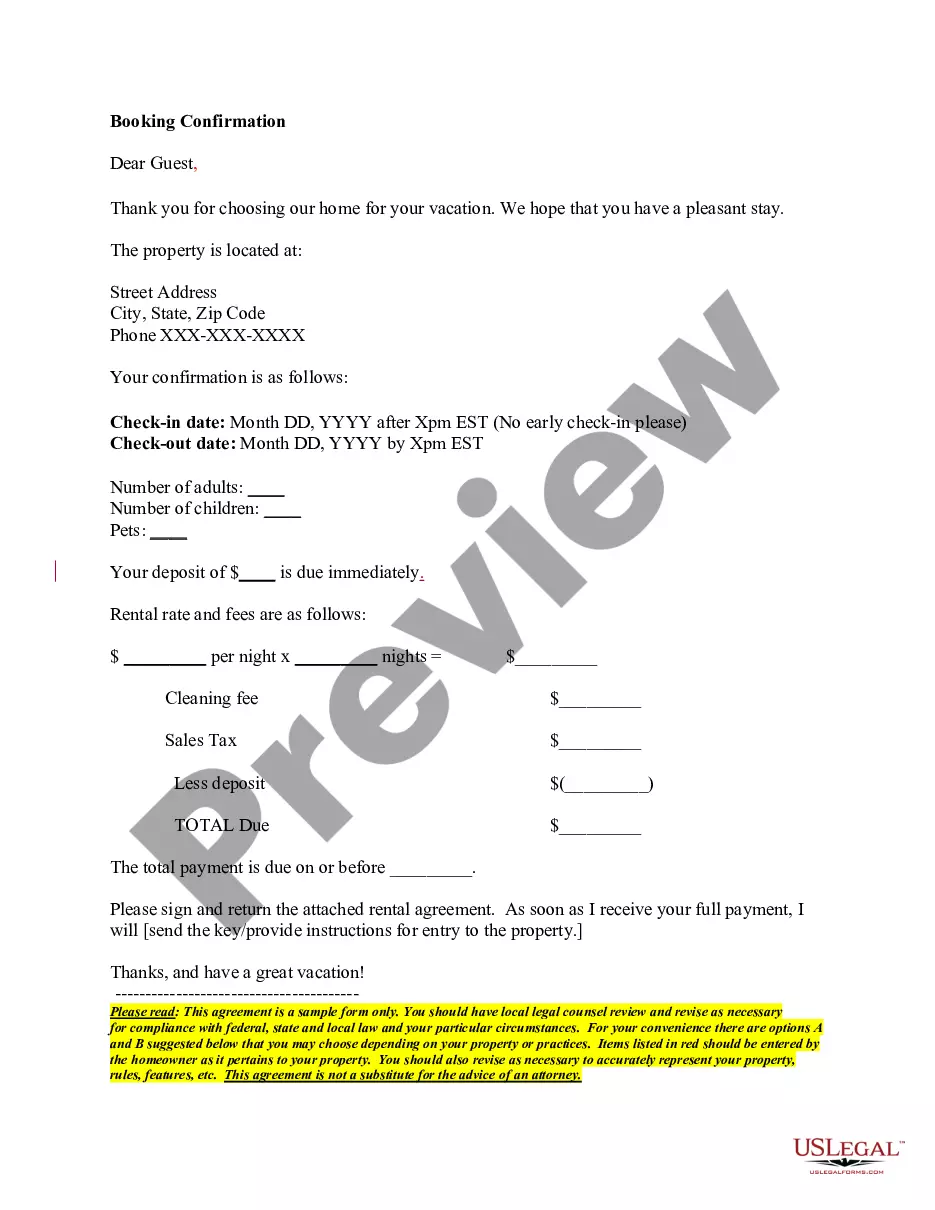

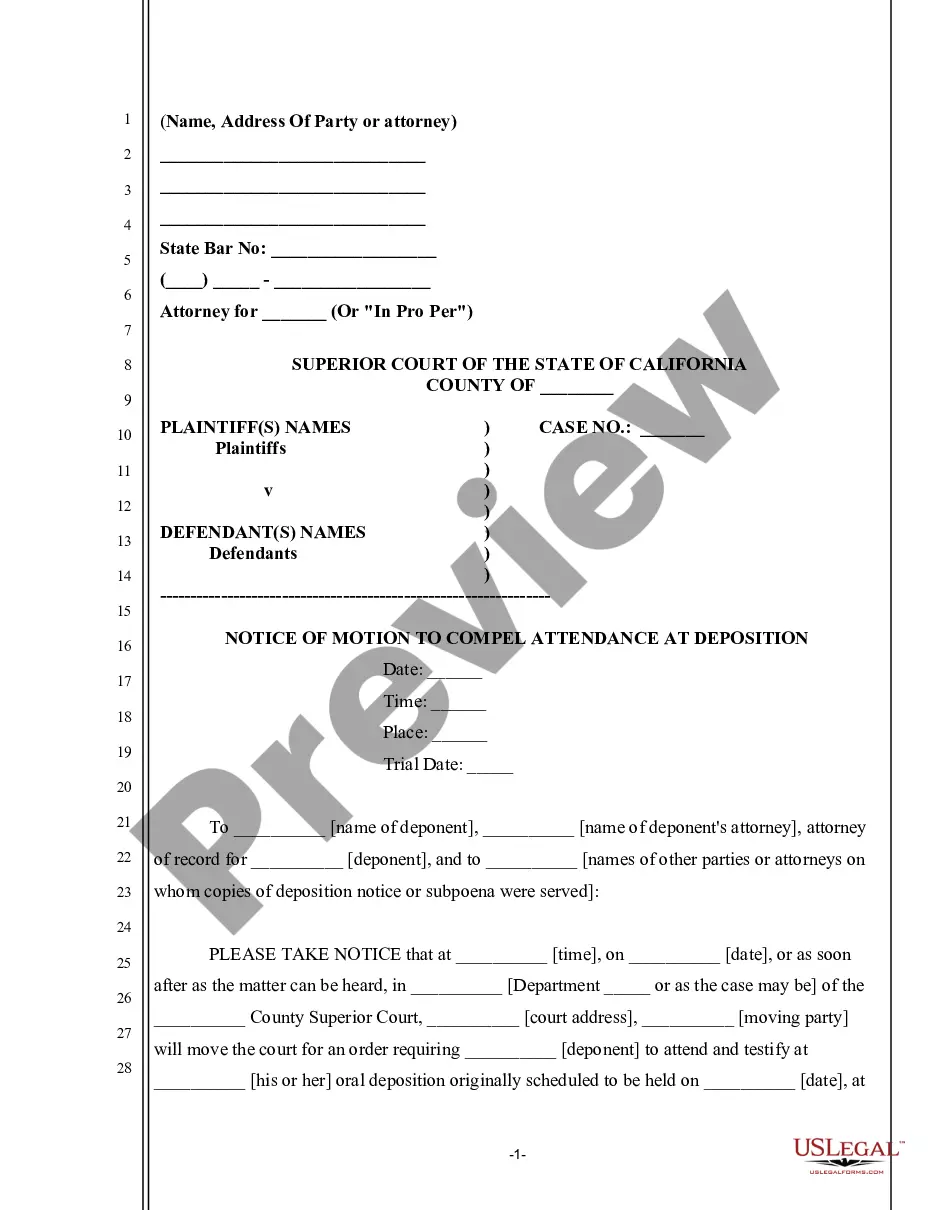

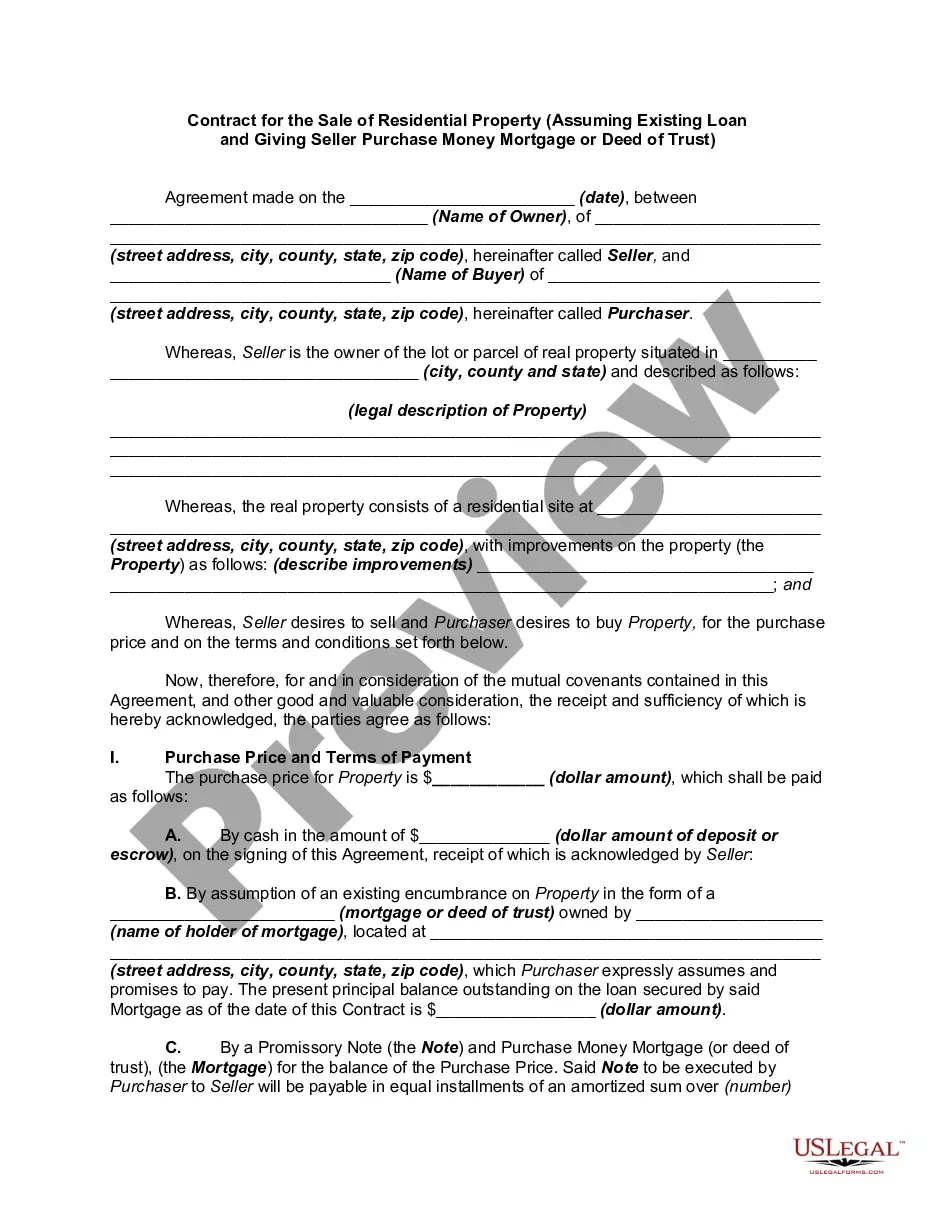

This form is a sample letter in Word format covering the subject matter of the title of the form.

Notice Judgment Lien Form For Property In Philadelphia

Description

Form popularity

FAQ

Pennsylvania judgments are valid for 5 years. Judgments can be revived every 5 years and should be revived if a creditor is attempting to actively collect on the debt. Judgments also act as a lien against real property for up to 20 years or longer if properly revived.

Steps to file a mechanics lien in Pennsylvania Fill out the Pennsylvania mechanics lien form. Fill out the PA lien form completely and accurately. File your lien claim with the county recorder. Serve a copy of the lien to the property owner.

Steps to File a Valid Pennsylvania Mechanics Lien Send Preliminary Notice Within 30 Days. Send Pre-Lien Notice at Least 30 Days Before Filing. File Your Lien Claim at Prothonotary's Office. Serve Notice of Filing on the Owner. Start Suit to Enforce Lien Within Two Years. File a Lien Bond to Remove the Lien.

