Paying Foreign Independent Contractors For Work In Broward

Description

Form popularity

FAQ

U.S. companies can hire non-U.S. citizens as independent contractors without a work visa, provided the contractor performs the work from outside the U.S.

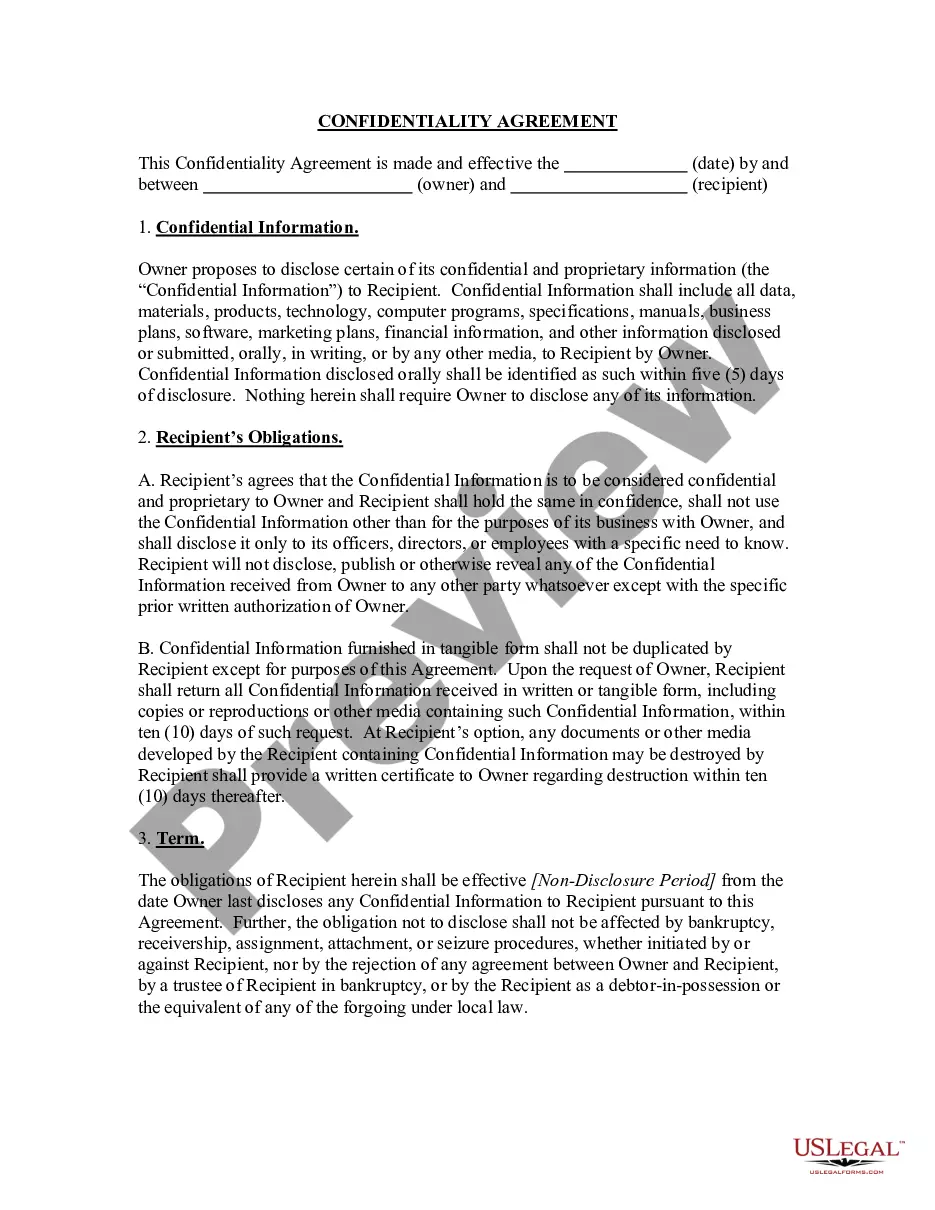

If you decide to hire independent contractors, you'll need to collect the following documentation: Form W-9. Forms W-8BEN or W-8BEN-E. Form 1099-NEC. Form SS-8. Independent contractor agreement. Confidentiality agreement (NDA) Non-compete agreement. Non-solicitation agreement.

No. The US taxes all citizens and green card holders on worldwide income, regardless of where they live. Even if you never return to the US, you are still required to file a tax return if you meet the minimum income threshold.

Conversely, if the independent contractor is not a US person and did not perform any of their services within the US, you will not be required to issue Form 1099. Instead, the foreign contractor will have to complete and file Form W-8BEN.

Manage the paperwork Contractors must complete a Form W-9 if they're US citizens or residents and a Form W8-BEN if they're based entirely abroad. Both forms are available to download from the IRS website. From the moment the contract begins, you must store these documents for at least four years.

All persons ('withholding agents') making US-source fixed, determinable, annual, or periodical (FDAP) payments to foreign persons generally must report and withhold 30% of the gross US-source FDAP payments, such as dividends, interest, royalties, etc.

Today, it's possible to hire independent contractors from any part of the world, thanks to improvements in technology and communications. It's a great idea to consider Mexico if you're looking to expand your team. Its proximity and strong economic ties to the US are definite advantages.

Exemption from withholding To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it's furnished to the employer.

Payments to a foreign corporation in exchange for personal services performed in the US by either a US citizen or alien is considered to be US-sourced income and is usually subject to withholding. (Can be wages or self-employment income.)

How long can a contractor work at a company for? There seems to be the belief (by some) that a contractor can only work for the same company for two years. This is completely false – contractors can work through an umbrella for an unlimited amount of time.