Donation Receipt For In Kind In San Diego

Description

Form popularity

FAQ

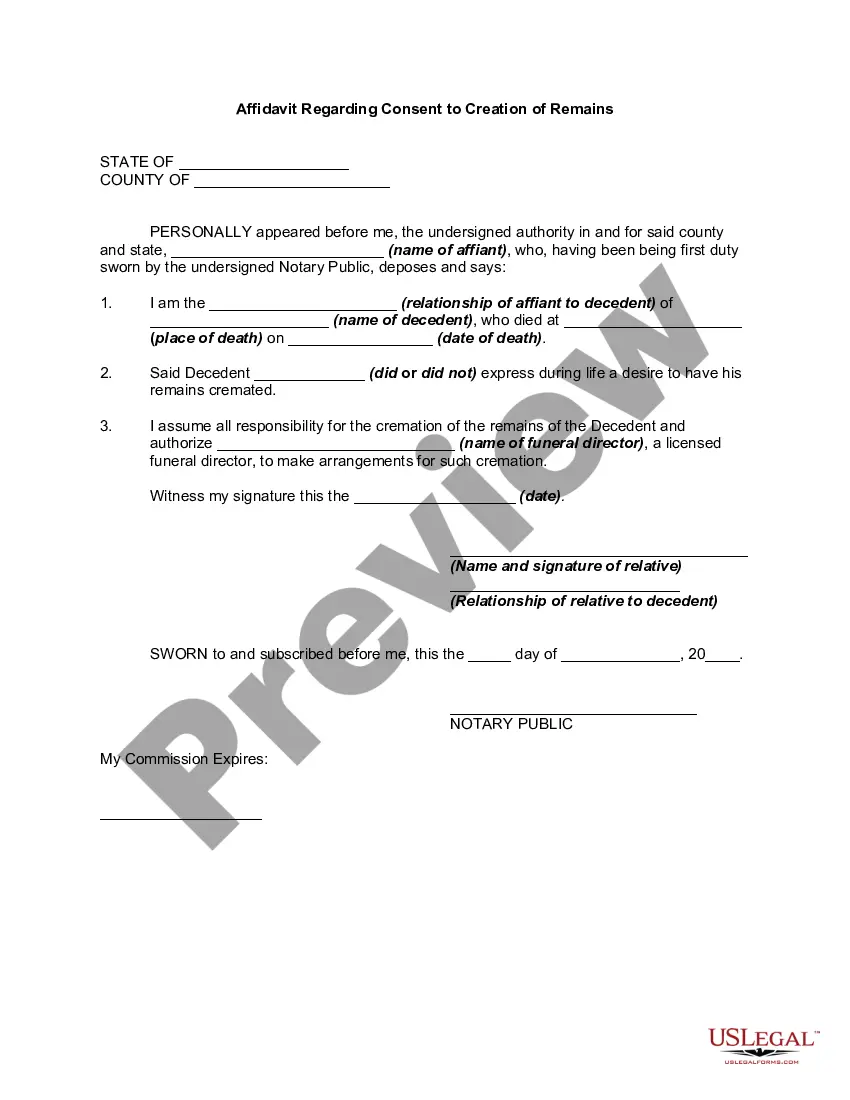

How should I recognize in-kind donations? Send the donor an acknowledgment that includes your tax ID number, a description of the goods and/or services they donated and the date you received them.

How to provide an in-kind donation receipt? In the case of in-kind donations exceeding $250, donors need to determine the deductibility of the items themselves. In that case, all you need to provide in the donation receipt is the name and EIN of the organization, date of donation, and a description of the donated item.

How to provide an in-kind donation receipt? In the case of in-kind donations exceeding $250, donors need to determine the deductibility of the items themselves. In that case, all you need to provide in the donation receipt is the name and EIN of the organization, date of donation, and a description of the donated item.

