Pay Foreign Independent Contractor Without Supervision In Bexar

Description

Form popularity

FAQ

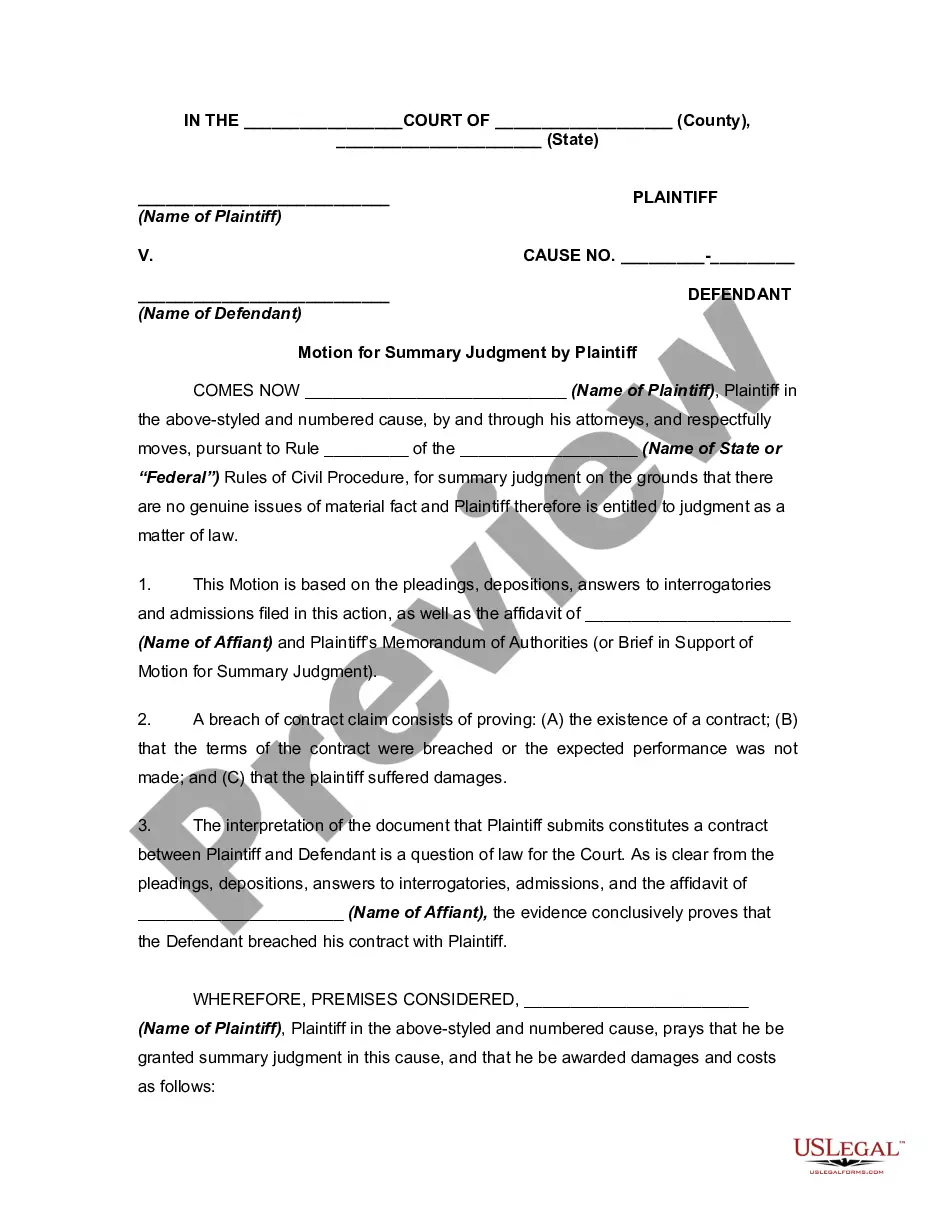

Employers are required to check the work authorization of employees and can face fines and penalties for failing to do so or for hiring employees who they know do not have work authorization. All immigrants regardless of legal status are able to earn a living as independent contractors by using an ITIN number.

