Judgment Lien In Texas In Alameda

Description

Form popularity

FAQ

If handled properly, a Texas judgment can exist indefinitely. But the creditor must be vigilant. We've collected judgments, in full, that were more than twenty years old. A Texas judgment is valid for ten years from the date it is signed by the judge.

After a creditor wins a lawsuit for unpaid debt, there is a time limit for them to enforce the judgment. Judgments awarded in Texas to a non-government creditor are generally valid for ten years but can be renewed for longer. If a judgment is not renewed, it will become dormant.

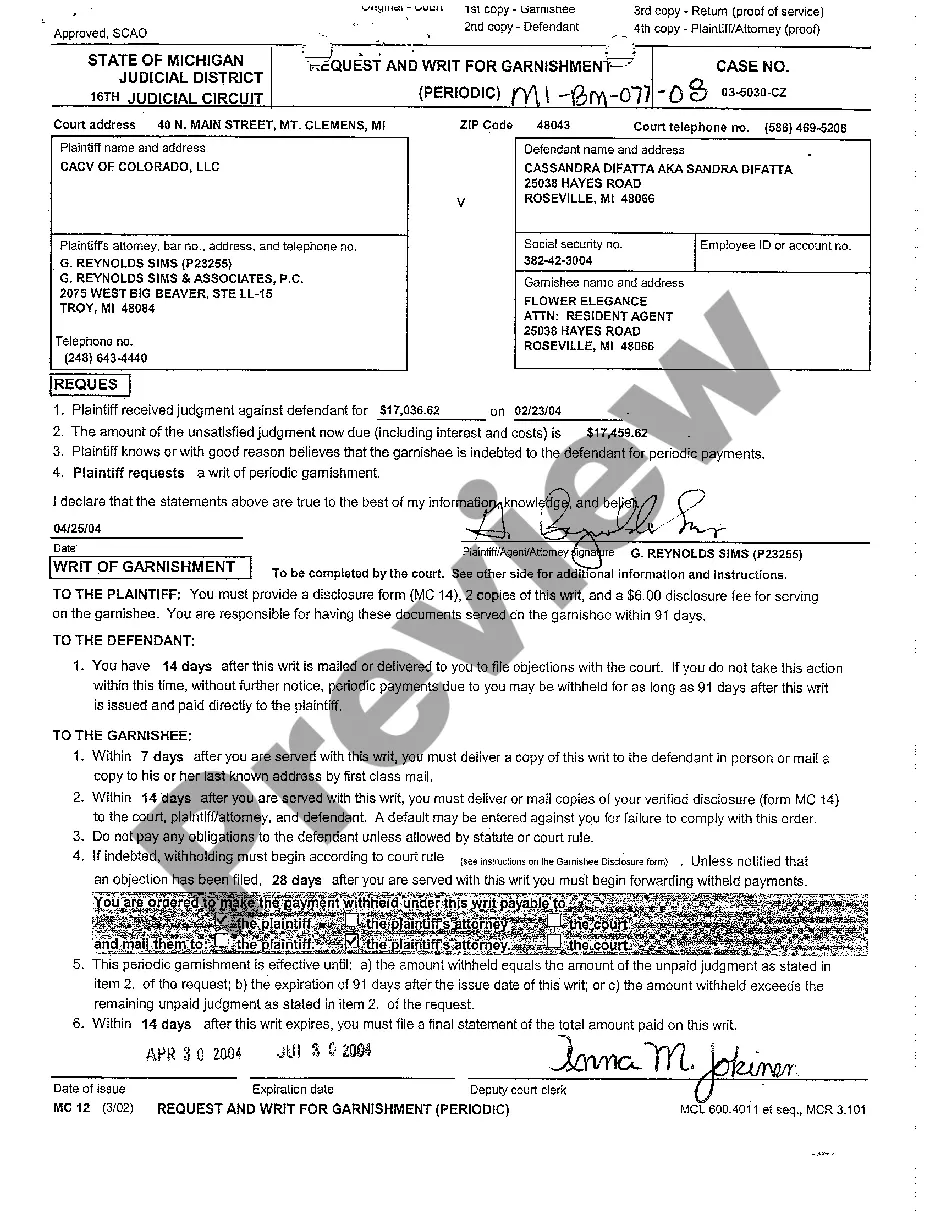

Once a court judgment is entered against you, creditors can access powerful debt collection tools they weren't previously able to use, like wage garnishment. In many cases, this means they can begin collection efforts right away. This could include garnishing your wages, freezing your bank account, or seizing property.

Of the three types of liens (consensual, statutory, and judgment), the judgment lien is the most dangerous form, but one which the informed business owner may be able to eliminate. A judicial lien is created when a court grants a creditor an interest in the debtor's property, after a court judgment.

Duration of Lien. (a) Except as provided by Subsection (b), a judgment lien continues for 10 years following the date of recording and indexing the abstract, except that if the judgment becomes dormant during that period the lien ceases to exist.

To file a lien claim, you will need: A brief description of the work you performed. The original contractor's name (general contractor) and mailing address (only if you are a subcontractor or sub-subcontractor). Sub-subcontractors will also need the name and mailing address of every subcontractor above them.

One of the ways to collect on a judgment is by placing a lien on real property owned by the debtor. Some types of real property are exempt from having a judgment lien placed on them. Homestead property is the most common exemption.

A Notice of Intent to Lien is a formal warning sent to property owners and general contractors that a mechanic's lien may be filed if payment for work or materials is not received. This critical document, also known as a pre-lien notice, is often the first step in how to file a lien for unpaid work in Texas.

Satisfy the Judgment: Paying the debt in full is the most straightforward way to remove the lien. Obtain a satisfaction of judgment from the creditor and file it with the court.

With Texas Easy Lien, you can prepare your own construction lien and bond claim documents online. No expensive attorney, finding a notary or waiting. Within minutes, you can do it yourself and save thousands of dollars.