Independent Contractor Agreement For Accountant And Bookkeeper In Utah

Description

Form popularity

FAQ

Anytime you complete more than $600 of work for a client, they will need to file and send you a copy of Form 1099-MISC. This is an information form for filing to send non-salary income numbers to the IRS. If they do not send you a Form 1099-MISC, you will want to follow up with your client.

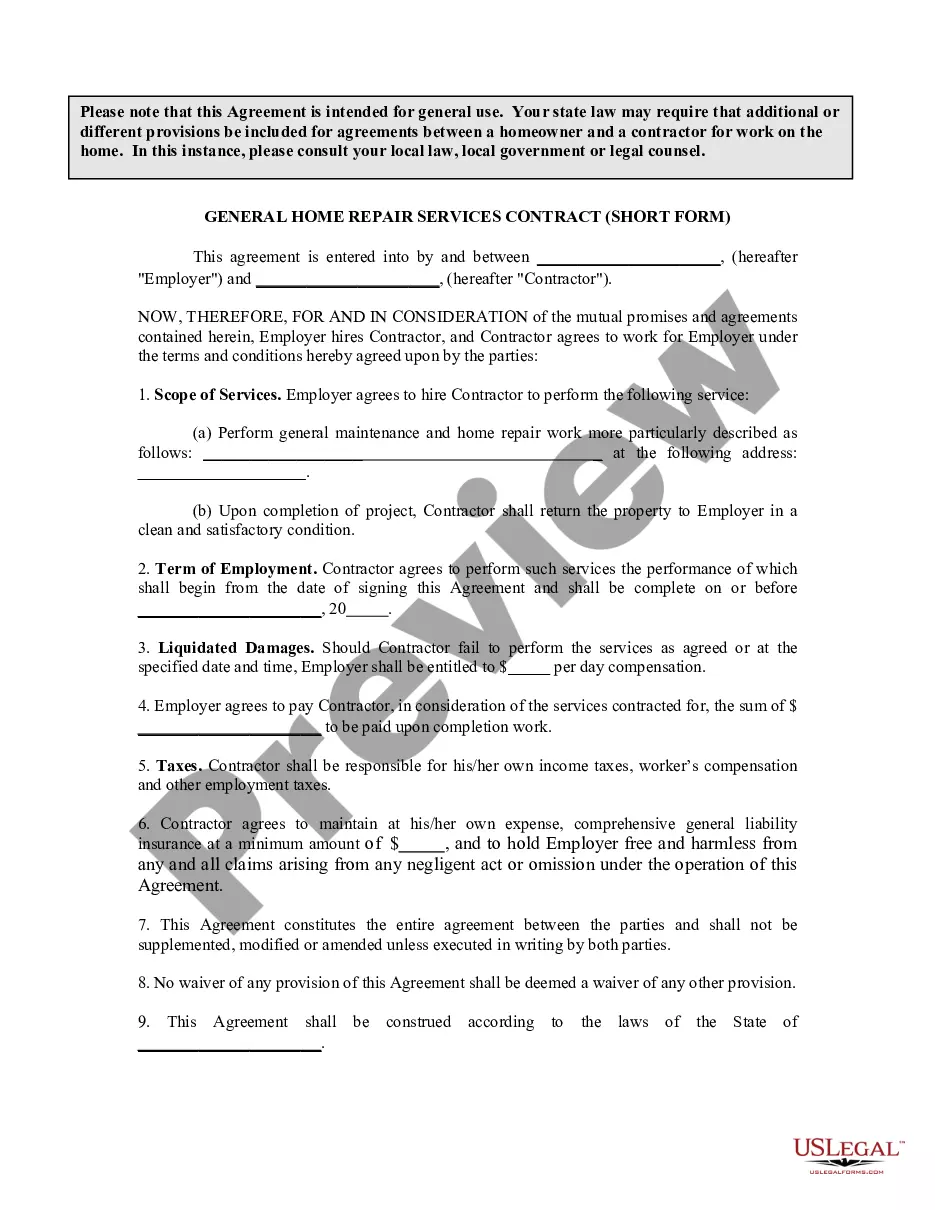

Following this step-by-step checklist will mean that you can write your contract with confidence: Know your parties. Agree on the terms. Set clear boundaries. Spell out the consequences. Specify how you will resolve disputes. Cover confidentiality. Check the legality of the contract. Open it up to negotiation.