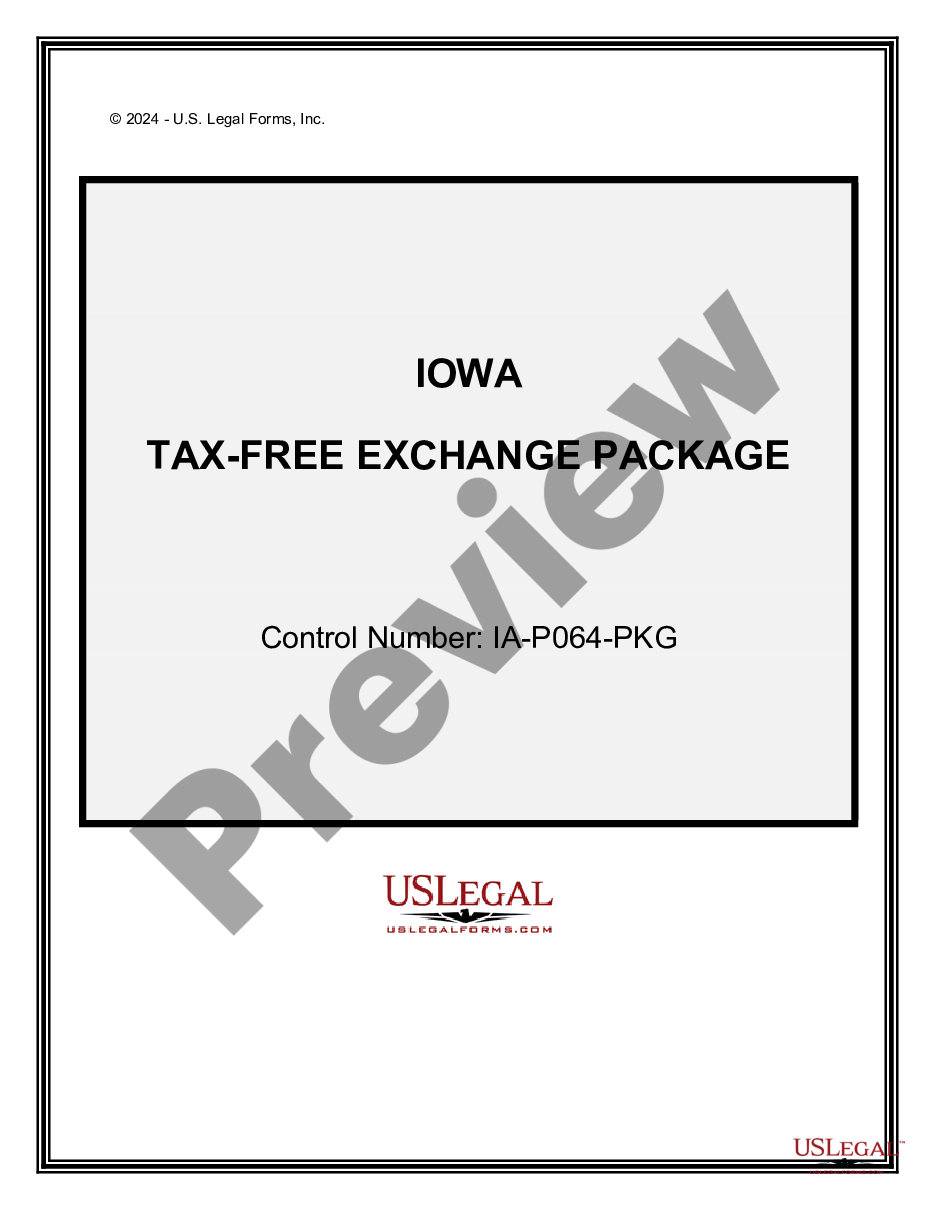

Foreign independent contractors must submit IRS Form W-8BEN (for individuals) or IRS Form W-8BEN-E (for entities) to the US company they work for. This form certifies the contractor's foreign status and can help reduce or eliminate withholding tax on payments. Purpose: Certifies foreign status.

The IRS requires a flat 30% withholding on ALL types of payments to foreign national individuals UNLESS: The individual has a U.S. tax identification number (SSN or ITIN) and qualifies for a tax reduction under the tax treaty between the U.S. and their country of tax residency.

First, employers must seek certification through the U.S. Department of Labor. Below you will find a link to documents and forms. Once the application is certified/approved, the employer must petition the U.S. Citizen and Immigration Services for a visa.

