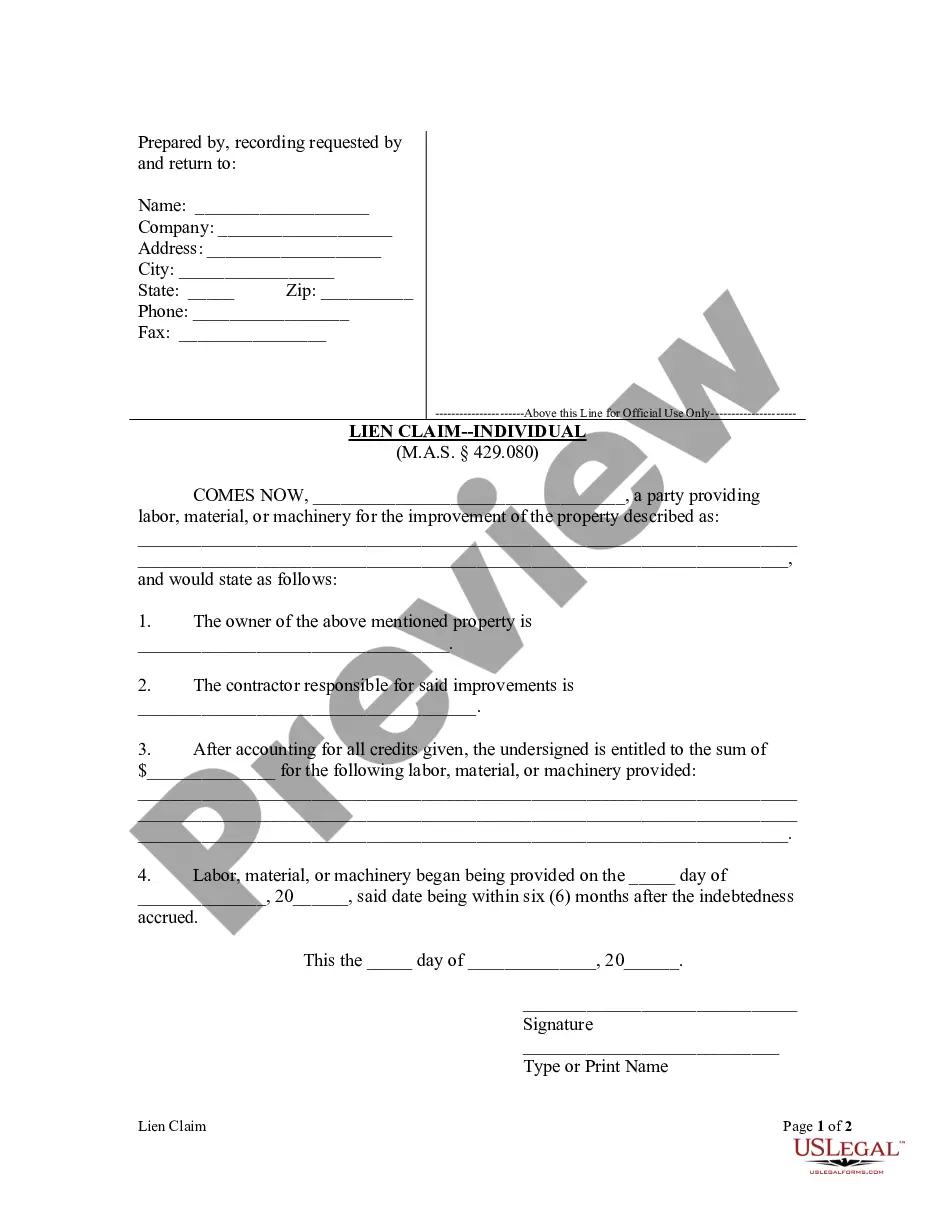

Judgment Against Property For Debt In Massachusetts

Description

Form popularity

FAQ

Examples of what you can exempt under Massachusetts law include: Up to $500,000 equity in your home or $1 million for two who are disabled or elderly. $7,500 exemption for your vehicle or up to $15,000 for the handicapped or elderly. Your clothing and bedding.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

A lien which results from a judgment shall terminate not later than twenty years from the date it was created.

Judgment Liens on Your Massachusetts Property Find the Registry of Deeds for your county and search county land records under the address where the property is located in Massachusetts as well as under the possible names of the people who own, or who you think own, that property.

Old (Time-Barred) Debts In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.