Judgment Against Property For Sale In North Carolina

Description

Form popularity

FAQ

Bankruptcy does not make these security interests go away. If you don't make your payments on that debt, the creditor may be able to take and sell the home or the property, during or after the bankruptcy case. There are several ways that you can keep collateral or mortgaged property after you file bankruptcy.

Bankruptcy does not make these security interests go away. If you don't make your payments on that debt, the creditor may be able to take and sell the home or the property, during or after the bankruptcy case. There are several ways that you can keep collateral or mortgaged property after you file bankruptcy.

Cars are personal property, and that means that judgment creditors can typically take and sell them.

Generally, the party seeking to sell or transfer the property will need to satisfy the judgment by paying the amount owed to the judgment creditor, or negotiate a settlement or release with the creditor.

Here are the California System 1 property exemptions: The Homestead Exemption protects up to $600,000 in your principal residence, which could be a home, boat, condo, or even a planned development. The Motor Vehicle Exemption protects up to $3,625 of equity in your car or other vehicle.

Household exemption typically includes clothing, furnishings, appliances, books, and other household items that are used as part of everyday residential existence.

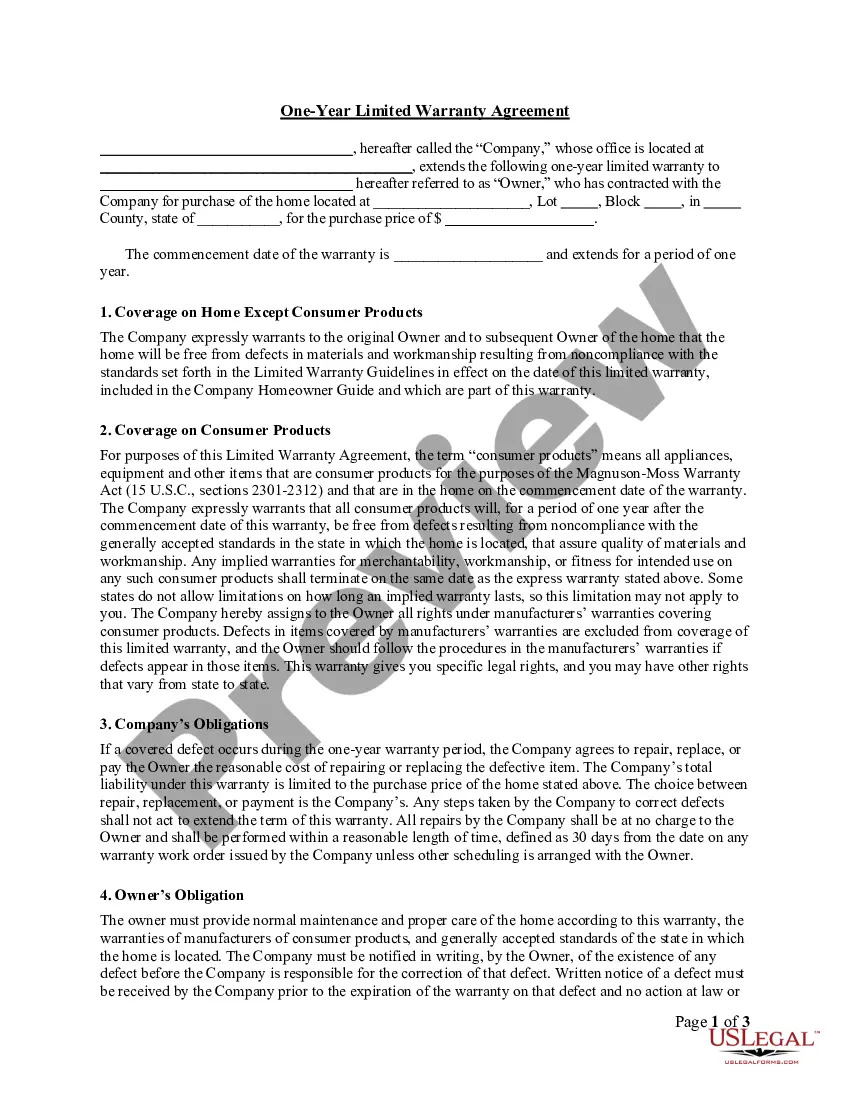

A judgment lien is created automatically on any property owned by the debtor in the North Carolina county where the judgment is entered. For any debtor property found outside the county, the creditor must file the judgment with the county clerk for the county where the property is located.

What kind of property is subject to a judgment lien under North Carolina law? In every state, a judgment lien can be attached to the debtor's real estate -- meaning a house, condo, land, or similar kind of property interest.

The judgment debtor may have exemptions under State and federal law that are in addition to those listed on the form for the debtor's statement that is included with the notice, such as Social Security benefits, unemployment benefits, workers' compensation benefits, and earnings for the debtor's personal services ...