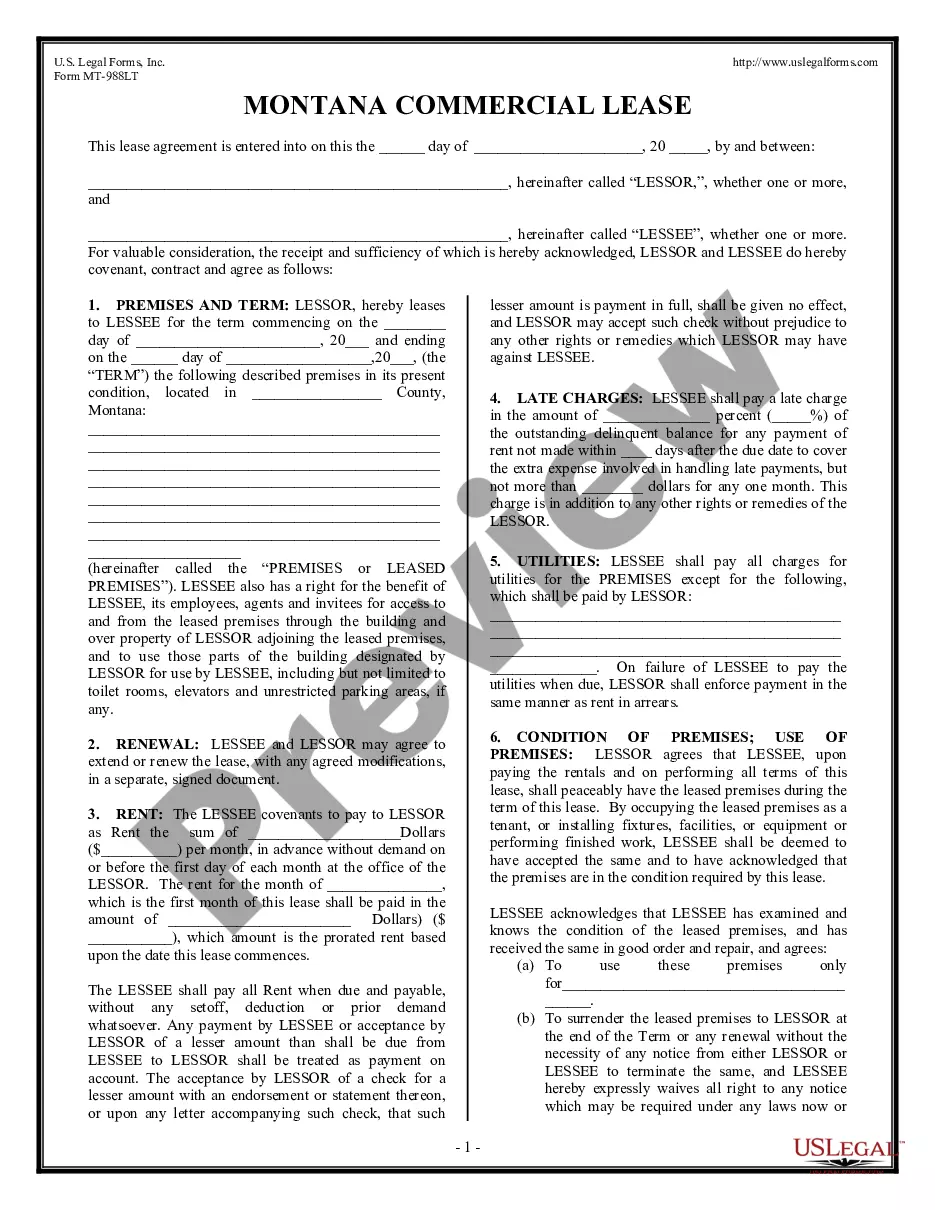

Many contracts now include clauses requiring team members to be U.S. citizens, but not always. If you're involved in work requiring a secret or top-secret clearance, it's a no-go for non-U.S. citizens. Even if you have multiple passports, you might be asked to give up the non-U.S. ones.

The immigration law ban on employing aliens unless they are lawfully admitted for permanent residence or otherwise authorized to be employed.

Foreign independent contractors must submit IRS Form W-8BEN (for individuals) or IRS Form W-8BEN-E (for entities) to the US company they work for. This form certifies the contractor's foreign status and can help reduce or eliminate withholding tax on payments. Purpose: Certifies foreign status.

