Letter Of Judgment Meaning In Wake

Description

Form popularity

FAQ

You can look at your credit report at .annualcreditreport or you can go to the local clerk for the courts and search the county database. If there are judgments in other jurisdictions you would have to look there as well.

If you believe the judgment was satisfied, discharged, or improperly filed, you may have grounds to oppose the motion. You typically have a limited amount of time to respond, so act promptly. File a written response with the court where the motion was filed, outlining any defenses or objections you may have.

The most common ways you may find out that there are outstanding judgements against you in one of the following ways: letter in the mail or phone call from the collection attorneys; garnishee notice from your payroll department; freeze on your bank account; or.

The Notice of Entry of Judgment (SC-130) is a court form that states the judge's decision. This form also tells you about your rights and lists the date the form was mailed to you. This date is very important. You have only 30 days from this date to file a motion to vacate the judgment or appeal the judge's decision.

Enter a judgment means to make a final recording of the decision and the opinion , if the court made one. When the entry is complete depends on the jurisdiction, but entering a judgment usually either occurs after the decision is inserted into the docket or sent to a specified official.

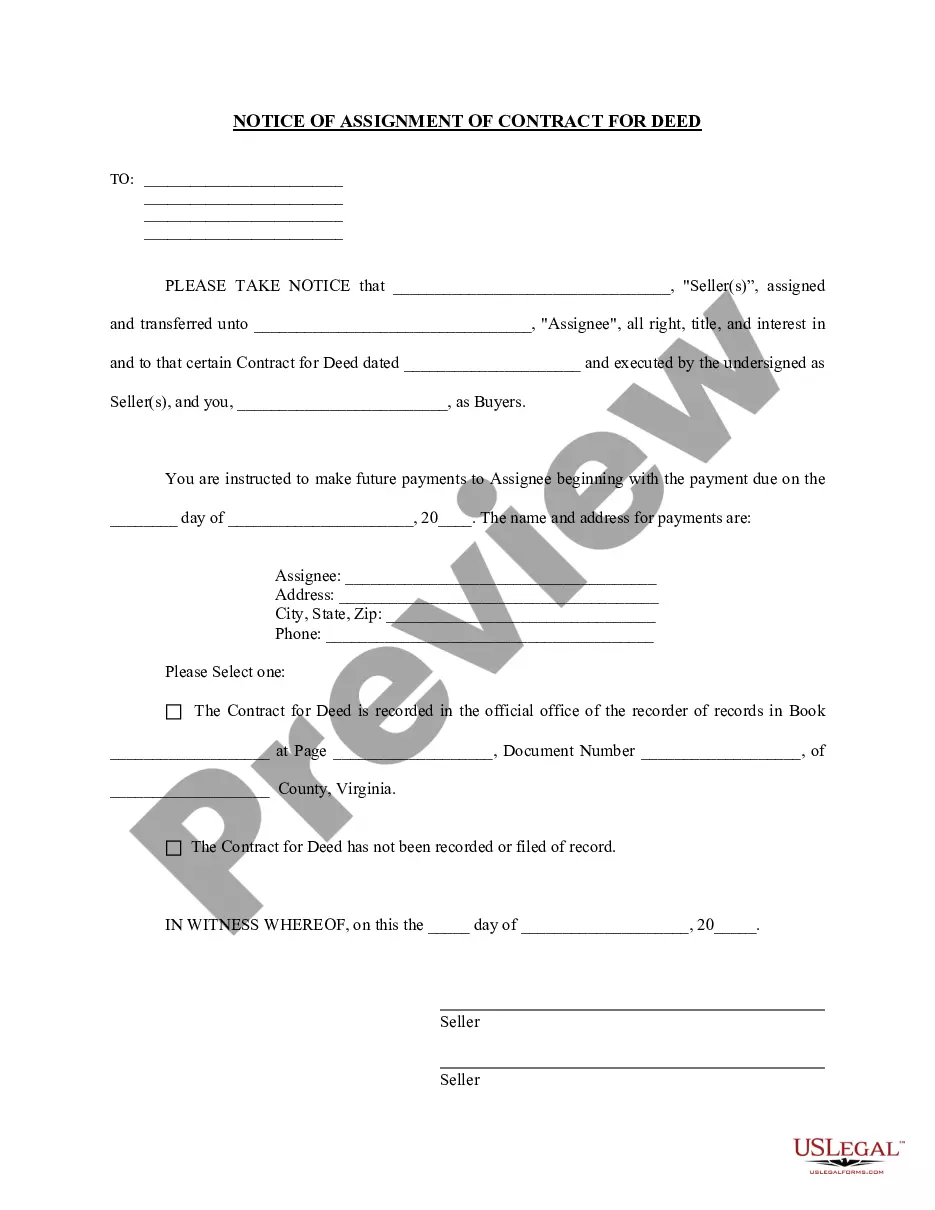

The person assigning the judgment (the seller) to you (the buyer) must sign the form in the presence of a notary. The form must be signed and stamped by the notary. Once this is done, the form becomes the original that the court needs.

Judgments can have a long-lasting, negative impact on your credit report. The fallout from a judgment means you could have trouble getting approved for a future line of credit, an apartment, or even have trouble getting a job.

Final judgment is the last decision from a court that resolves all issues in dispute and settles the parties' rights with respect to those issues.

Judgments may be classified as in personam, in rem, or quasi in rem. An in personam, or personal, judgment, the type most commonly rendered by courts, imposes a personal liability or obligation upon a person or group to some other person or group.

The judgment becomes a matter of public record, and is indexed with the clerk of the court. It shows up on your credit report as well as on any background checks. The judgment is considered a lien against your property, including any real estate that you have, in the state in which the judgment is filed.