Judgment Lien In California In Bexar

Description

Form popularity

FAQ

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.

Once a Notice of State Tax Lien is recorded or filed against you, the lien: Becomes public record. Attaches to any California real or personal property you currently own or may acquire in the future. Is effective for at least 10 years (may be extended)

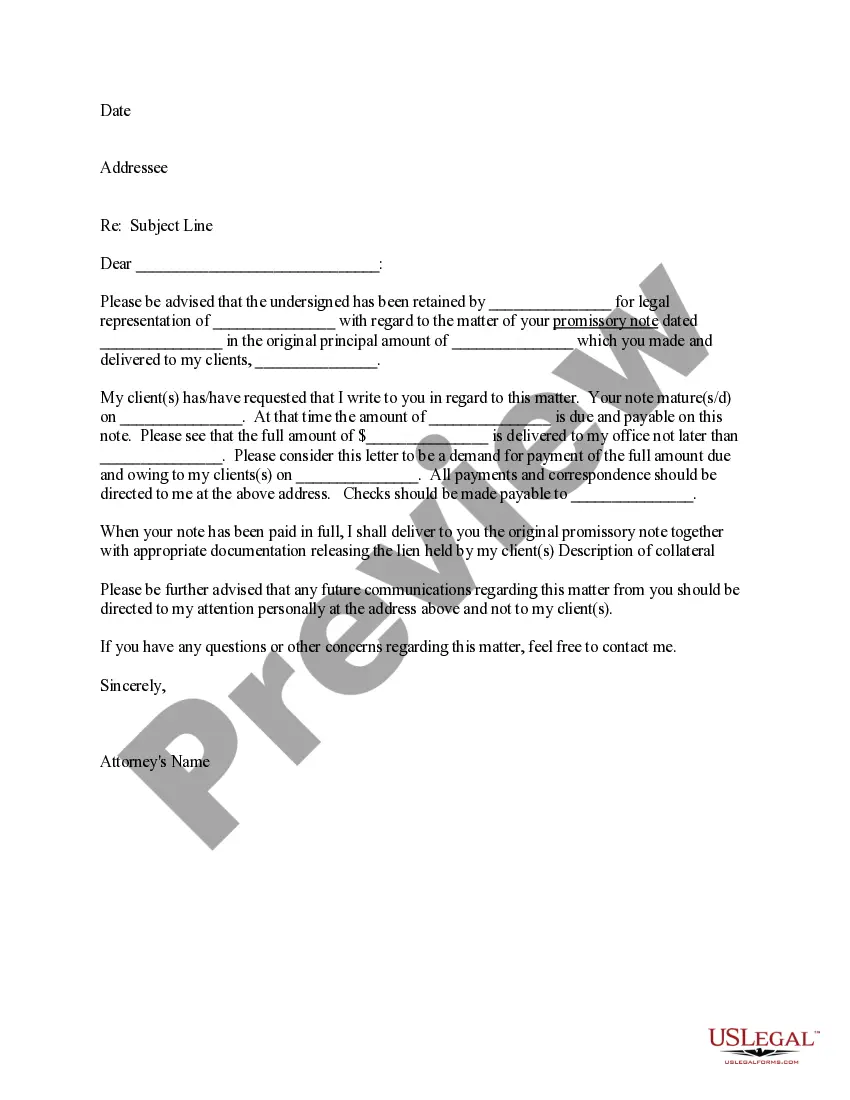

To domesticate an out-of-state judgment in California, follow this procedure: First, the creditor must file an Application for Entry of Judgment on Sister-State Judgment (Form EJ-105). Second, the creditor must submit a Notice of Entry of Sister-State Judgment (Form EJ-110).

Remove liens (if any) To remove a lien, file a certified copy of the Acknowledgment of Satisfaction of Judgment (form EJ-100) with each county recorder's office where you put the lien on their property.

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.

On residential projects, the deadline to file a Texas mechanics lien is the 15th day of the 3rd month after the month the contract was completed, terminated, or abandoned.

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.

