Independent Contractor Contract Example In Ohio

Description

Form popularity

FAQ

Writing a contract with myself has made personal development both sustainable and approachable. It's very different than the black-and-white perfectionistic way of being in the world. The contract is about creating an external version of me to reference whenever I'm feeling small or scared.

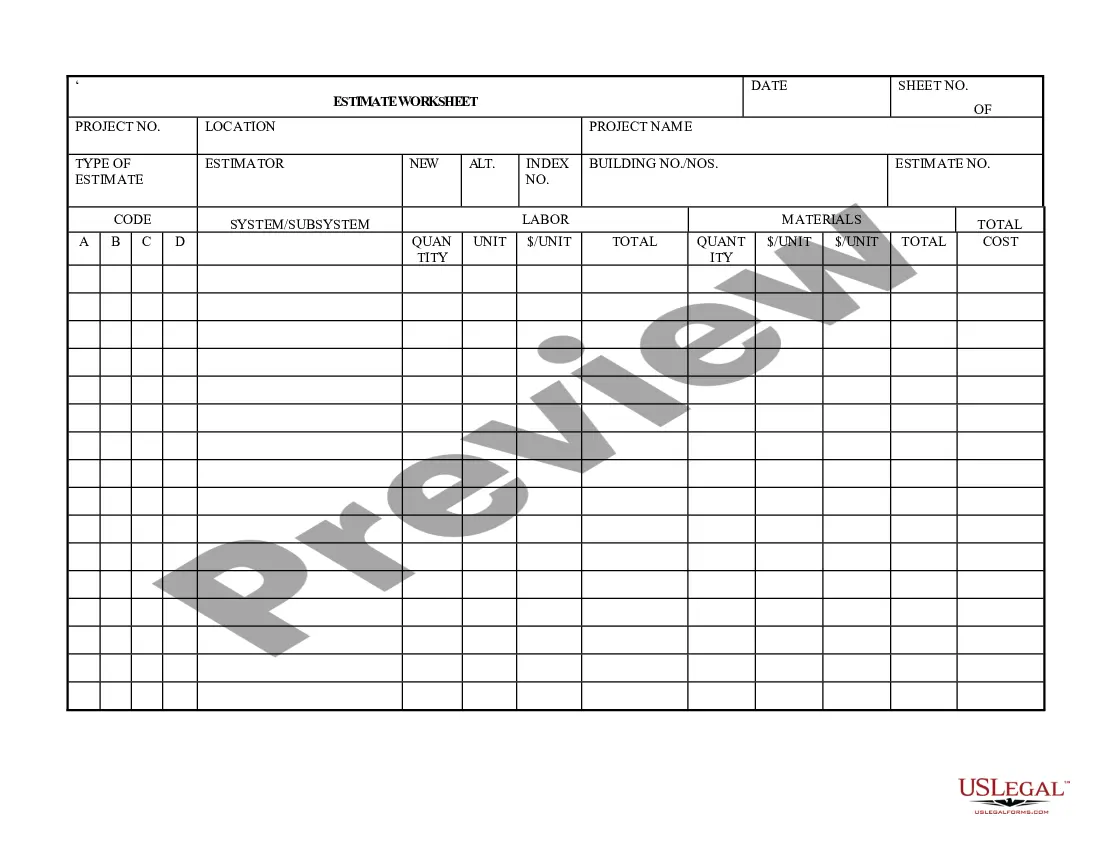

Independent contractors generally report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if your net earnings from self-employment are $400 or more.

There are many situations in which a business will want to engage the services of an independent contractor instead of hiring an employee. In these situations, both parties must sign an independent contractor agreement.

Do you need a contractor license in Ohio? A general contractor license is not required in Ohio if you perform minor repair work or on home improvement projects under $1,000. However, you may need a license from the state if you plan to work on larger projects.