While this opens doors to diverse talent and skill sets, it also introduces unique challenges in terms of tax compliance. One critical aspect of this compliance involves Form 1099, which US-based businesses may need to issue to foreign contractors for reporting payments made during the tax year.

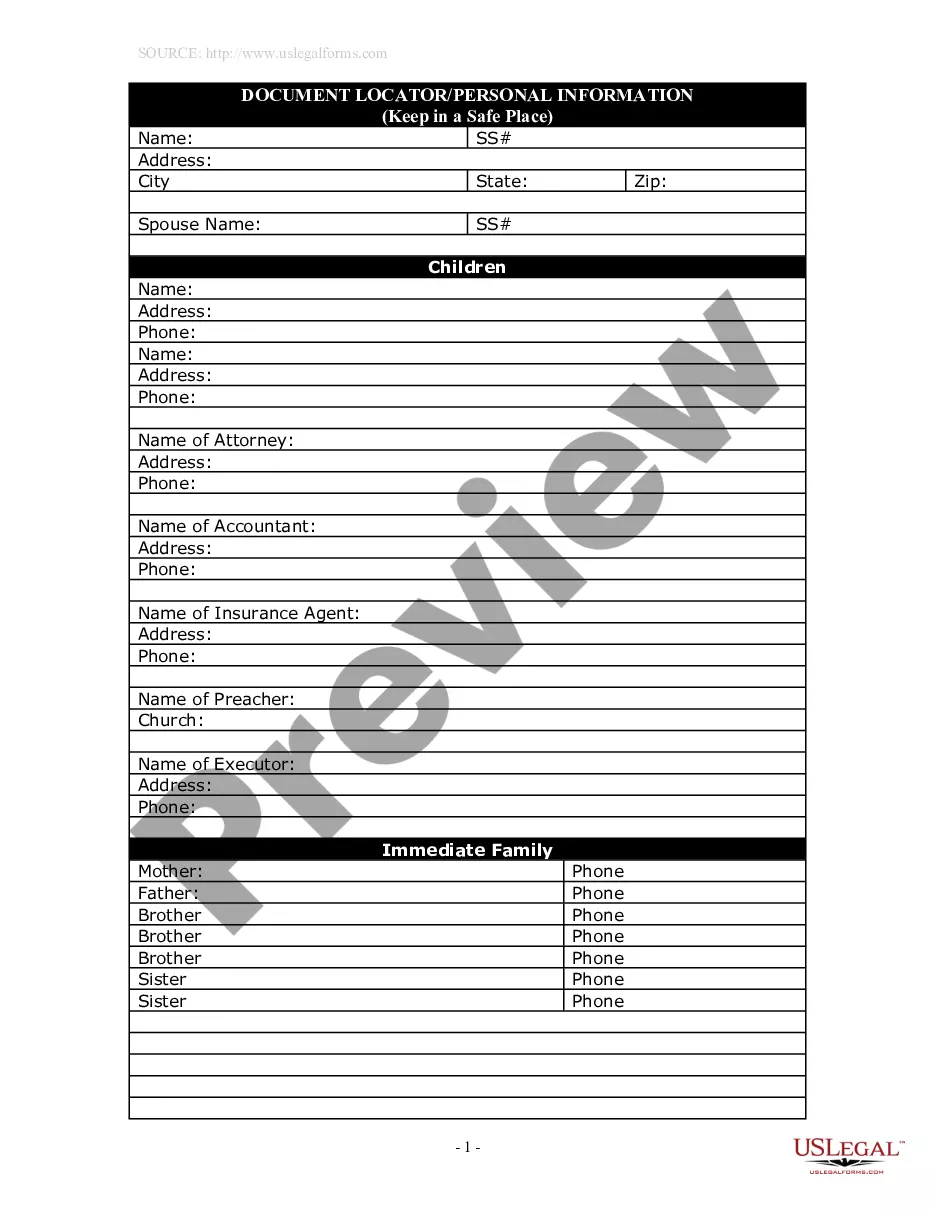

First, you will need to gather all the necessary documents, such as your birth certificate, social security card, and any court orders related to your name change. Secondly, you will need to complete the appropriate forms, which can be found on the Bexar County Clerk's website.