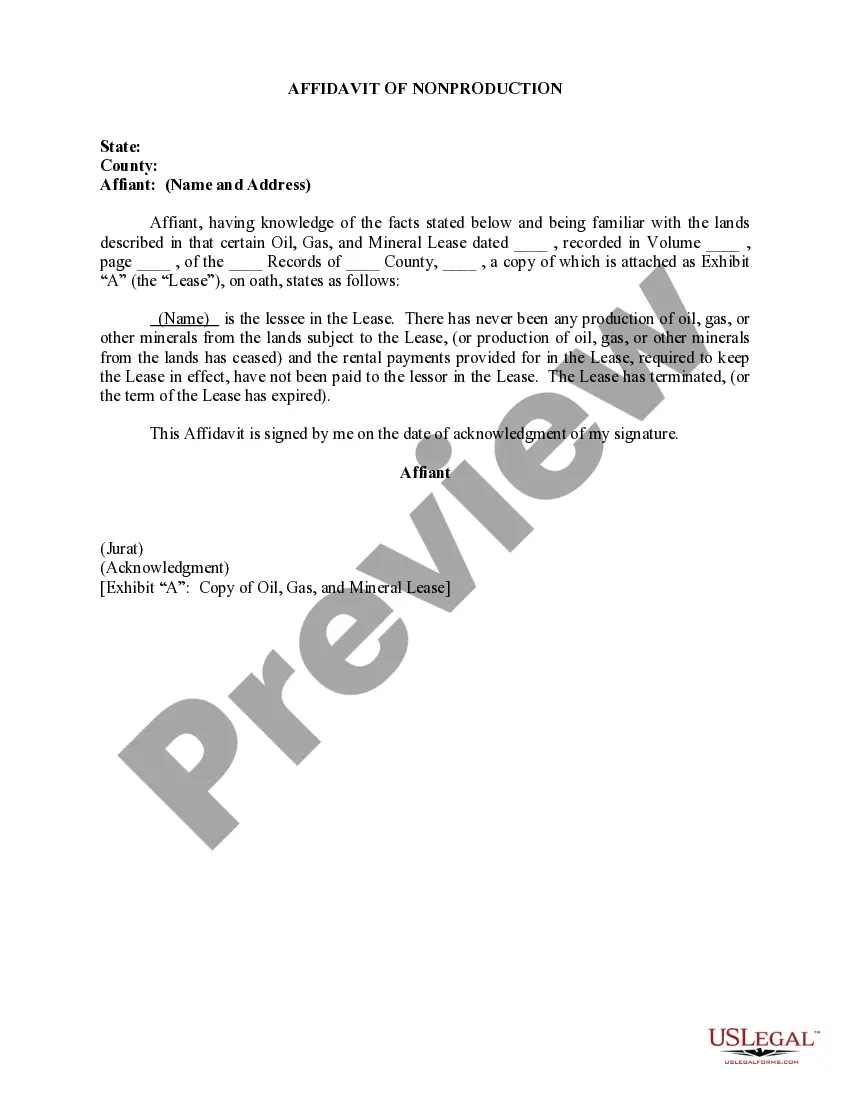

The accepted way to record in-kind donations is to set up a separate revenue account but the expense side of the transaction should be recorded in its functional expense account. For example, revenue would be recorded as Gifts In-Kind – Services, and the expense would be recorded as Professional Services.

Here is a simple example of an appropriate in-kind donor acknowledgment: “Thank you for your generous contribution of detailed description of goods/services, received by name nonprofit on ____ date of receipt. No goods or services were provided in exchange for your contribution.

Record the in-kind donation. As mentioned above, you'll record your in-kind donation in a separate revenue account within your chart of accounts. In general, in-kind donations will have no impact on your entity's net income because you'll record the value of the donation as both a revenue and expense item.