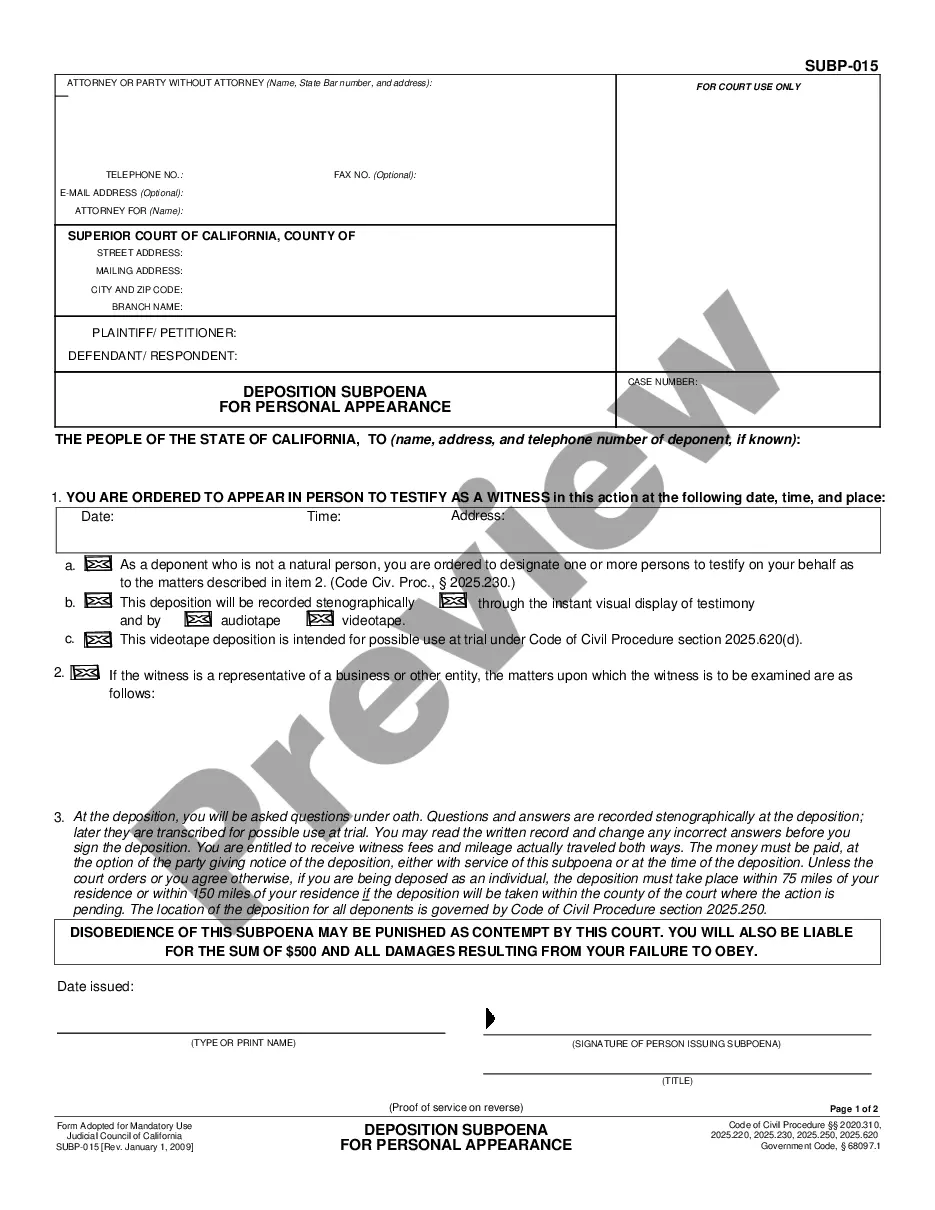

A contractor agreement should describe the scope of work, contract terms, contract duration, and the confidentiality agreement. It should also include a section for the two parties to sign and make the agreement official. If the contract doesn't meet these requirements, it may be inadmissible in a court of law.

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.

Factors that show you are an independent contractor include working with multiple clients instead of just one, not receiving detailed instructions from hiring firms, paying your own business expenses such as office and equipment expenses, setting your own schedule, marketing your services to the public, having all ...

California Law states that a worker may be considered an independent contractor if (1) the worker has the right to control the performance of services, (2) the result of the work is the primary factor bargained for, and not the means by which it is accomplished, (3) the worker has an independently established business, ...

Ing to the Ohio Department of Job and Family Services, an independent contractor is someone who is “under contract to perform a special service for an employer.” For matters like unemployment insurance tax reporting for Ohio independent contractor law, independent contractors are excluded from benefits such as ...