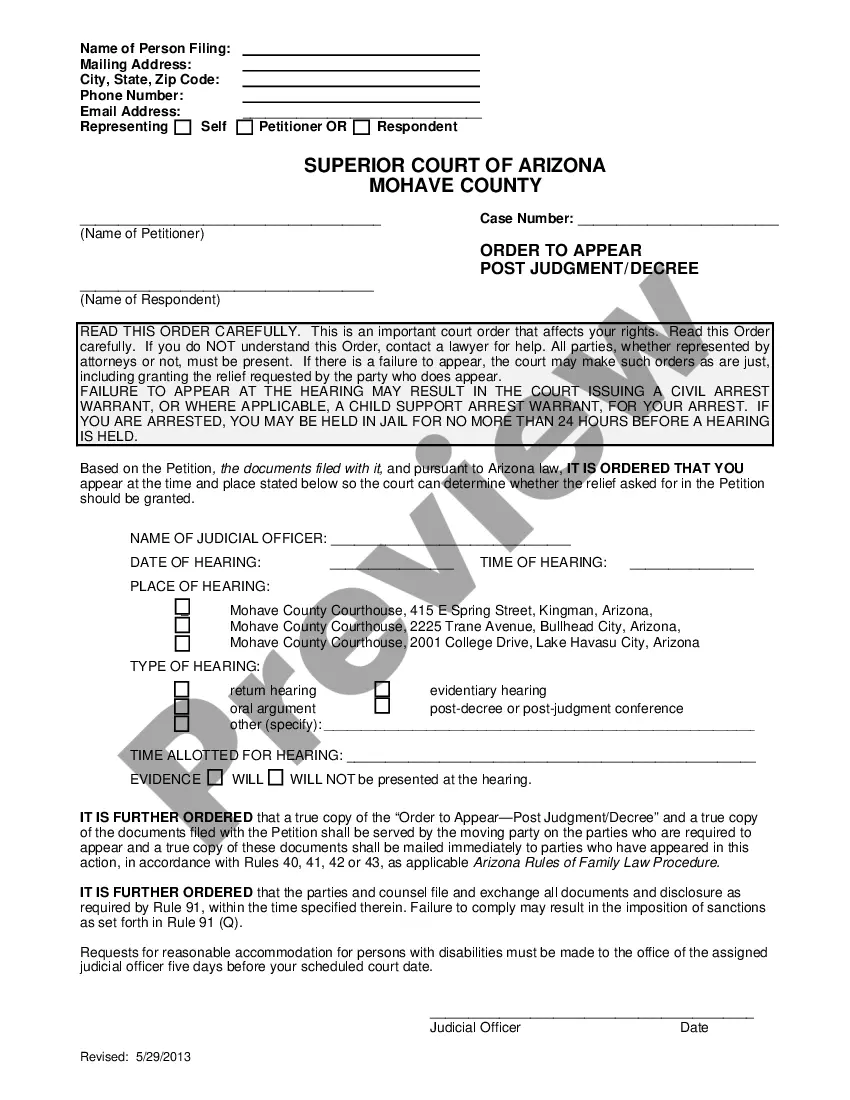

Deed/Lien Information To record it in person, bring the original Release to the Bexar County Clerk's Recordings Department at the Paul Elizondo Tower. To record it through the mail, send the original document to the Bexar County Clerk's Office in the Courthouse.

Deed/Lien Information To record it in person, bring the original Release to the Bexar County Clerk's Recordings Department at the Paul Elizondo Tower. To record it through the mail, send the original document to the Bexar County Clerk's Office in the Courthouse.

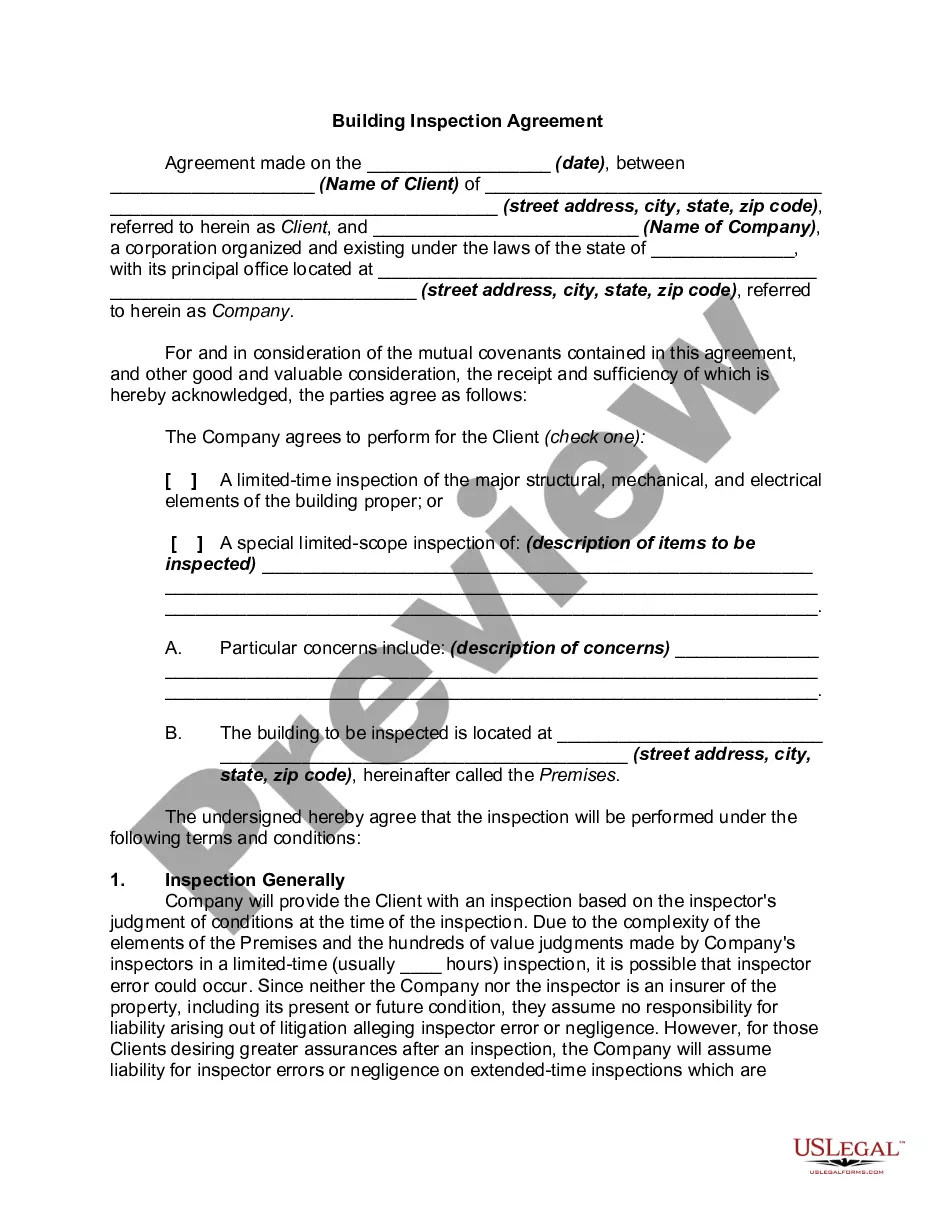

Generally, to file a judgment lien, an abstract of judgment must be issued by the justice court. Some justice courts have a form available on their website to request an abstract of judgment.