When creating your accounting and bookkeeping contract, be sure to include the following details: Identifying information for both parties. Effective date and contract term. Description of services to be performed. Fees. Representations. Confidentiality clause. Termination conditions. Legal terms.

The independent contractor should complete the W-9 and return it to the business with other requested information. When should the Form W-9 be completed? Contractors should complete it at the start of their working relationship with a company.

A bookkeeper comes to the organization once a week to do the bookkeeping. If he has other clients, controls when the work will be done, and gives the client the results (i.e., monthly financial statements), it is pretty clear he is an independent contractor.

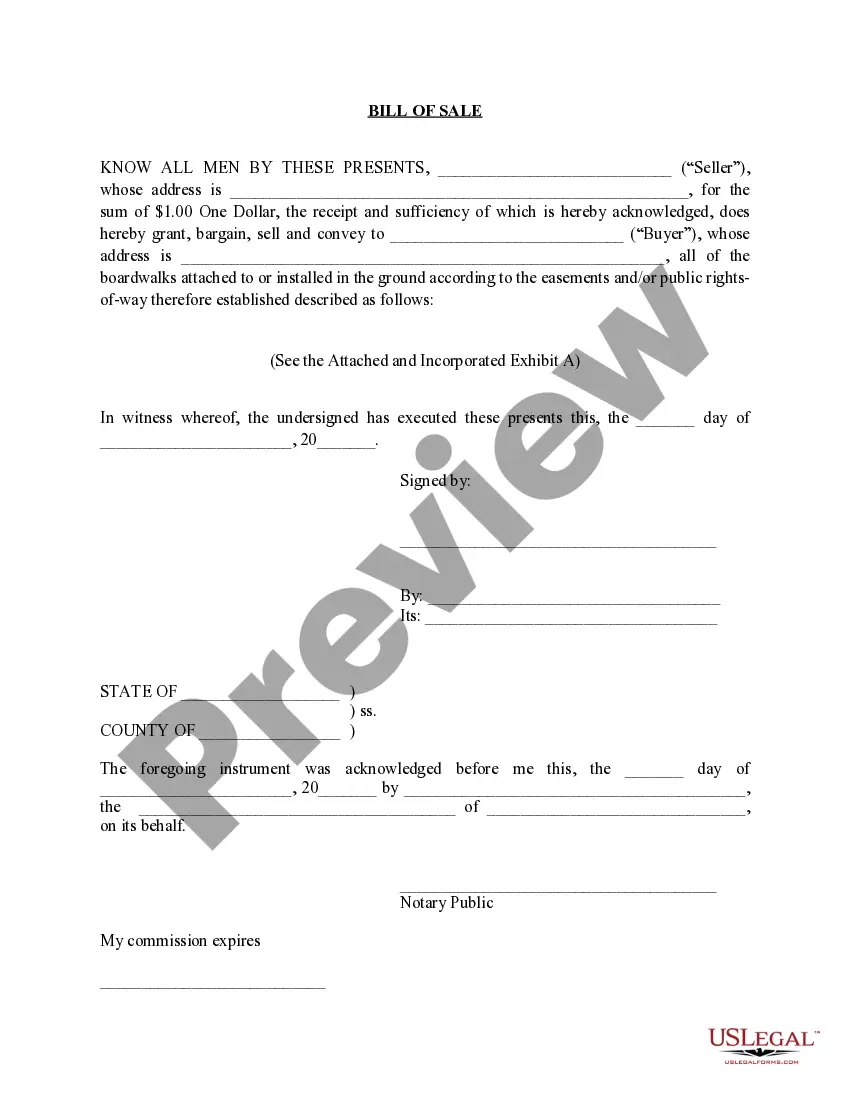

The agreement should have an introductory paragraph outlining who is the client and who is the service provider. It should contain the legal names of both parties, the date, and the physical addresses of each party.

When creating your accounting and bookkeeping contract, be sure to include the following details: Identifying information for both parties. Effective date and contract term. Description of services to be performed. Fees. Representations. Confidentiality clause. Termination conditions. Legal terms.

Many self-employed people choose to do their own accounting. With the right software in place, you may have everything you need to handle your accounting obligations. Other people appreciate the strategic expertise of an accountant or bookkeeper who can offer services beyond compliance.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.