Judgment Lien Form Withdrawal In California

Description

Form popularity

FAQ

If you put liens on the other side's property, you or the other side must remove them. To remove a lien, file a certified copy of the Acknowledgment of Satisfaction of Judgment (form EJ-100) with each county recorder's office where you put the lien on their property.

“There can be but one final judgment in an action, and that is one which in effect ends the suit in the court in which it is entered, and finally determines the rights of the parties in relation to the matter in controversy.” San Joaquin County Dept.

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.

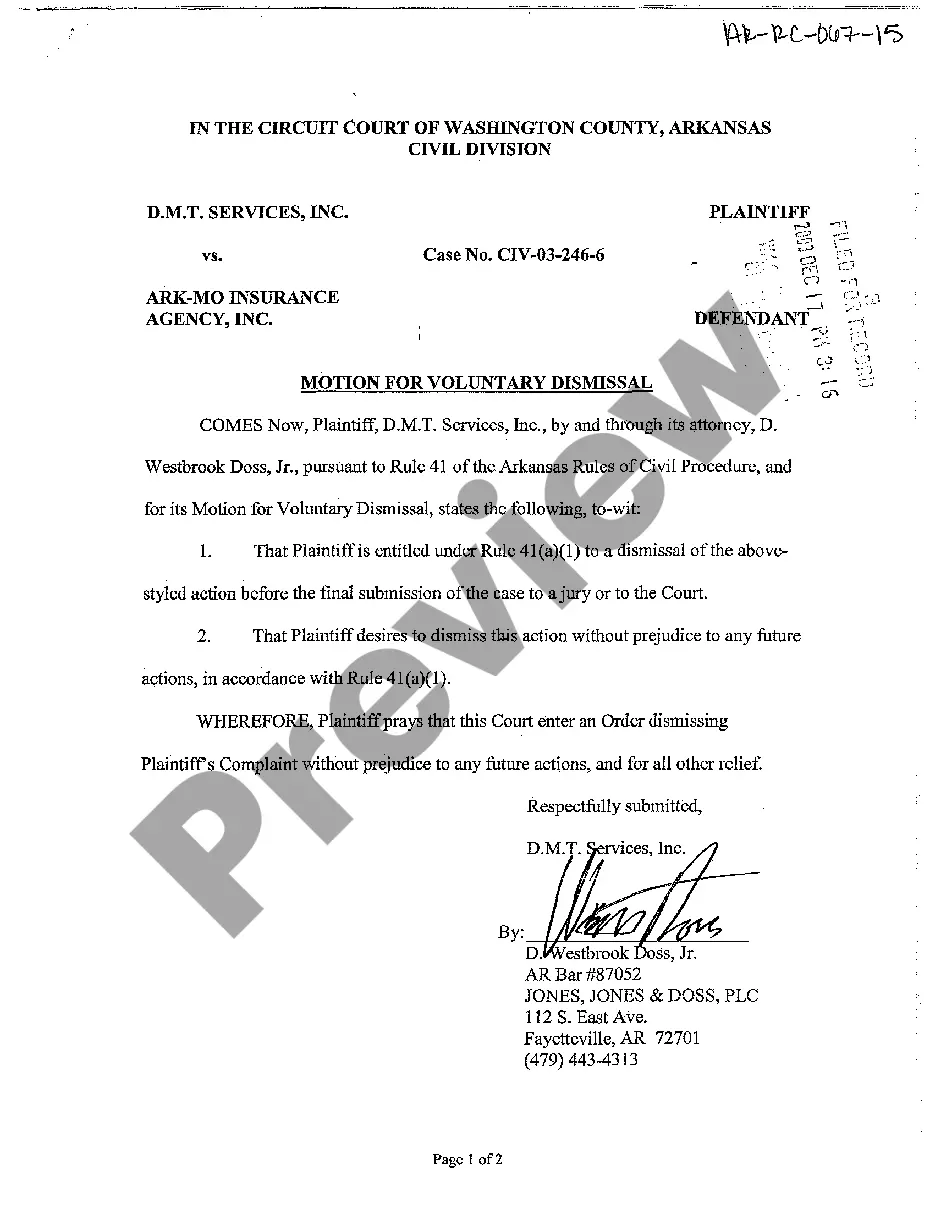

'Vacating' or 'setting aside' is used when referring to nullifying a specific judgment from the judge (in this case, a guilty or 'no contest' judgment). On the other hand, 'dismissing' applies to the entire case. It means that the case is thrown out for reasons other than its factual merits.

It shows up on your credit report as well as on any background checks. The judgment is considered a lien against your property, including any real estate that you have, in the state in which the judgment is filed.

Most judgment liens last for 10 years and can be renewed for another 10 years. For example, the creditor could place a judgment lien on your home which would inhibit you from selling the property without first paying the creditor what you owe.

An example of a general lien is a state income tax lien. Unlike specific liens that attach only to particular assets, a general lien is against all of the assets of a debtor and not tied to a specific asset. For instance, A mortgage lien is tied specifically to a piece of property.

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.