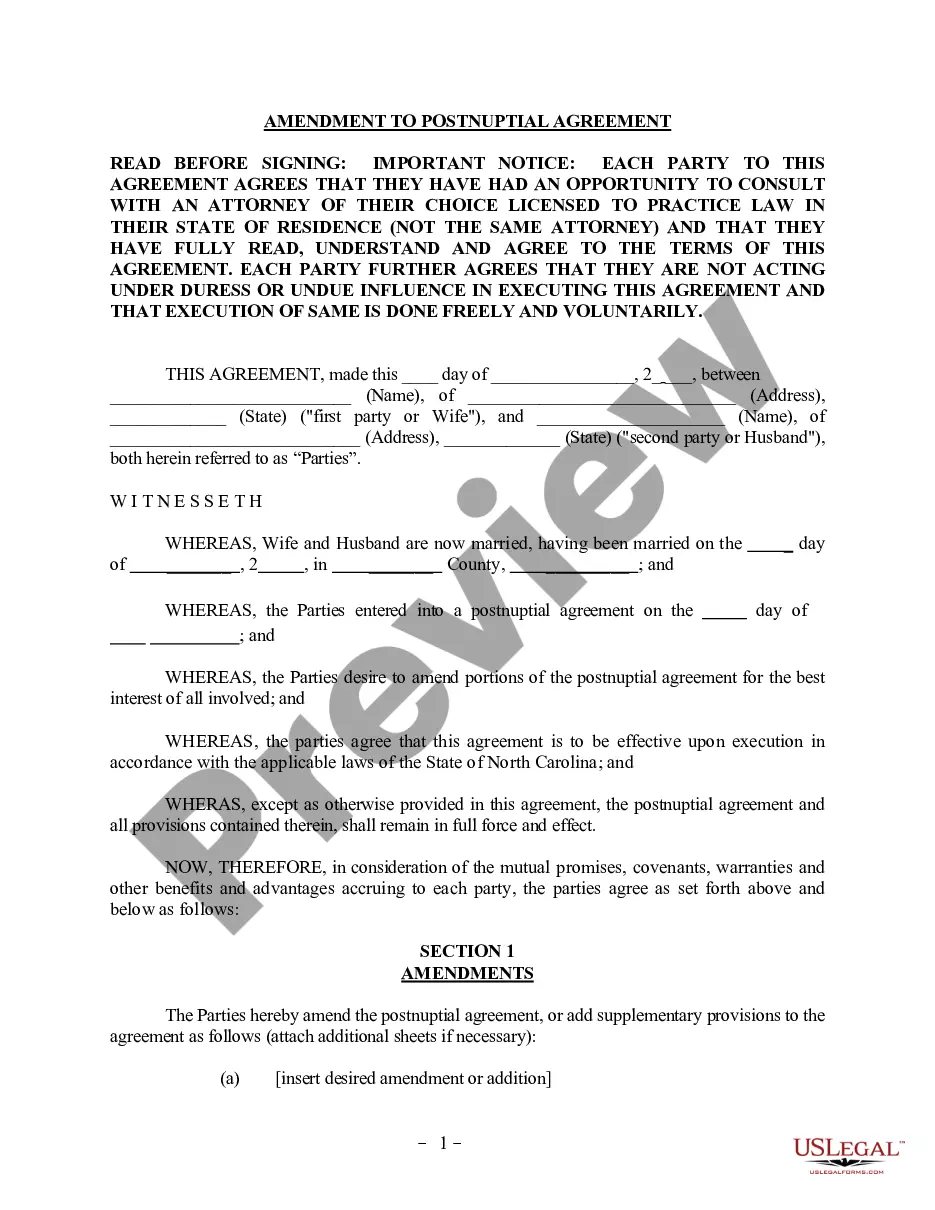

If only her signature is notarized, it's legal. If yours also is indicated as being notarized, then the notary broke the law in any state. It is impossible to legally notarize a document without the signer being present. (There is ``online notarization'' which has an online equivalent requirement.)