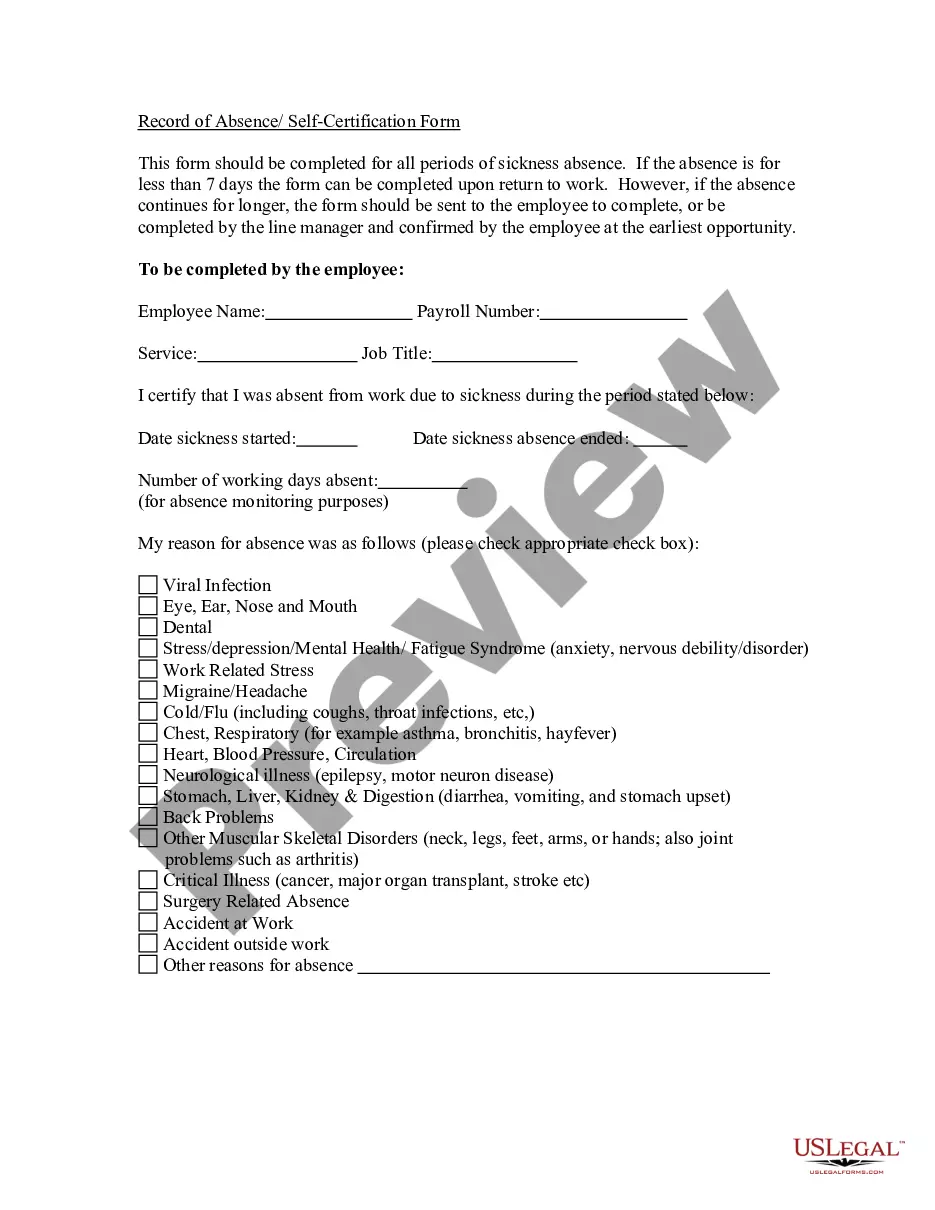

In-kind donation receipt. The donor, not the nonprofit, must determine the monetary value of goods donated. In-kind donation receipts should include the donor's name, the description of the gift, and the date the gift was received.

In-kind donation receipt. The donor, not the nonprofit, must determine the monetary value of goods donated. In-kind donation receipts should include the donor's name, the description of the gift, and the date the gift was received.

The IRS views an in-kind contribution as a contribution and calculates it ing to its market value. The IRS allows you to deduct the fair market value of property donated. Donations to registered 501(c)(3) nonprofits are eligible for a deduction.

How do I fill this out? Enter the donation date and your contact details. List each item you donated along with a brief description. Assign an estimated dollar value to each item. Complete the section for the Goodwill employee's name. Keep this receipt for your records when filing taxes.