Lien must be filed w/in 6 months after last labor or materials furnished. In Pennsylvania, an action to enforce a mechanics lien must be initiated within 2 years of the date of filing the lien claim. This deadline may not be extended, and failure to meet the deadline results in the lien becoming unenforceable.

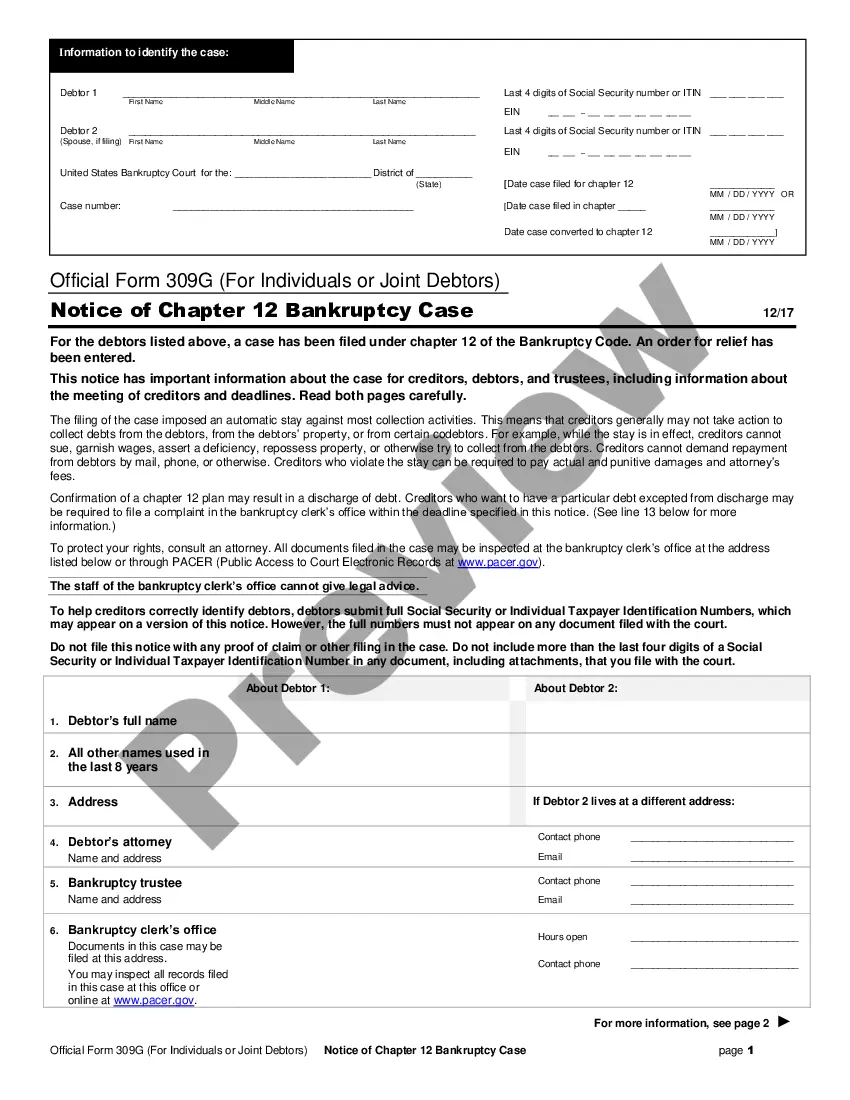

To obtain a judgment lien, you must first record the judgment with the court of common pleas in the county where the debtor owns property. The lien will stay in effect for five years, but can be renewed, if the debtor does not sell the property within that time period.

A judgment lien expires after 5 years from the date it is recorded but may be rerecorded once for another period of 5 years not less than 120 days before the expiration of the initial judgment.

Requirements for Liens in Pennsylvania This may include providing notice to the property owner, filing a lien claim with the appropriate county office, and adhering to strict deadlines for filing. Tax liens are typically imposed by the government when property taxes or other taxes go unpaid.

How can I obtain information about liens and judgments? Where can I obtain property tax information? You can obtain tax information from the Office of Property Assessment (OPA) 601 Walnut Street .phila/OPA or the Department of Revenue located in the Municipal Services Building., 1401 JFK Blvd, concourse level.