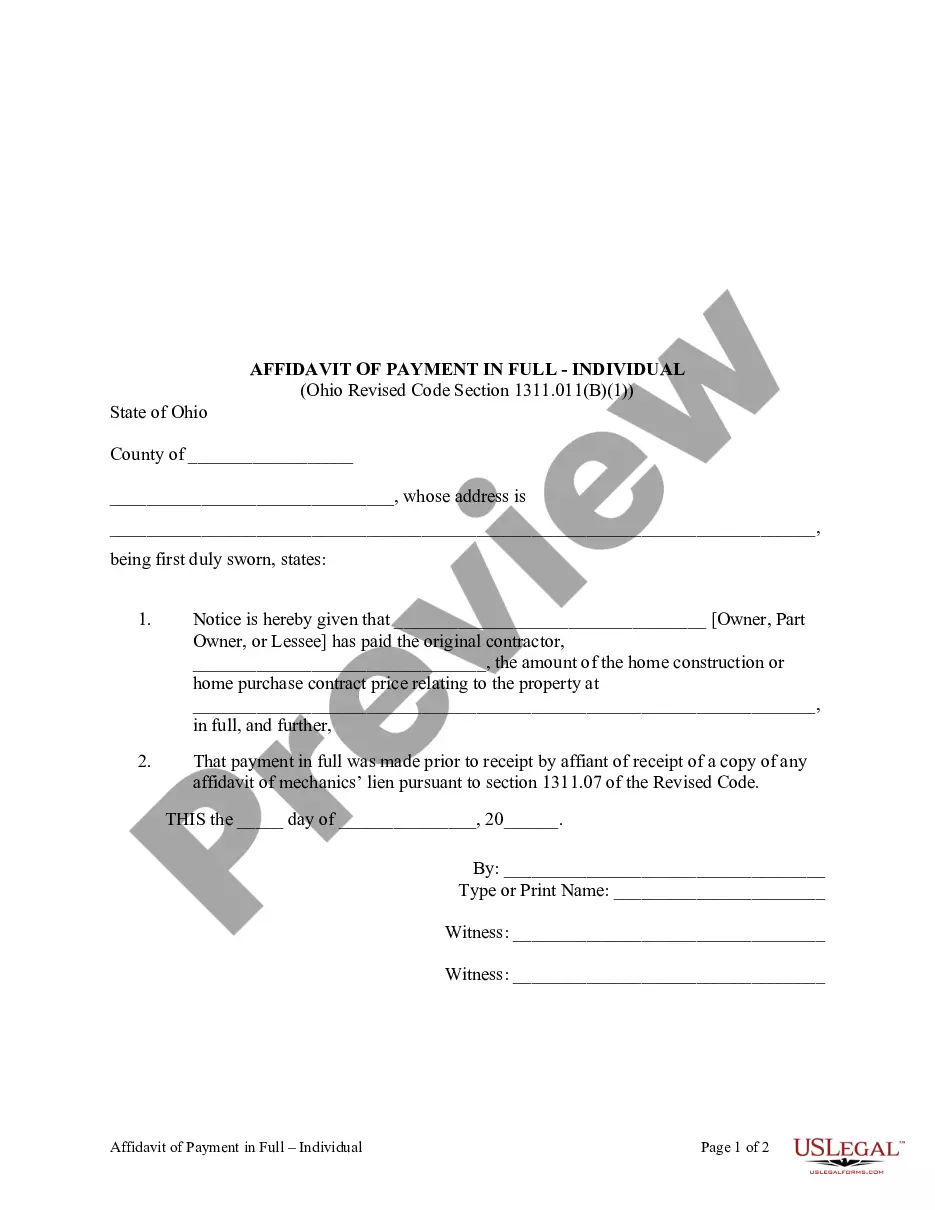

Many states don't mandate notarization for bills of sale. States like California, Texas, Florida, Ohio, and New York allow transactions without a notarized document. In these states, a signed bill of sale is often sufficient for legal purposes, provided it includes all required information.

Notarization requirements for bills of sale vary by state and transaction type. Vehicles: States like Louisiana require notarization for vehicle sales. Conversely, states like California do not. Boats: Some states mandate notarization for boat transactions, ensuring secure ownership transfer.

Courts often view notarized documents as more credible than those without notarization. If disputes arise about ownership or transaction terms, a notarized bill provides clear evidence of the agreement, reducing legal risks and ambiguities.

In most cases, a contract does not have to be notarized since the signed contract itself is enforceable and legally binding in state or federal courts. Many types of written contracts don't require a notary public to be valid.

Which states require notarization for a bill of sale? States such as Louisiana and Maryland require notarization for certain transactions. However, many states like California and Texas do not require notarization, allowing transactions to be finalized with just a signed document.

Key Takeaway: Getting a bill of sale notarized isn't always required, but it's often worth the effort. Notarization provides solid proof of agreement and can protect you in legal disputes. Always check local DMV requirements for specific transactions to avoid potential issues.

A bill of sale is more akin to a receipt rather than a contract. Since it is such a simple document, there is no way to truly enforce it. If the bill of sale is the only document you use in a transaction, it is best to ensure there is enough detail on it to make the transaction enforceable.