Installment Contract In Real Estate Definition In Cook

Category:

State:

Multi-State

County:

Cook

Control #:

US-002WG

Format:

Word;

Rich Text

Instant download

Description

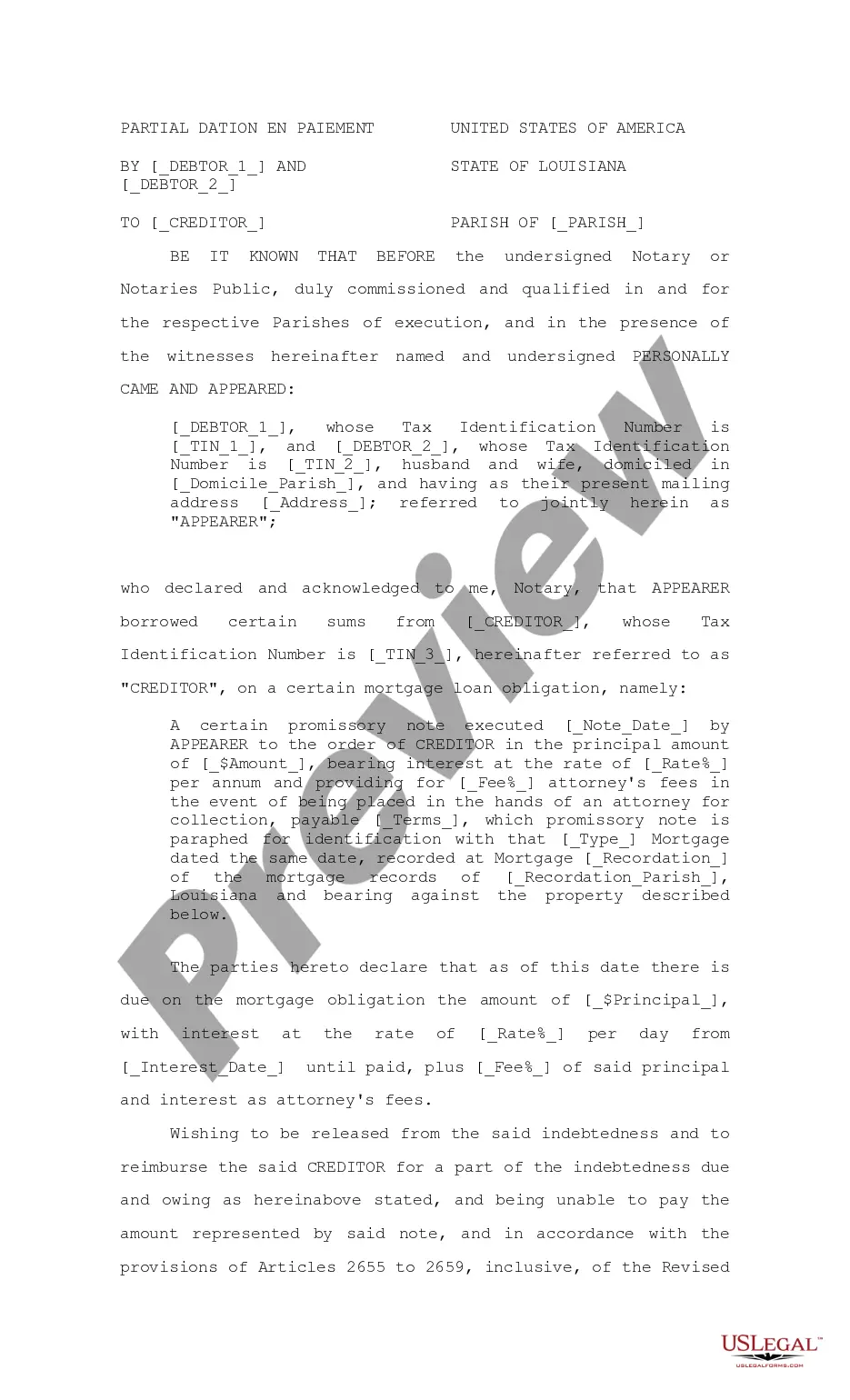

The installment contract in real estate definition in Cook outlines the terms under which a seller and purchaser agree to a purchase price and payment structure. This form specifies the total purchase price, applicable simple interest rate, monthly payment terms, and conditions regarding late fees. Importantly, it grants a purchase money security interest to the seller, allowing security over collateral until financial obligations are met. Users should note the events that trigger default and the available remedies, including the seller's rights to reclaim the collateral. The form emphasizes the need for modifications to be documented in writing, ensuring clarity and mutual consent. This contract is beneficial for attorneys, partners, owners, associates, paralegals, and legal assistants as it provides a structured approach for real estate transactions, outlines key legal rights and responsibilities, and facilitates effective communication between parties involved in property sales.

Free preview

Form popularity

FAQ

Installment Method Versus Accrual Basis Accounting In the accrual basis approach, all revenue from a sale can be recognized from the first transaction, without accounting for the risk associated with deferred payments. The installment method offers a more conservative approach to revenue recognition.

An instalment sale agreement between you and a credit provider allows you to buy a vehicle or asset using the principal debt, which you repay by means of regular instalments over an agreed period, with fees and interest.

Tax Deferral (for the seller): One of the most compelling reasons to consider an installment sale is the ability to defer capital gains tax.